December 2024

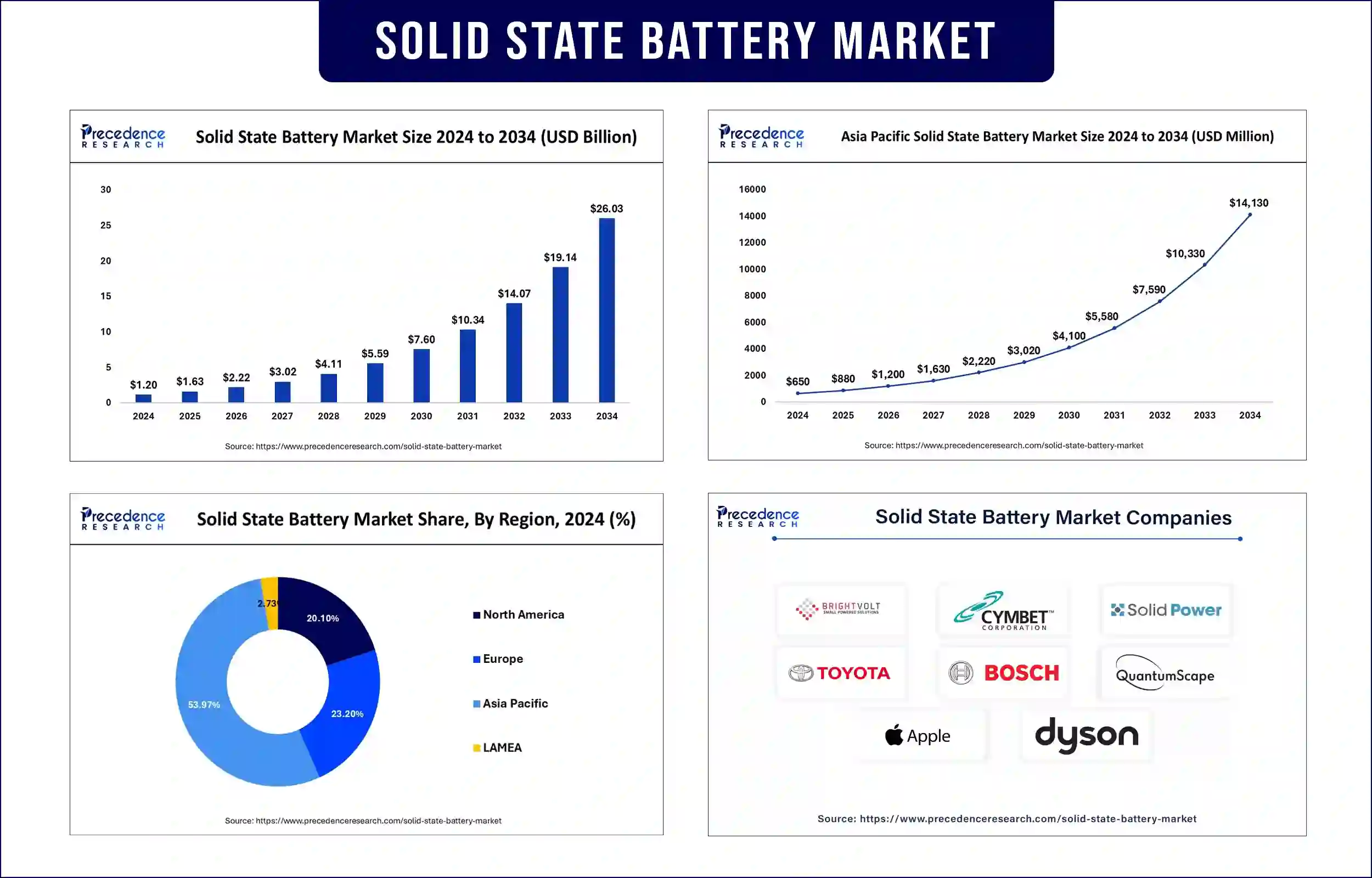

The global solid state battery market revenue reached USD 1.63 billion in 2025 and is predicted to attain around USD 19.14 billion by 2033 with a CAGR of 36.03%. Growing demand from the automotive sector, particularly for electric vehicles (EVs), is a key driver for market expansion.

The solid state battery market continues to progress with a strong industry push for safe battery storage solutions that have increased performance abilities. Solid-state batteries work with solid electrolytes, which significantly minimizes both leakages and fire hazards compared to traditional lithium-ion batteries. This highlights the growing demand for advanced battery technologies driven by the automotive industry. An organized international push shows that multiple actors across the world aim to develop better sustainable, and efficient energy storage solutions.

Surging Investments in EV Battery Technology

Automakers with battery manufacturers actively boost their research and development funding for high-energy-density solid-state battery development to improve both vehicle range and charging speed. Honda disclosed its decision to boost electric vehicle (EV) driving distance by two times using solid-state batteries for the late 2020s period. The industry is witness to an expansion of EV performance and charging convenience through partnerships aimed at addressing consumer needs regarding range and charging ease.

Advancements in Manufacturing Techniques

Companies are focusing on scalable production methods to reduce costs and enhance battery performance, paving the way for mass commercialization. These developments demonstrate an industry-wide shift toward emerging manufacturing methods that address existing problems to speed up solid-state battery implementation in electric vehicles and related applications.

The beginning of research using 3D printing technologies for developing functionally graded solid-state electrolytes that could boost both performance and manufacturing quality. The united work demonstrates profound dedication toward creating revolutionary energy storage breakthroughs powered by state-of-the-art manufacturing advancements.

Rising Demand for Consumer Electronics

The miniaturization trend in consumer electronics is driving demand for compact, durable solid-state batteries with longer lifespans and improved efficiency. The technology of solid-state batteries enables both increased energy capacity and improved protection against injuries, thus making them suitable for use in small, efficient devices. Researchers have developed better solid-state electrolytes that address battery performance weaknesses by enhancing ionic conductivity. The consumer electronics market received a boost through the development of flexible solid-state batteries, made possible by innovative polymer design.

Government Support and Policies

Public authorities from across the world support research investments while providing financial benefits to increase the deployment of solid-state battery technology as an energy storage solution. The U.S. Department of Energy (DOE) established plans in September 2024 to distribute USD 3 billion across various projects involving advanced battery and material creation to build a homegrown supply line for electric vehicle batteries and energy storage systems. Such initiatives demonstrate an organized commitment to developing battery technology while lowering expenses and spreading clean energy solutions worldwide.

Asia Pacific led the global solid state battery market with the highest share. Major companies from Japan and South Korea lead solid-state battery innovation in the region through significant investments to produce and commercialize this technology. The growth of solid-state battery technology receives substantial backing from Chinese government funding, which has reached over USD 830 million for 2024, driving adoption in consumer electronics, medical devices, and renewable energy storage units.

Japan received government approval for four all-solid-state battery research programs in 2024, which came with a total funding amount of USD 660 million to restore its market leadership position in next-generation battery technology. A Japanese company declared a 43 billion yen (USD 277 million) investment to build a Tochigi facility pilot production line.

South Korean companies, including SK On, will build their first all-solid-state battery production facilities in 2025 and prepare to scale up commercial operations by 2028. South Korean and Japanese companies invest strategically in combining forces with private and public entities to become global leaders in developing sustainable advanced energy storage technology.

Europe is estimated to host the most opportunistic solid state battery market during the forecast period. EU regulations that support sustainability and green energy transition currently drive increased funding for solid-state battery research and development initiatives. Furthermore, the EU demonstrates its commitment to creating a competitive, sustainable battery industry through all-inclusive policies while allocating substantial investments, which help to reach climate targets and guarantee energy security.

The EU established the Battery Regulation 2023/1542 in July 2023 to guarantee battery sustainability throughout each stage of their existence, including material sourcing and recycling, so that the energy transition advances in European territories and fuel imports decrease. The Critical Raw Materials Act, which the EU passed in March 2023, outlines exciting targets for EU mining and processing and recycling critical battery materials up to 2030 to decrease supply chain weaknesses and increase European independence.

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 1.63 Billion |

| Market Revenue by 2033 | USD 19.14 Billion |

| CAGR | 36.03% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Type

By Capacity

By Application

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/1489

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344

December 2024

January 2025

April 2025

January 2025