January 2025

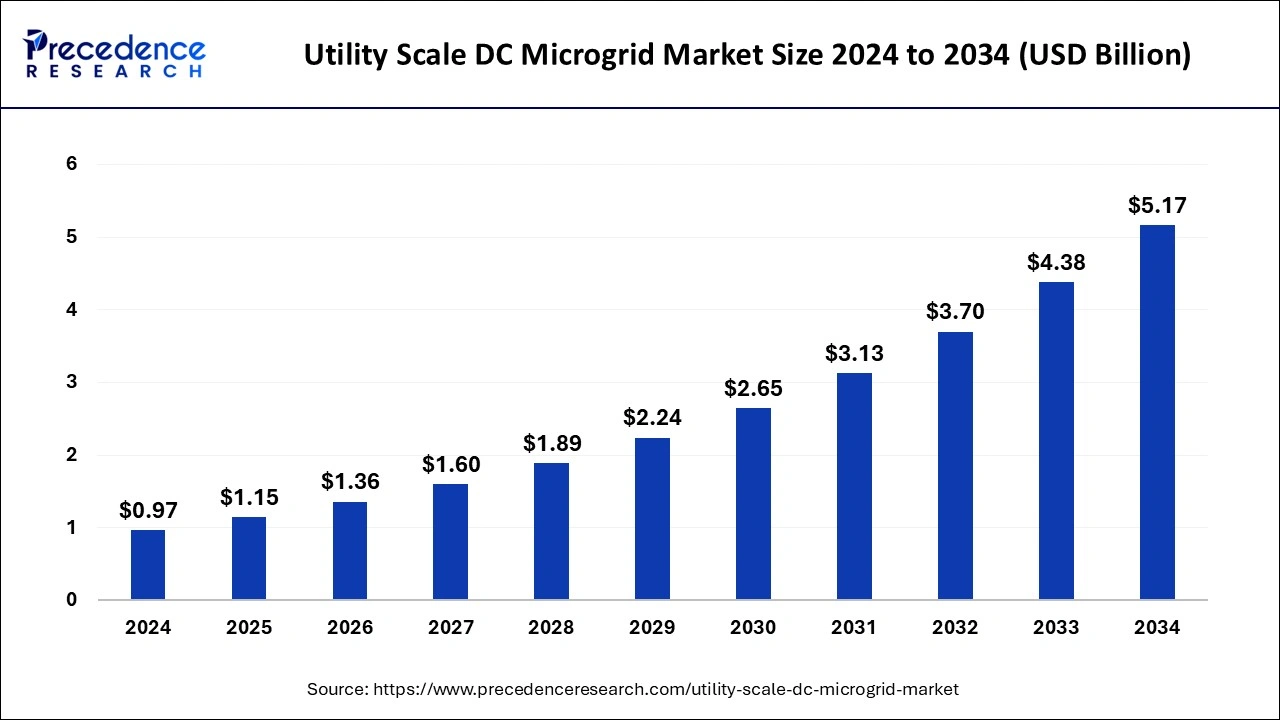

The global utility scale DC microgrid market size is calculated at USD 1.15 billion in 2025 and is forecasted to reach around USD 5.17 billion by 2034, accelerating at a healthy CAGR of 18.22% from 2025 to 2034. The Asia Pacific market size is evaluated USD 340 million in 2024 and is expanding at a CAGR of 18.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global utility scale DC microgrid market size accounted for USD 0.97 billion in 2024 and is expected to exceed around USD 5.17 billion by 2034, growing at a CAGR of 18.22% from 2025 to 2034. The utility scale DC microgrid market growth is attributed to the increasing demand for enhanced grid resilience and advancements in renewable energy and storage technologies.

Artificial intelligence automation helps the utility scale DC microgrid market grow by improving efficiency, energy management, and system robustness. Statistical analysis using artificial intelligence helps operators forecast the energy demand and its consequent consumption to the highest efficiency without wasting a lot of energy. The sophisticated pre-diagnostic methods in artificial neural networks spot and rectify possible system malfunctions before they happen, thus avoiding power shortages. AI also makes the integration of variable renewable energy sources like solar energy and wind energy easy because it has the ability to balance supply and demand.

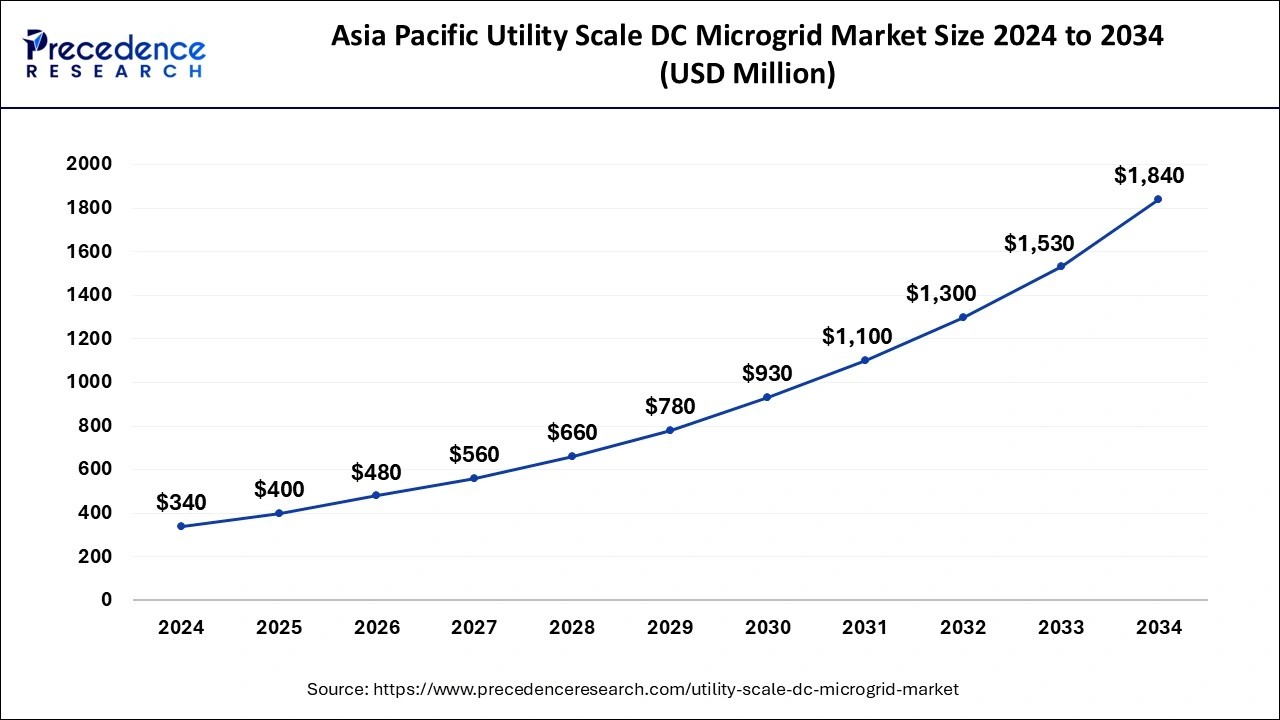

The Asia Pacific utility scale DC microgrid market size was exhibited at USD 340 million in 2024 and is projected to be worth around USD 1,840 million by 2034, growing at a CAGR of 18.39% from 2025 to 2034.

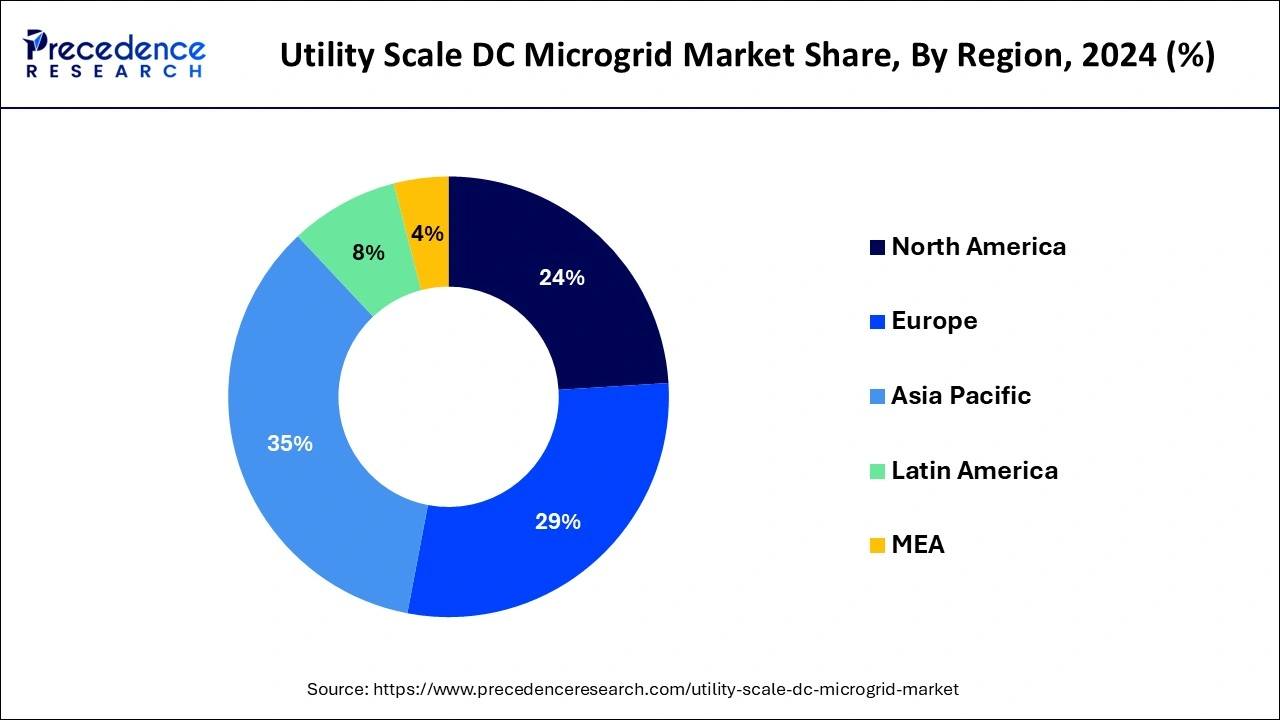

Asia Pacific dominated the utility scale DC microgrid market in 2024, owing to the growing need for electricity in the rural sections and the support given to renewable energy initiatives by the government. The governments of developed countries, such as India, China, and Japan, are expected to boost this growth immensely.

North America is projected to host the fastest-growing market in the coming years due to the region’s emphasis on energy security, renewable energy, and smart grid. The U.S. and Canada are the world’s leaders in implementing microgrid solutions mainly as a result of there being instances, including an unstable grid, evolving demand for energy for both commercial and domestic practices, environmental standards, and measures.

Rising consciousness about the utilization of sustainable electrical power appears to shape the position of the utility scale DC microgrid market. These are integral microscale power stations that are used to produce, transmit, and use DC electricity to strengthen the grid and drive decarbonization. The increasing need for energy access in utility-scale areas is one of the driving factors of this market. Several developments in the distribution of energy storage systems, such as lithium-ion batteries and solid-state batteries, have increased the capabilities and durability of DC microgrids. All these innovations help enhance the connection of renewable sources, such as solar and wind, so as to reduce conversion losses and maximize the usage of energy.

| Report Coverage | Details |

| Market Size by 2024 | USD 0.97 Billion |

| Market Size in 2025 | USD 1.15 Billion |

| Market Size in 2034 | USD 5.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.22% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Connectivity, Power Source, Storage Device, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for renewable energy integration

Increasing demand for renewable energy integration is projected to drive the growth of the utility scale DC microgrid market. Governments and organizations around the globe focus on energy efficiency measures to mitigate further emissions of greenhouse gases and the promotion of cleaner energy. DC microgrids are preferred, as they provide a relatively efficient method of integrating renewable energy plants, including solar and wind, by reducing conversion losses and enhancing direct use of the energy produced.

Improved integration of DC microgrids with energy storage like lithium-ion batteries makes it possible to maintain energy supply even within fluctuating production of renewable sources. Furthermore, the increasing relevance and potential of DC microgrids in accommodating large-scale renewable energy integration and energy sustainability.

| Year | Global Renewable Energy Capacity (GW) | Global DC Microgrid Installations (Units) | Global Renewable Share (%) |

| 2020 | 2800 | 1500 | 27 |

| 2021 | 3050 | 1800 | 30 |

| 2022 | 3300 | 2100 | 32 |

| 2023 | 3600 | 2500 | 35 |

| 2024 | 3900 | 3000 | 38 |

High initial costs

High initial costs associated with designing, installing, and integrating utility-scale DC microgrids are anticipated to restrain the utility scale DC microgrid market growth. Implementation of these systems necessitates the application of enhanced technologies, such as efficient energy management software, efficient converters, and capacity batteries, which, in the long run, call for enhanced capital investment. The incorporation of renewable energy systems in a DC microgrid system requires a tailored approach most of the time, which increases costs. These costs present a problem, especially for small to medium-sized firms and developing areas that may lack adequate financial might.

High advancement in energy storage technologies

Growing advancements in energy storage technologies are expected to drive opportunities in the utility scale DC microgrid market. Advancements in battery technology, including lithium-ion and solid-state, make DC microgrids suitable for the integration of renewable energy sources due to increased storage, efficiency, and longer life span.

Advancements by leading utility scale DC microgrid market manufacturers boosted battery energy density, which brought down the cost per kilowatt-hour and paved the way for the large-application battery. Increased demands for peak load management, utilization of the grid, and increase in cost efficiency in the integration of renewable energy led to high demand for energy storage across the industrial, utilities, and transportation industries.

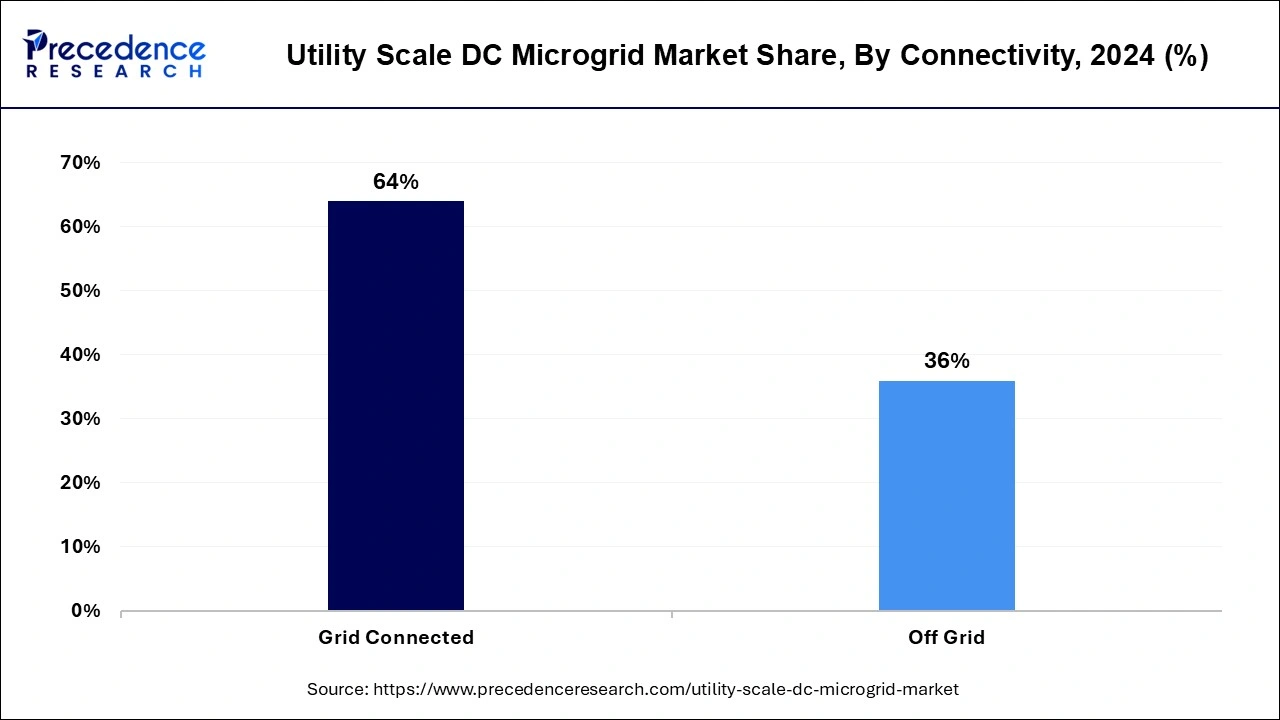

The grid-connected segment held a dominant presence in the utility scale DC microgrid market in 2024 due to the growth in the need for secure power systems with microgrids as part of the overall electrical grid. Microgrids are specifically intended to work alongside large utility systems and provide power in a synchronized manner. They are also able to sustain the flow of power in the event of a system disturbance. This connectivity enhances improved load flow, peak clipping, and energy control through licensing to the exporter or importer central grid. Moreover, grid-connected microgrids provide utilities with a cheaper and more scalable approach to upgrade and modernize typically outdated energy infrastructure.

The off-grid segment is expected to grow at the fastest rate in the utility scale DC microgrid market during the forecast period of 2025 to 2034, owing to their ability to supply electricity to the areas that have limited or no access to utility grid connection. These systems are the perfect fit for areas experiencing issues with connecting to the grid, its stability, or its susceptibility to disasters. Integrated microgrids also play a useful role in integrating off-grid renewable energy and supplying reliable energy in off-grid areas.

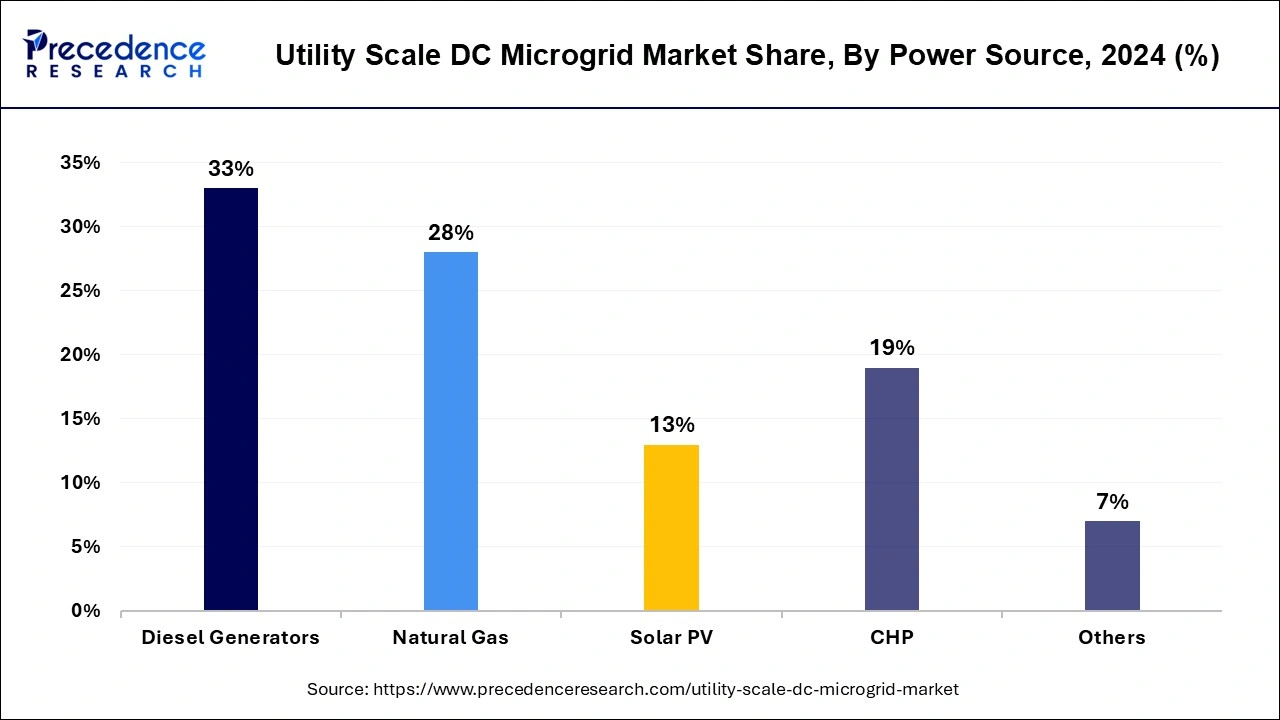

The diesel generators segment accounted for a considerable share of the utility scale DC microgrid market in 2024 due to their ability to deliver a viable power alternative in regions that suffer from inadequate or unreliable network connectivity or pay for those with high demand rates. Diesel generators have remained a popular source of backup and off-grid power, as they are quite mainstream and relatively easy to source and deploy at large capacities. Moreover, the high energy density and resistant operating capacity in all-weather conditions further fuel the segment.

The solar PV segment is anticipated to grow with the highest CAGR in the utility scale DC microgrid market during the studied years, owing to the increasing tendency to integrate renewable energies and the emerging trends in the transition to sustainable electricity generation around the world. The benefits of installing Solar PV systems include low operational expenditure, low impacts on the environment, and increased utilization of solar energy as a renewable source of energy. Additionally, the increasing consumer demand for clean electricity is expected to further the adoption of solar photovoltaic or PV in DC microgrids.

In 2024, the lithium-ion segment led the global utility scale DC microgrid market, as they contain higher energy density, long life span, and falling cost trends. These batteries have become popular due to their ability to charge and discharge cycles and facilitate the incorporation of renewable power sources into microgrids. Their capacity to store a lot of energy is smaller than that of traditional lead-acid batteries, making them ideal for large uses. These, combined with a very high scalability index and manufacturing outreach throughout the world, made lithium-ion batteries dominate the market. Furthermore, due to natural disasters and grid volatility, Indonesia and the Philippines, among others, are shifting their focus on decentralization within the energy sector.

The flow battery is projected to expand rapidly in the utility scale DC microgrid market in the coming years, owing to their benefits of long-duration energy storage and scalability characteristics. The flow batteries are based on liquid electrolytes, meaning that scalability is not a problem in terms of energy storage density without compromising system effectiveness. The researchers predict that flow batteries perform particularly well in those use cases that involve longer discharge durations, such as grid leveling and renewable energy facilitation. Additionally, with the increasing maturity of the flow battery system, a surge of demand for flow batteries in DC microgrid applications is expected, especially where long-term, seamless energy storage is needed to incorporate renewable energy systems.

By Connectivity

By Power Source

By Storage Device

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

March 2025

January 2025