December 2024

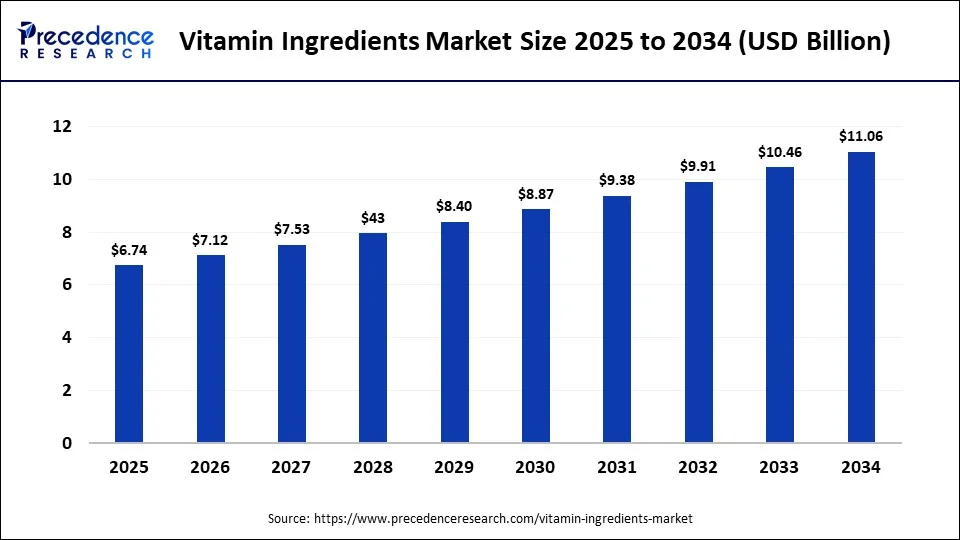

The global vitamin ingredients market size was USD 6.04 billion in 2023, calculated at USD 6.38 billion in 2024 and is expected to be worth around USD 11.06 billion by 2034. The market is slated to expand at 5.65% CAGR from 2024 to 2034.

The global vitamin ingredients market size is worth around USD 6.38 billion in 2024 and is anticipated to reach around USD 11.06 billion by 2034, growing at a CAGR of 5.65% over the forecast period 2024 to 2034. The market is driven by the rising demand for vitamin-based supplements. The growing awareness about the healthy lifestyle further boosts the global vitamin ingredients market.

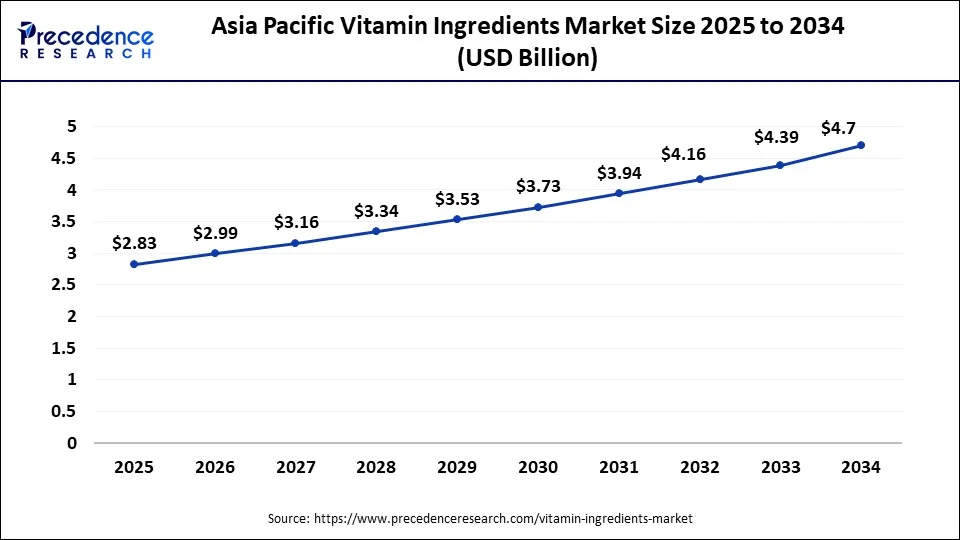

The Asia Pacific vitamin ingredients market size was exhibited at USD 2.54 billion in 2023 and is projected to be worth around USD 4.70 billion by 2034, poised to grow at a CAGR of 5.75% from 2024 to 2034.

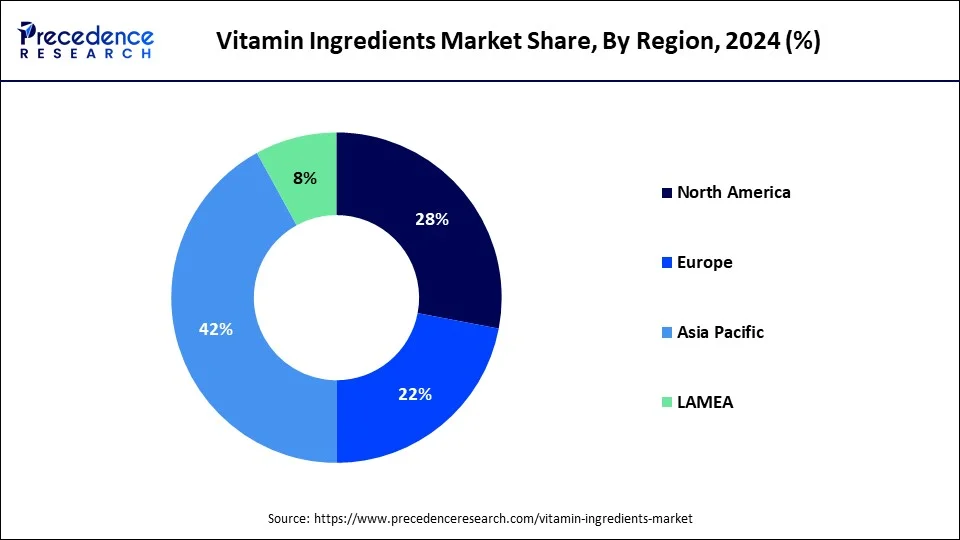

Asia Pacific dominated the vitamin ingredients market in 2023. The growing population and increasing sports activities are the major factors boosting the market in the region. China is the leading exporter of vitamins and dietary supplements. With the increasing instances of chronic and other diseases, the demand for health supplements has increased in the region. Moreover, the rising aging population and the high demand for dietary supplements further bolstered the market in Aisa Pacific.

Companies such as DSM and CSPC Pharmaceutical Group have extensive vitamin production facilities in China, exporting vitamin ingredients to markets around the world. This production scale enhances Asia Pacific’s dominance in the vitamin ingredients sector.

Japanese company Asahi Group and Indian brand Himalaya Wellness are major players in the functional food and supplement markets, offering products enriched with vitamins to meet growing consumer demand for health-enhancing foods. These companies’ emphasis on vitamin-infused products is a direct result of regional health trends. The U.S. is the leading importer of vitamin C supplements from China.

North America is observed to grow at the fastest CAGR in the vitamin ingredients market during the forecast period. This is mainly due to the availability of well-established healthcare and pharmaceutical industries in the region. Heightened awareness of healthy lifestyles and the rising health consciousness among the American population boost the adoption of nutrient-rich products. Moreover, regional pharmaceutical companies are making efforts to develop innovative products and compete in the market.

Additionally, the country is well-known for cosmetic production. Thus, the rising demand for cosmetic products further drives the market. Moreover, the rising FDA’s initiatives in expanding consumer awareness regarding dietary supplements propel the market growth.

The global vitamin ingredients market is expanding at a significant growth rate due to rising awareness about health and wellness. Changes in lifestyle lead to vitamin deficiencies in the human body. In order to cope with an active lifestyle, the consumption of vitamin supplements has increased. The increased prevalence of chronic disease is driving the market globally. Moreover, the vitamin ingredients market is expanding due to the growing aging population and the demand for vitamins to maintain age-related conditions.

Furthermore, AI and cutting-edge testing methods are helping customers determine their preferences. Technologies like 3D printing are helping production industries manufacture customized supplements. These emerging technologies are a significant step toward satisfying customer demands. The rising demand for dietary supplements is impacting the global market.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.06 Billion |

| Market Size in 2024 | USD 6.38 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.65% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising prevalence of chronic diseases

With the increasing prevalence of chronic diseases across the globe, consumer preferences toward dietary patterns are changing. This has led to an increased demand for dietary supplements. The increasing awareness about health & wellness and growing concerns about disease susceptibility encourage consumers to incorporate essential vitamins in their daily routine. Aging populations are more prone to chronic diseases. Thus, the growing aging population worldwide is responsible for market expansion. Additionally, the pharmaceutical industry heavily uses vitamin ingredients in drug manufacturing. Therefore, the increasing demand for novel and personalized medicines significantly drives the market growth.

Demand for plant-based Vitamin Ingredients

The growing adoption of plant-based diets encourages market players to boost the production of plant-based vitamins. With the growing awareness of healthy eating, the consumption of plant-based vitamins has increased in the past few years. However, ongoing innovations by key players are making it possible to create artificial plant-based vitamin supplements. Advancements in technology are opening doors for developing pure plant-based vitamin supplements.

Volatile raw material prices

Volatile raw material prices is the major factor restraining the market. Fluctuations in the costs of raw materials lead to an increase in the production cost, forcing manufacturers to reduce production volume and increase the final product's cost. This further disrupts the overall supply chain, hampering the market growth. Additionally, stringent regulations about the safety, quality, and efficacy of vitamin supplements further restrain the market.

Innovations in manufacturing techniques

Rising innovations in vitamin ingredient manufacturing techniques are opening new doors for market growth. Innovations like lab-grown nutrients are gaining popularity, and there is a growing concern for high-quality and easily digestible nutrition. Lab-grown nutrients are developed in regular atmospheres, which offer the growth conditions for pure, high-quality nutrient production. Additionally, growing awareness about sustainability is likely to encourage the use of lab-grown nutrients. Moreover, small-scale companies have increased their stock of reliable nutrients with the help of cutting-edge technologies and scientific research.

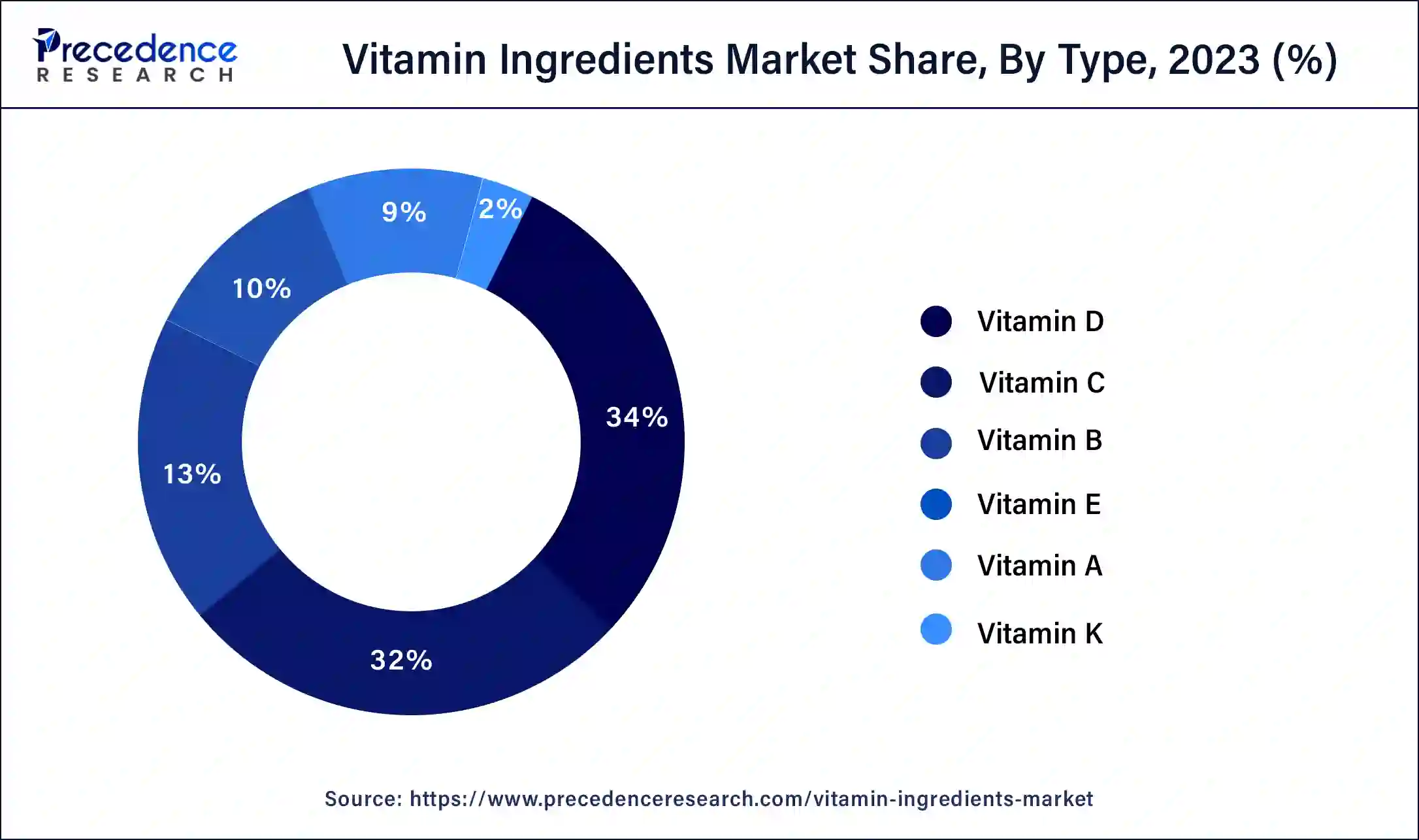

The vitamin D segment dominated the global vitamin ingredients market in 2023. This is due to vitamin D deficiency, which has been observed as the most common issue in recent years. The prevalence of kidney and liver diseases, increased indoor lifestyle, and an aging population are the common factors of increased vitamin D demand. Vitamin D deficiency is common among elderly people. Vitamin D is frequently used in the pharmaceutical and food & beverages industries. The growing demand for sports nutrition and healthcare products boosts the segment. Moreover, the rising demand for animal feed further contributed to the segmental growth, as vitamin D is essential for animal health.

The vitamin C segment is expected to expand at a rapid pace in the near future in the vitamin ingredients market. Vitamin C has multiple applications in food and skincare. It is widely used in health and skincare supplements. The growing demand for cosmetic products further boosts the demand for vitamin C. It is known for its antioxidant properties, which promote overall health and support immune functions. Moreover, the rising demand for immunity booster supplements further fuels the segment growth.

The pharmaceuticals segment dominated the vitamin ingredients market with the largest share in 2023. Growing awareness of the effects of vitamin deficiencies and poor diet are factors boosting the utilization of vitamins. Such awareness has increased the demand for various health supplements. Pharmaceutical companies highly use vitamins in drug manufacturing. Additionally, vitamin-rich drugs are in high demand among health-conscious people to promote health and well-being.

The dietary supplements segment is projected to expand at the fastest growth rate during the forecast period. This is mainly due to the changing food patterns and rising awareness about healthy eating. Moreover, the growing again population worldwide contributes to segmental growth, as aging people often face difficulties in digestion. The functional food and dietary supplement markets are rapidly expanding in Asia Pacific due to the increasing adoption of preventive healthcare and rising disposable incomes.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

July 2024

April 2025