January 2025

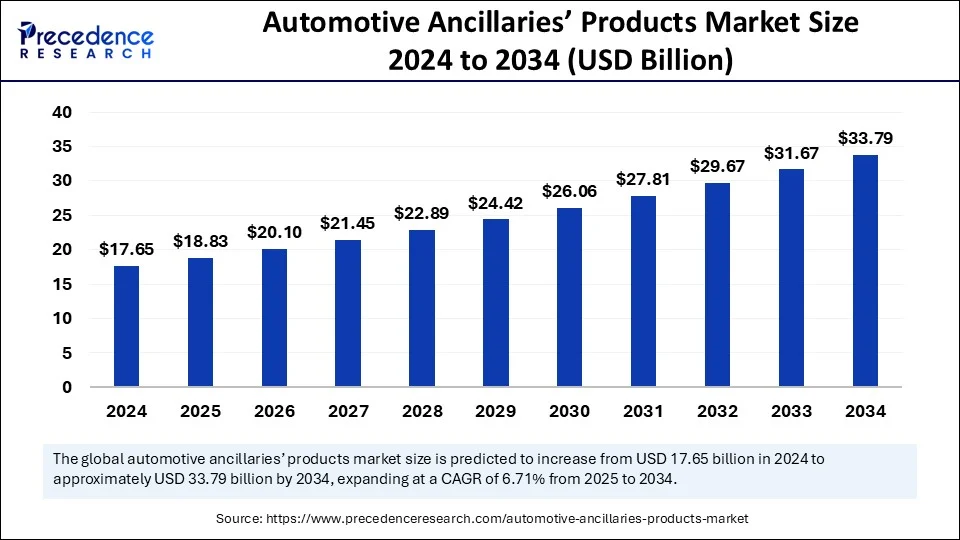

The global automotive ancillaries’ products market size is calculated at USD 18.83 billion in 2025 and is forecasted to reach around USD 33.79 billion by 2034, accelerating at a CAGR of 6.71% from 2025 to 2034. The Asia Pacific market size surpassed USD 6.88 billion in 2024 and is expanding at a CAGR of 6.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global automotive ancillaries’ products market size accounted for USD 17.65 billion in 2024 and is predicted to increase from USD 18.83 billion in 2025 to approximately USD 33.79 billion by 2034, expanding at a CAGR of 6.71% from 2025 to 2034. The market experiences fast growth because of evolving advanced technologies that create advances for vehicle safety, performance, and customization.

Artificial Intelligence currently transforms the automotive ancillaries’ products market through advanced efficiency improvements, safer functions, and better performance capabilities. The analysis of artificial intelligence is essential for designing automotive components because it enables manufacturers to generate exact, optimized products during the production phase and testing period. AI also drives innovations in the development of advanced driver-assistance systems (ADAS) and autonomous vehicles.

The manufacturing process of automotive ancillaries receives improvements from AI implementation. Production schedules succeed better with enhanced quality and detect patterns to optimize schedule timing for cost reductions. AI-based systems improve aftermarket supply chain operations by analyzing future demand patterns to achieve optimal inventory control, thus maintaining required product availability. The combination of artificial intelligence technology speeds up innovation and enhances operational productivity in the market.

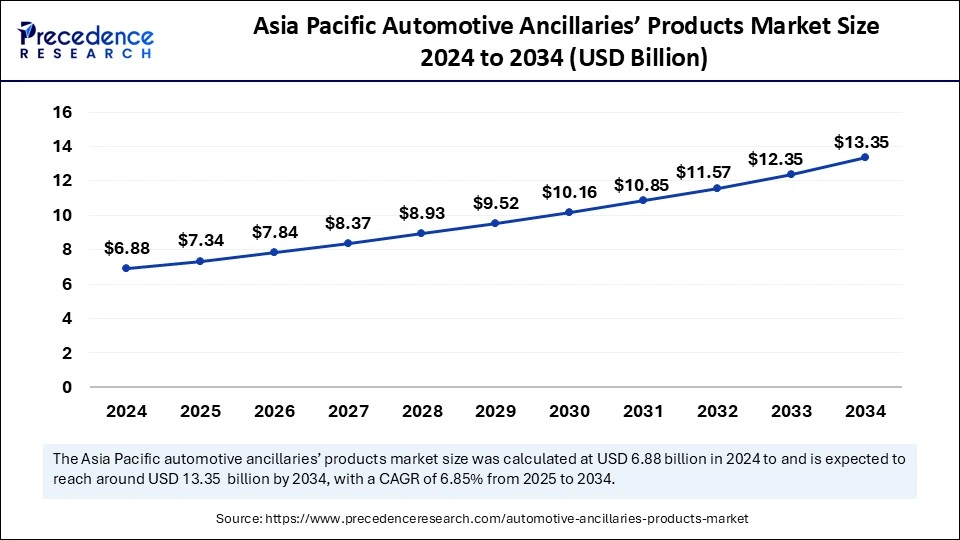

The Asia Pacific automotive ancillaries’ products market size was exhibited at USD 6.88 billion in 2024 and is projected to be worth around USD 13.35 billion by 2034, growing at a CAGR of 6.85% from 2025 to 2034.

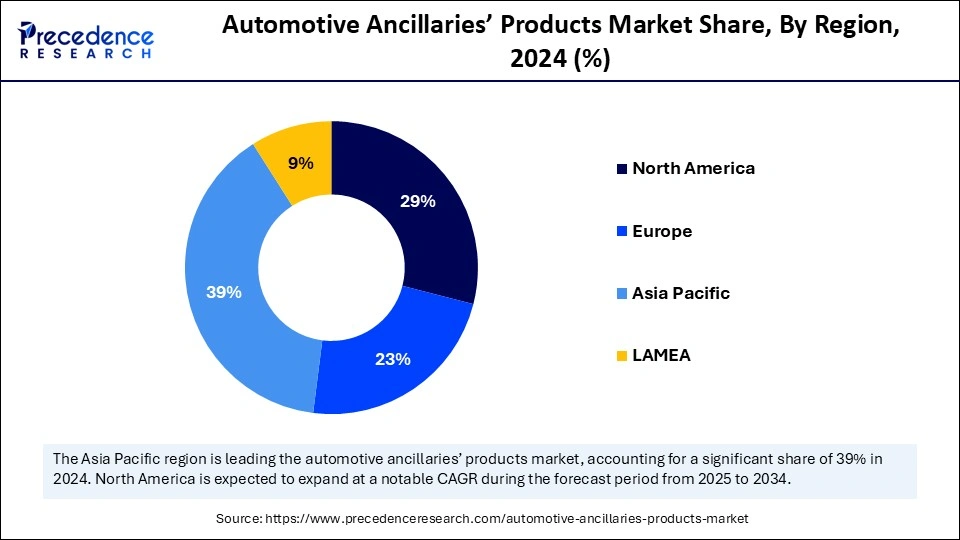

Asia Pacific accounted for the largest share of the automotive ancillaries’ products market in 2024 because of its established automotive manufacturing centers located in China, Japan, and South Korea. These countries produce extensive automobile vehicles with substantial automotive component products. The Chinese automotive market stands central due to its huge vehicle manufacturing capacity and its fast-growing domestic automotive industry.

Asia Pacific is experiencing a technological advancement boom because China stands at the forefront of implementing electric vehicle adoption. The Chinese government provides widespread backing of green technologies through subsidies while implementing EV-supportive policies that make China a world leader in EV supply chains.

North America is anticipated to witness the fastest growth in the automotive ancillaries’ products market during the forecasted years. The market expands rapidly because major automobile firms combine forces with high vehicle possession rates in the region. As the United States maintains the position of one of the world's biggest automobile markets, it substantially impacts automotive ancillary product consumption. A large number of vehicles on the roads leads to an ongoing demand for maintenance parts as well as repair and replacement parts that fuel the market growth.

The increased adoption of electric vehicles drives robust North American market demand for supporting components and accessories. The market continuously experiences rising demand because manufacturers seek out advanced automotive technologies, including autonomous driving systems, connectivity solutions, and in-vehicle infotainment platforms.

The European automotive ancillaries' products market continues to increase steadily because the region maintains a robust automotive production sector while investing heavily in research and development activities. Leading automotive producer base and their manufacturing operations from Europe where they participate actively in worldwide automotive manufacturing.

The European automotive industry requires advanced auto ancillary components because governments enact strict emission rules, and the market needs sustainable and environment-friendly transportation solutions. The European market continues to develop due to advanced automotive innovation in nations like Germany, France, and the United Kingdom.

The automotive ancillaries define basic vehicle elements and additional parts that ensure operational effectiveness, maintenance needs, and product enhancement features. Automotive ancillary products serve essential purposes within the manufacturing operations and support activities of the automotive industry after vehicles leave the manufacturing plant. The ancillary products that are not used for vehicle assembly provide essential contributions to vehicle performance and safety as well as aesthetics.

The automotive ancillaries’ products market requirement for premium-grade safe automotive components that deliver performance improvements drives producers to innovate their offerings. The aftermarket services sector supports the overall growth of automotive ancillaries by increasing vehicle maintenance demands that come with both fleet increases and vehicle repair requirements. The rising demand for vehicle personalization, infotainment technologies, and consumer demand for modern automotive parts functions as fundamental drivers of market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 33.79 Billion |

| Market Size in 2025 | USD 18.83 Billion |

| Market Size in 2024 | USD 17.65 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.71% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for vehicle personalization

Vehicle customization has become a major trend since drivers need to transform their automobiles according to their specific preferences. Apart from visual aspects, drivers want their vehicles to become more practical while simultaneously showing improved performance capabilities. Vehicle customization has become a market that stretches extensively because customers invest their money in performance, safety upgrades, and comfortable vehicle modifications.

A wide array of products commands the market because customers seek changes through custom paint, body kits with performance enhancements from turbochargers, and advanced suspension systems. The establishment of specialized online platforms focused on auto personalization enables consumers to browse various parts easily, thereby expanding the market trend.

Fluctuating raw material prices

The automotive ancillaries’ products market faces its main obstacle from fluctuating raw material prices. The production of engine suspension systems and electrical systems needs steel, aluminum, and rubber as their foundation for basic components. The events, including political instability, new trading approaches, and natural calamities, trigger variations in raw material market prices. Manufacturers encounter production budget development challenges due to unknown rises in raw material prices generated by the unpredictable nature of costs and outcomes.

Rising demand for sustainable mobility solutions

The world is transitioning toward sustainable and green mobility solutions because people aim to reduce their carbon emissions while combating environmental changes. Customers now choose electric vehicles instead of internal combustion engine (ICE) vehicles because petroleum prices are increasing and new government standards.

Technological advancements in EVs brought more people to choose electric vehicles because of advanced charging systems, as well as longer driving distances and lower vehicle costs. Electric vehicle sustainability rates gain support from the rising availability of renewable energy in the market. These governments support green mobility through their resource management to achieve environmental targets with the establishment of environmentally friendly transport systems.

The engine transmission and suspension components contributed the most market in 2024 and are expected to be dominant throughout the projected period. The demand for these engine parts rises because customers demand to protect engine functionality and achieve top vehicle performance. The demand for high-quality engine components increases because of newly developed, powerful, and fuel-efficient engines.

The growing commitment to vehicle safety and strict safety standards has intensified the market requirement for sophisticated suspension systems. Manufacturers direct their efforts toward the production of high-performance components because they meet the current market requirements of automotive customers.

The electrical parts segment is expected to show substantial growth in the automotive ancillaries’ products market. Growing numbers of electric vehicle manufacturers and mounting electronic system implementations within traditional internal combustion engine (ICE) vehicles lead to increasing electrical part demands. EVs particularly demand diverse electrical elements like batteries, electric motors, and charging infrastructure to boost their technological advancement.

Smart connected vehicles demand electrical systems to assume a vital position in controlling vehicle capabilities. The investment from manufacturers operates to generate cutting-edge electrical parts that provide performance, durability, and efficiency for vehicles, thus continuing market expansion for this segment in automotive ancillaries.

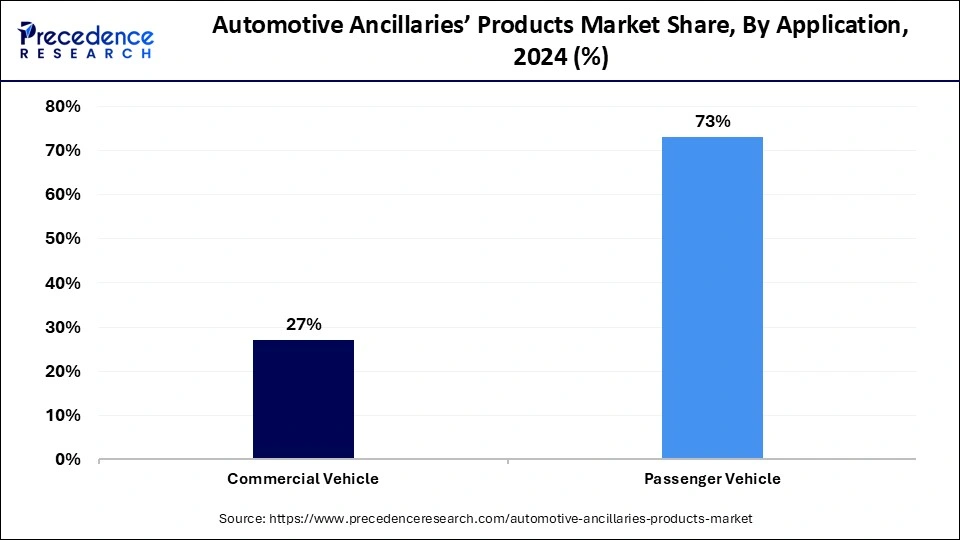

The passenger vehicle segment led the automotive ancillaries’ products market in 2024 due to growing public choice for private transportation and rising household financial capabilities. Rising consumer choices for private transportation as the main reason for mobility and convenience have significantly increased the necessity for automobile ancillary items. The expansion of new car models featuring modern components supporting safety systems as well as infotainment options and fuel efficiency technologies produces robust market demand.

Sustained vehicle performance and safety with comfort requirements demand fundamental elements, which consist of engine parts, suspension systems, electrical parts, and safety features. Automakers make passenger vehicles technologically advanced through their product focus, so they require advanced and premium-quality auxiliary goods for their vehicles.

The commercial vehicle segment is expected to show significant growth in the market over the forecast period. The essential role of commercial vehicles, including trucks, buses, and delivery vans in global logistics, requires top-quality ancillary products, which drive the market's demand level.

The strong growth of e-commerce has generated additional demand for efficient logistics solutions that drive up the need for advanced commercial vehicles with their essential parts. Manufacturers prioritize making components that combine strength with high-performance capabilities for enduring commercial industry requirements.

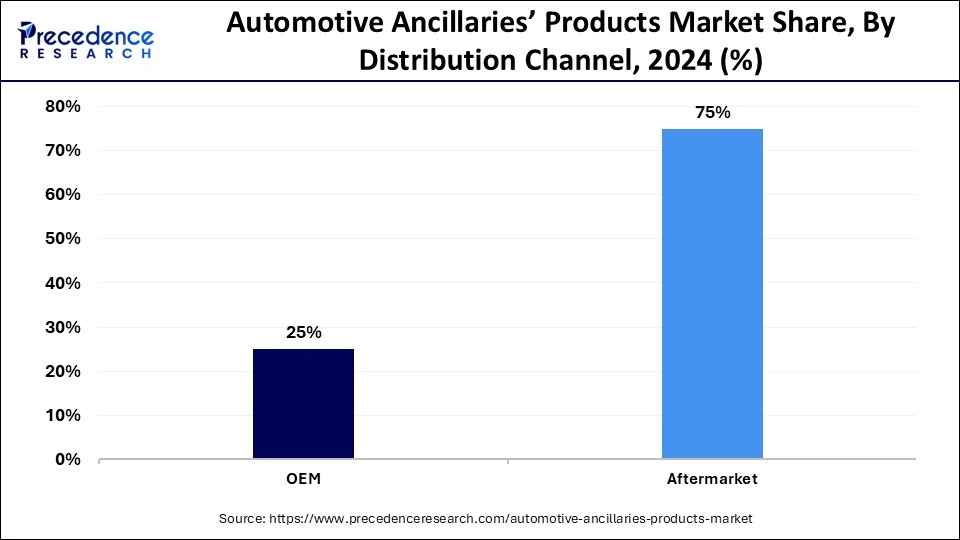

The aftermarket segment held the largest automotive ancillaries’ products market share in 2024. The rising age of vehicles and expanding global vehicle fleet leads to an increasing demand for replacement parts. Aftermarket auto part demands are rising because more people are performing car maintenance themselves and because independent repair shops exist more frequently.

E-commerce platforms serve as major market growth factors that bring aftermarket parts within easier reach of buyers worldwide. Connecting vehicles and emerging technologies with electric components is transforming the aftermarket sector by making businesses focus on developing new solutions for consumer demands that include advanced sensors and parts compatible with EVs.

The OEM segment is anticipated to show considerable growth in the market over the forecast period. OEM auto parts are designed for vehicle manufacturers since they must adhere to performance standards while ensuring safety and meeting quality criteria. The rising number of vehicle productions worldwide with new vehicle releases creates a strong market requirement for OEM components.

Manufacturers serving the automotive ancillaries market develop enduring relationships with Original Equipment Manufacturers to acquire contractual agreements that support ongoing market demand. The automotive manufacturer segment within ancillary products will continue to expand due to ongoing advancement from manufacturers leading to OEM segment market expansion.

By Component

By Application

By Distribution Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

April 2025

January 2024

January 2025