May 2025

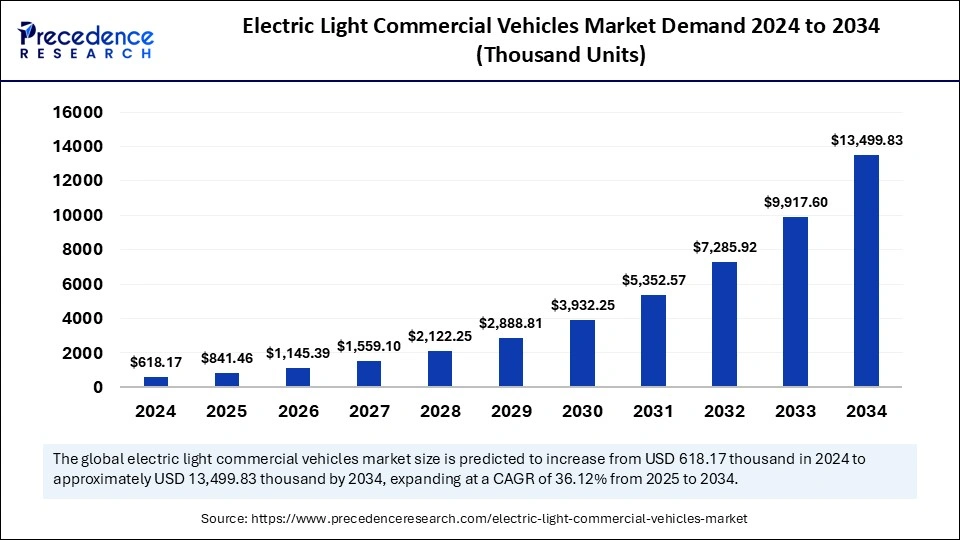

The global electric light commercial vehicles market demand was estimated at 618.17 thousand units in 2024 and is predicted to increase from 841.46 thousand units in 2025 to approximately 13.499.83 thousand units by 2034, expanding at a CAGR of 36.12% from 2025 to 2034. The demand for light commercials EVs is growing due to the rising focus on adopting low-operating infrastructure that attracts significant investments.

The emergence of technologies like artificial intelligence and machine learning (ML) is playing a transformative role in shaping the transportation sector while maintaining environmental norms. The use of AI is significantly increasing in fleet management, where these algorithms analyze the traffic, weather, and other conditions and provide real-time insights to improve delivery outcomes within less time.

The electric light commercial vehicles market is growing rapidly due to technological adoptions that provide advanced analysis of the potential issues within the vehicles. Additionally, the rising innovations in autonomous vehicles are anticipated to mandate the requirement for AI in these vehicles, which will help in various tasks, from traffic prediction to object detection to driving assistance.

Electric light commercial vehicles (LCV) are battery-based vehicles that are specifically designed to carry goods for delivery and transportation. Some of the LCVs include vans, pickup trucks, gross weight vehicles, and others that are recharged instead of adding up traditional fuels like petrol or diesel. The electric vehicle commercial vehicles market is growing rapidly due to the rising trade activities that require these vehicles for short and long-term transport operations. The use of electric light commercial vehicles market is mainly attracted by e-commerce businesses, retail businesses, and the construction sector. The adoption is helping companies manage their transport goals with the help of lightweight vehicles that can be used in multiple applications.

| Report Coverage | Details |

| Market Size by 2034 | 13.499.83 Thousand Units |

| Market Size in 2025 | 841.46 Thousand Units |

| Market Size in 2024 | 618.17 Thousand Units |

| Market Growth Rate from 2025 to 2034 | CAGR of 36.12% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Propulsion Type, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Government Support

The automotive industry is witnessing rapid growth for several reasons, which attract government attention in multiple ways. The electric light commercial vehicles market is growing rapidly as many governments are offering tax credits and subsidies to boost the sales of EVs in commercial applications. The governments are also investing in the improvement of charging infrastructure that helps towards the increasing adoption of EVs, especially for commercial purposes, as it can be beneficial in the long run for large businesses.

Constant government support is also anticipated to boost the industry players' adoption of EV transport in the upcoming years. For instance, the United States offers federal tax credits of up to USD 7500 per EV under the Inflation Reduction Act.

Rapid expansion in the e-commerce sector

The rising smartphone penetration, especially in developing economies, is playing a crucial role in the growth of digital business adoption. The electric light commercial vehicles market is growing due to the rising consumer base that is opting for online shopping for various goods through various e-commerce platforms like Amazon, Flipkart, and many more that offer different ranges of products.

Digitalization is also leading towards enhancing last-mile delivery services that would help in developing cost-effective services. For instance, the U.S. retail e-commerce sales of the third quarter of 2024 marked an increase of 2.6% from the second quarter, accounting for USD 300 billion.

Higher initial costs

The rise of EVs is one of the booming topics in recent years that has gained significant attention in urbanized areas. The use of EVs is increasing in the commercial sector, and they often require expensive battery packs. The electric light commercial vehicles market is experiencing several issues due to the requirement for specialized components like motors and other systems, which increase manufacturing costs. This affects its overall prices and makes it unavailable for the SMEs, especially in underdeveloped regions. Additionally, the lack of charging infrastructure also acts as a restraint where traditional fuel-based vehicles are being used on a large scale.

Rising sustainable adoption among businesses

The rising trend for sustainable transport is one of the biggest factors influencing the use of e-vehicles, especially in commercial applications. The electric light commercial vehicles market is anticipated to gain more popularity, where e-LVCs are becoming a popular option as they help reduce carbon footprints. For instance, IKEA has aimed to adopt 91% zero-emission deliveries by the end of 2025 in India.

Recent initiatives are also anticipated to help companies mark a significant brand image among consumers and their competitors. This is also anticipated to create more partnerships and collaborations among companies like Siemens and Tesla. Additionally, these companies' adoption of EVs is anticipated to reduce logistics costs in the upcoming years.

Increasing R&D in battery innovation

EV adoption has been growing significantly in recent years, and regulatory bodies are keen on developing solutions in the transport sector. The biggest concerns are among the EVs and the traditional fuel-based vehicles. The EVs often require more charging times and have a low battery life, which is attracting significant investments in the growth of lithium-ion batteries. For instance, Toyota and QuantumScape are investing heavily to develop solid-state battery technology that will be beneficial for commercial EVs. These initiatives are also anticipated to reduce battery costs, which can be profitable for companies in the long run.

The e-pickup trucks segment marked its dominance over the market by generating the largest share in 2024. These vehicles are mainly designed for transporting logistics, cargo, and fleet operations. The dominance of e-pickups is attributed to the growing popularity in industrial and commercial sectors, which can carry heavy loads while being operated at low costs. The electric light commercial vehicles market is growing rapidly, and governments are promoting the use of EVs, which can be used in these applications. The battery capacity also provides 250+ miles on a single charge, which makes it ideal for the construction sector.

The e-vans segment is anticipated to grow at the highest CAGR during the forecast period of 2025 to 2034. These vehicles are specially designed for passenger transport, urban mobility, and last-mile delivery. The market is anticipated to grow more rapidly due to e-commerce expansion, which will increase the sales of e-vans. Companies are also contributing through partnerships that can help improve electric delivery options. The rising pollution in regions like Delhi (India), Dhaka (Bangladesh), and others is anticipated to attract more investments in sustainable transportation.

The BEV segment stood the dominant in the market by contributing to the largest share in 2024. These vehicles run on rechargeable batteries, which eliminates the need for an internal combustion engine. The electric light commercial vehicles market is growing rapidly due to the rising regulatory support from governments that provide subsidies and incentives to EV buyers. The increasing focus on the advancement in lithium-ion batteries is providing significant opportunities for companies to attract more consumers. The expansion of the charging infrastructure is also increasing the sales where the consumers can use these vehicles regularly. Businesses are investing in these vehicles, which would help them generate more revenue in the long run due to the low operating cost of the BEVs.

The diesel/gasoline segment is anticipated to grow at the fastest rate during the forecast period of 2025 to 2034. These vehicles had maintained their growth due to the lack of charging infrastructure in underdeveloped regions. The agriculture and industrial sectors in these regions rely on these vehicles, which is anticipated to attract more investments. Companies also restrict the adoption of BEVs due to a lack of charging stations, which can eventually disrupt their supply chains.

Asia Pacific dominated the global electric light commercial vehicles market in 2024. The dominance of the region is attributed to the rapid expansion of e-commerce in countries like Japan, China, and India. The region is also one of the largest EV manufacturers, with the inclusion of China, which leads in battery manufacturing. These factors have managed to mark significant adoption of EVs in these regions, which would reduce the reliability of imports in other regions. The rising government initiatives are anticipated to maintain the growth with a massive increase in EV sales for commercial purposes.

China Electric Light Commercial Vehicles Market

The Light Commercial Vehicles sector in China has seen considerable expansion in recent years, influenced by evolving consumer preferences, new trends, and unique local conditions. In the Light Commercial Vehicles market in China, customer preferences are changing toward vehicles that provide both practicality and fuel efficiency. Chinese buyers are progressively searching for vehicles suitable for both personal and professional use, seeking versatile and cost-efficient choices. Consequently, there has been an increasing need for compact vans and pickup trucks that can house both passengers and cargo, while also being fuel-efficient. As the market progresses, manufacturers and companies must keep up with these trends and adjust to the shifting demands of Chinese consumers.

Europe is anticipated to grow at the highest CAGR in the market during the forecast period of 2025 to 2034. The growth of the region is attributed to the strict regulation of bodies like the European Union (EU) that have adopted policies to eliminate the use of fossil fuel transportation. The electric light commercial vehicles market is anticipated to grow more rapidly due to the rising popularity of logistic providers like Amazon, FedEx, and many more. The rising government investments in the charging infrastructure are anticipated to increase the station capacity in the upcoming years.

By Vehicle Type

By Propulsion Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

January 2025

September 2024