April 2025

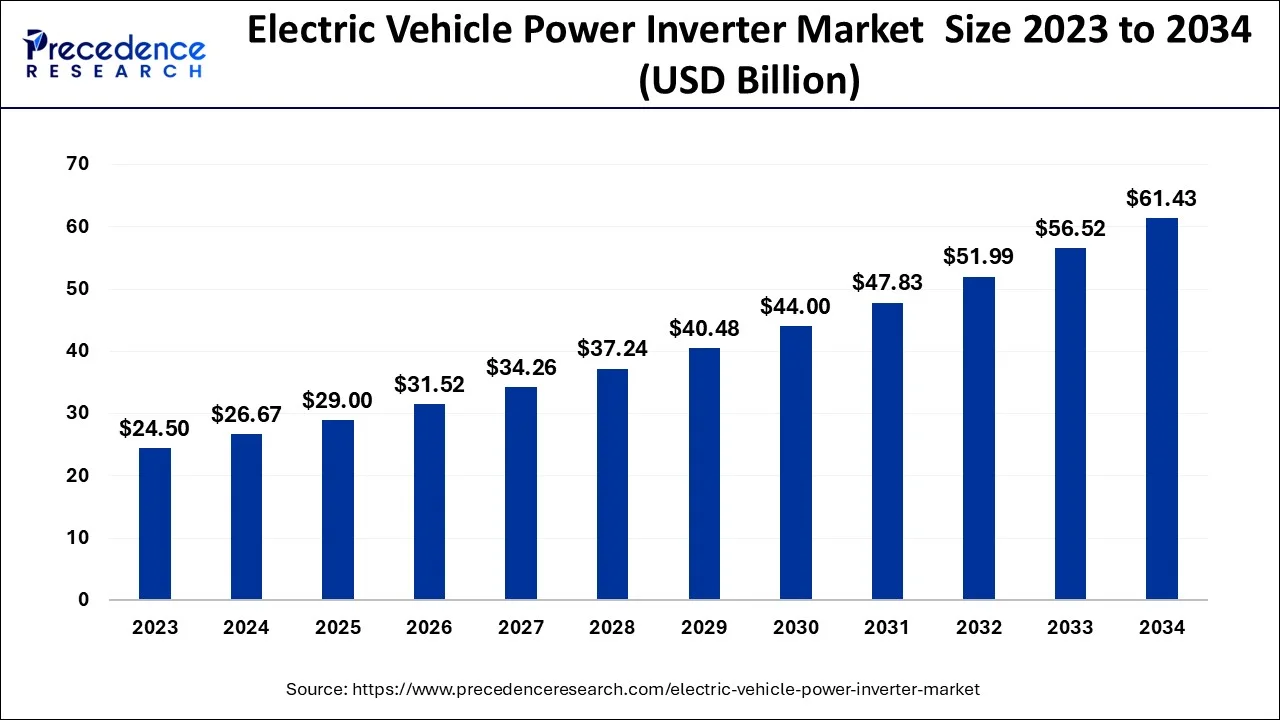

The global electric vehicle power inverter market size accounted for USD 26.67 billion in 2024, grew to USD 29 billion in 2025 and is predicted to surpass around USD 61.43 billion by 2034, representing a healthy CAGR of 8.70% between 2024 and 2034.

The global electric vehicle power inverter market size is estimated at USD 26.67 billion in 2024 and is anticipated to reach around USD 61.43 billion by 2034, expanding at a CAGR of 8.70% from 2024 to 2034.

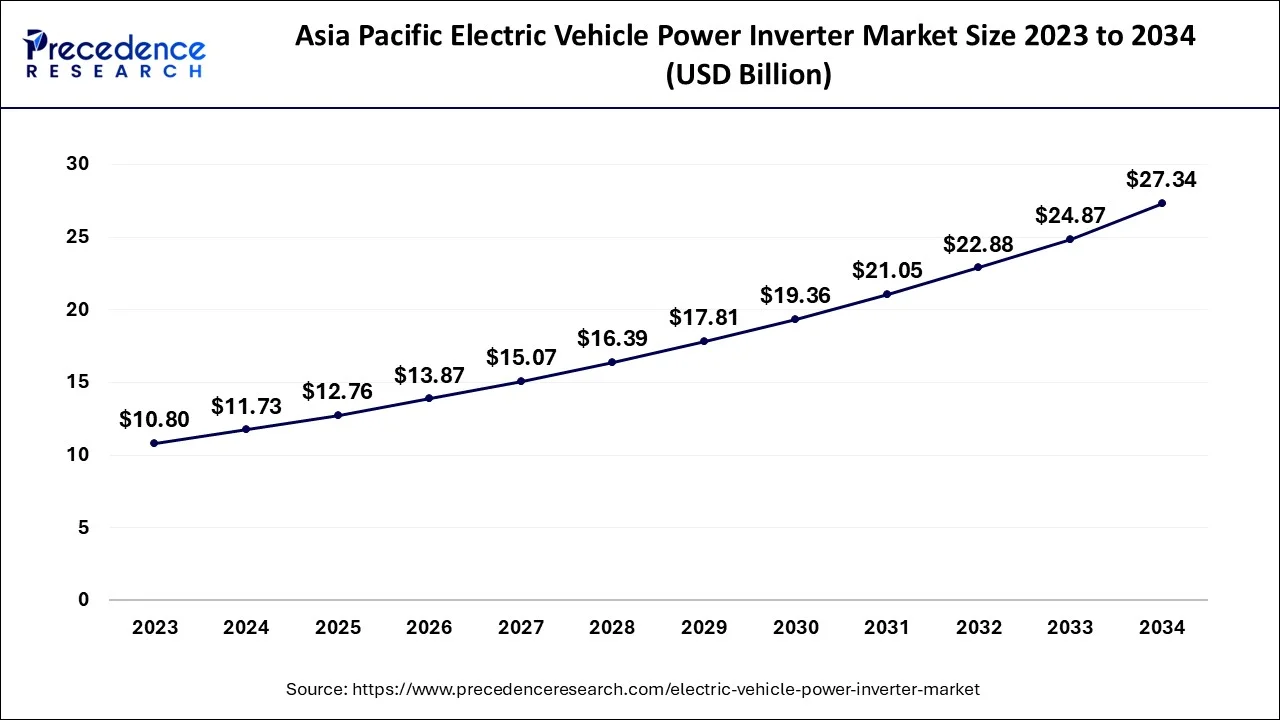

The Asia Pacific electric vehicle power inverter market size is evaluated at USD 11.73 billion in 2024 and is predicted to be worth around USD 27.34 billion by 2034, rising at a CAGR of 8.81% from 2024 to 2034.

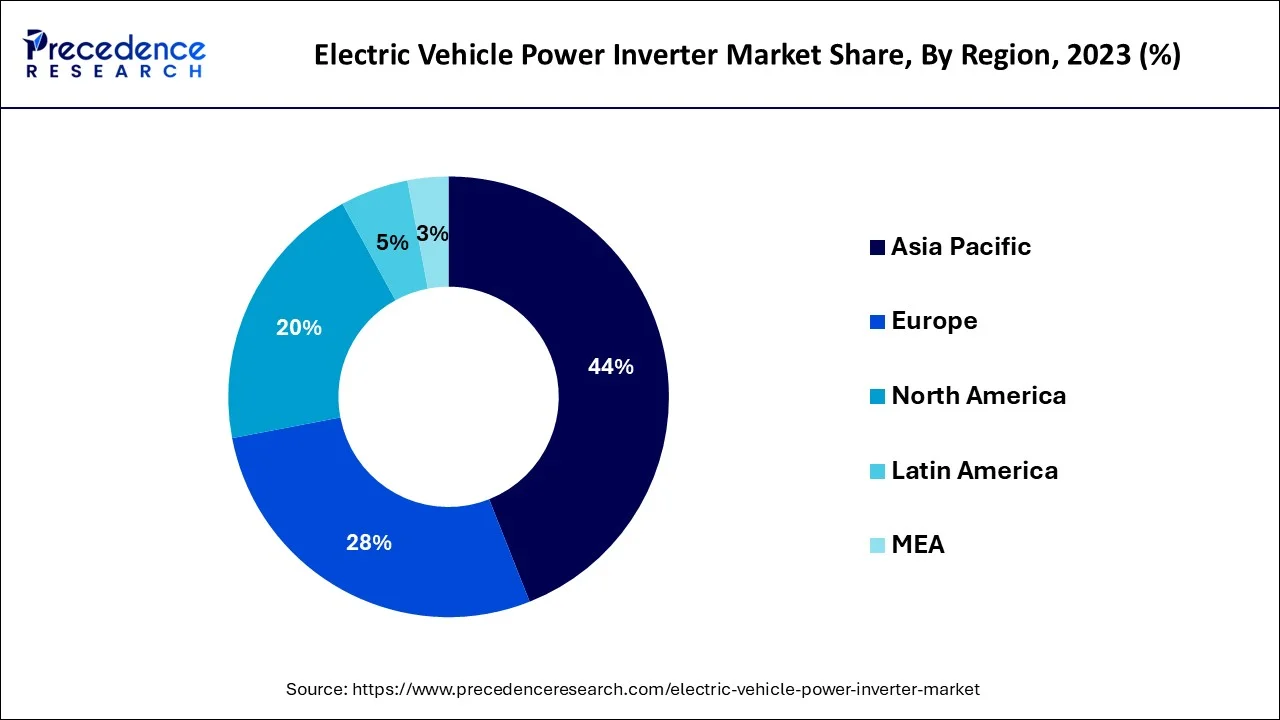

Asia-Pacific has dominated the market with the largest market share in 2023. China is a significant global player in the electric vehicle industry. Furthermore, the Chinese government is pushing citizens to use electric automobiles. The country intends to phase out diesel and gasoline automobiles altogether by 2040. The Chinese electric passenger vehicle market is also one of the largest in the world, and it has been quickly expanding in recent years. It is likely to rise throughout the forecast period, influencing demand for electric vehicle power inverters as the demand for electric vehicles rises. Contracts and agreements for the sale of electric buses between Chinese automotive manufacturers and other countries are likely to stimulate demand for electric vehicle power inverters in China. The primary factors projected to raise demand for electric car power inverters in China are an increase in vehicle manufacturing for export to other countries and the adoption of electric mobility.

Europe is expected to be worth USD 6,500 million by 2033, with a CAGR of 23.6%. Germany is a prominent European vehicle market. It is one of the world's top markets for electric trucks. In Germany, the demand for electric vehicles has been steadily increasing in recent years, paving the way for electric vehicle power inverters. For example, passenger automobile sales have increased dramatically in recent years. Electric vehicles increased by 207% year on year, with 194.4 thousand unit sales in 2020 compared to 63.2 units in 2019. Several alliances, partnerships, and joint ventures amongst component producers are expected to benefit the electric car power inverter industry. For example, on May 22, 2020, VIC, an Israeli technology firm, and ZF Friedrichshafen AG announced a collaboration. The major purpose of the cooperation endeavour is to manufacture inverters for electric automobiles. The above-mentioned causes present potential for producers of electric vehicle components and parts, since demand for components such as electric vehicle power inverters is likely to expand throughout the forecast period.

A power inverter is a machine that converts one kind of a voltage to another, such as converting DC voltage input to symmetric AC output voltage or exactly opposite. Produced AC output voltage has a specific magnitude as well as frequency. Inverters of various varieties, including traction inverters as well as soft switching inverters, are used in electric vehicles for a variety of applications. Increasing OEM efforts to develop and introduce electric vehicles as soon as possible are projected to enhance the electric vehicle power inverter market over the forecast period.

The increasing government support for the development of electric vehicles from various nations across the globe is expected to boost the electric vehicle power inverter market in coming future. During the forecast period, rapid technical breakthroughs in the field of power electronics, such as the development of high-power density inverters, are projected to fuel the electric vehicle power inverter market. In recent years, prominent vehicle manufacturers such as Tesla have increased the inclusion of inverters working on an AC power supply in electric cars, which is expected to boost the electric vehicle power inverter industry over the projected period.

The increase in need for electric cars, aggressive government measures for the production of vehicles that run on electricity, and increase in the market for low emission as well as fuel efficient automobiles are factors driving the rise of the electric vehicle power inverter market. The market economy is accountable for the market's growth. India, China, Brazil, and South Africa all have expanding economies. Thus, the manufacturing sector in these nations saw significant expansion, which is projected to give attractive prospects for the growth of the automotive industry, thereby fueling the market. Furthermore, there is a surge in electric car sales in several developing nations, which is projected to drive the EV power inverter market.

| Report Coverage | Details |

| Market Size in 2024 | USD 26.67 Billion |

| Market Size by 2034 | USD 61.43 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Propulsion Type, Vehicle Type, Inverter Type, Level of Integration, Distribution Channel, and Geography |

The greatest market share is held by battery electric vehicles in 2023. Increased sales of battery electric cars, as well as the expensive cost of batteries, have demanded the upgrading of inverters and other power electronics, as well as vehicle performance. Companies that carry goods are also replacing their present fleets of vehicles with ones driven by electric propulsion due to the fast-rising use of electric mobility worldwide. Governments all across the globe have taken the lead in developing legislation to encourage the usage of electric cars. With the growing worldwide demand for battery electric cars, the need for power inverters is likely to rise throughout the forecast period.

The second-largest sector is Hybrid Electric Vehicles. Hybrid electric car sales have been steadily increasing over the world. For example, 454,890 hybrid car sales in the United States in 2019 compared to 380,794 hybrid electric vehicle sales. In 2019, 0.5 million hybrid cars were sold, representing a 20% increase year over year. Many premium car manufacturers throughout the world are now introducing hybrid vehicles.

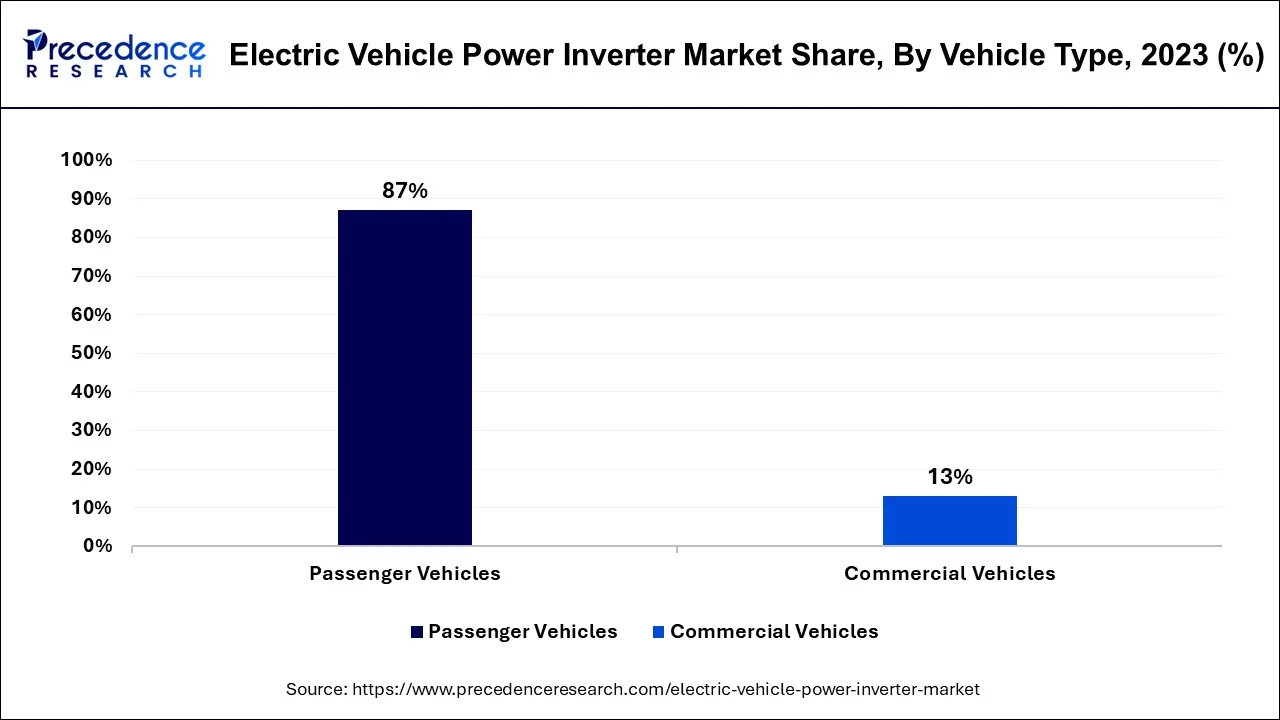

Passenger Cars have the most market share in 2023. The inverter regulates the electric motor in an electric powertrain. This inverter, like the engine management system (EMS) in combustion cars, is a critical component in the automobile since it controls the vehicle's efficiency.

The global market for hybrid, electric, and fuel cell passenger automobiles has been increasing in recent years, mainly to increased demand in North America, Europe, and Asia-Pacific (especially China). Because of planned models from manufacturers throughout the world, automotive electrification is projected to continue during the projection period. These improvements in electric passenger vehicles are expected to open up new potential for participants in the power inverter industry.

By Propulsion Type

By Vehicle Type

By Inverter Type

By Level of Integration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

September 2024