March 2024

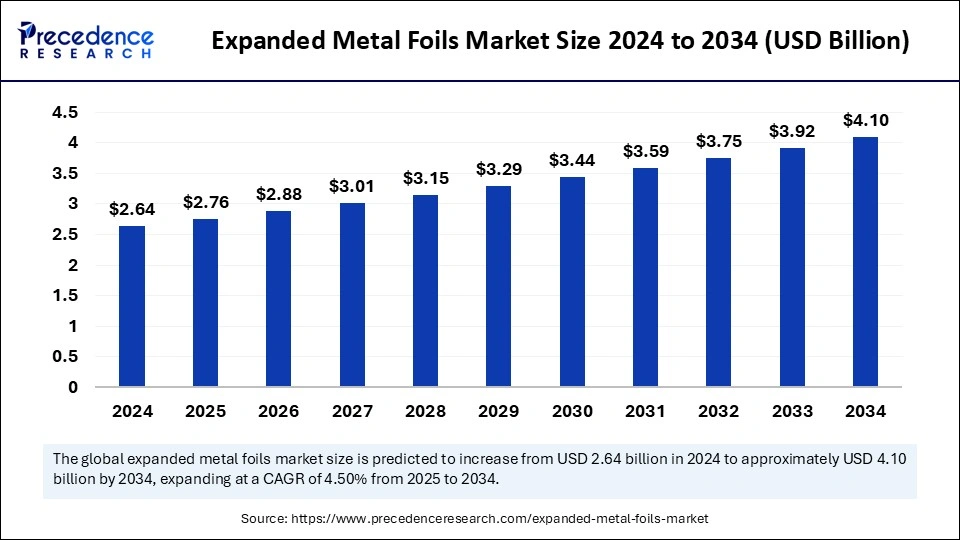

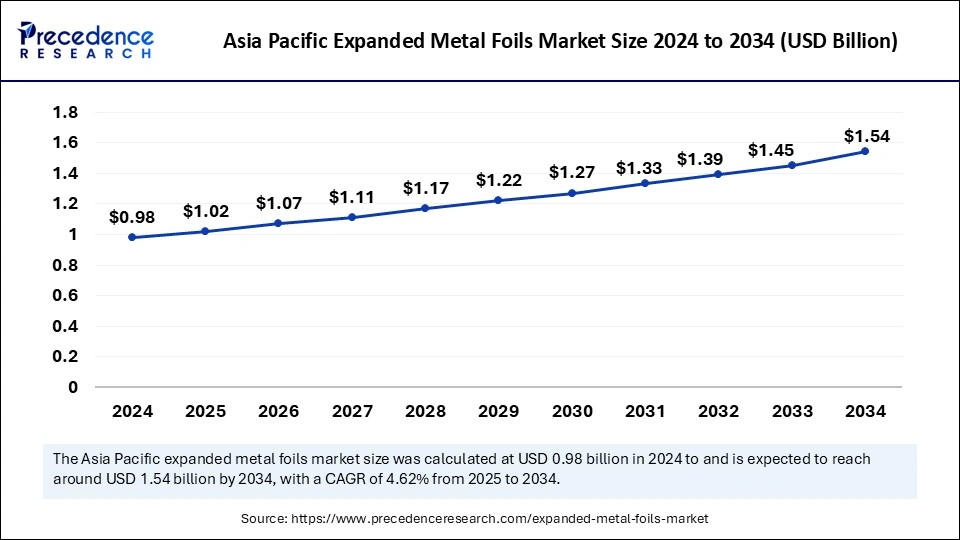

The global expanded metal foils market size is calculated at USD 2.76 billion in 2025 and is forecasted to reach around USD 4.10 billion by 2034, accelerating at a CAGR of 4.50% from 2025 to 2034. The Asia Pacific market size surpassed USD 980 million in 2024 and is expanding at a CAGR of 4.62% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global expanded metal foils market size was estimated at USD 2.64 billion in 2024 and is predicted to increase from USD 2.76 billion in 2025 to approximately USD 4.10 billion by 2034, expanding at a CAGR of 4.50% from 2025 to 2034. Rising demand for renewable energy, especially wind power, is the key factor driving the growth of the market. Also, technological developments in materials coupled with stringent regulatory standards can fuel market growth further.

The advent of Artificial Intelligence and Machine Learning is substantially impacting the expanded metal foils market positively. These technologies enable organizations to optimize operations, automate processes, and gain key insights into market trends. Furthermore, companies using AI-powered analytics can detect patterns, forecast demand, and make decisions, accordingly, fuelling innovation.

The Asia Pacific expanded metal foils market size was exhibited at USD 980 million in 2024 and is projected to be worth around USD 1.54 billion by 2034, growing at a CAGR of 4.62% from 2025 to 2034.

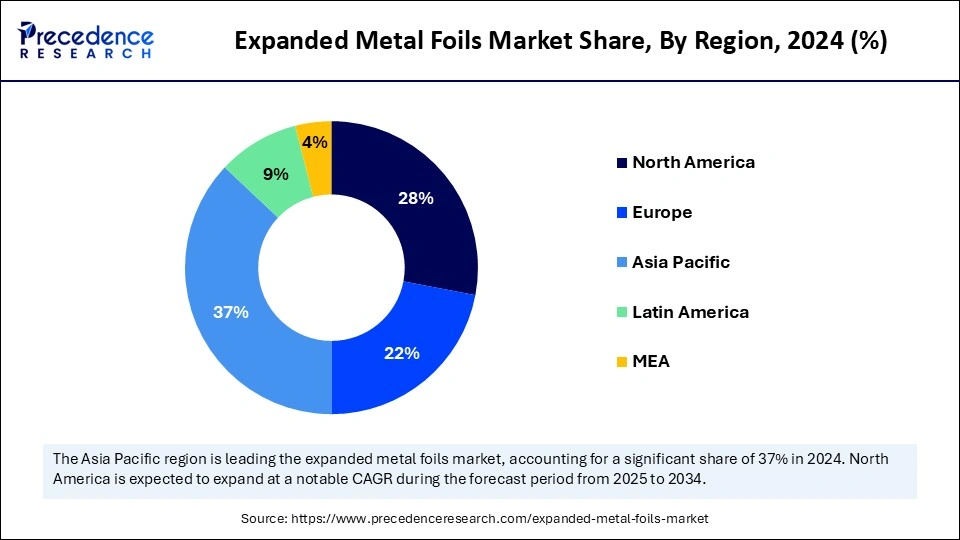

Asia Pacific dominated the global expanded metal foils market in 2024. The dominance of the region can be attributed to the rising demand for expanded metal foil in the automotive and construction industries. Also, the region exhibits a strong presence of key market players which facilitates the demand for this metal further. Moreover, governments are increasingly promoting food exports.

North America is expected to grow at the fastest rate in the expanded metal foils market over the studied period. The growth of the region can be credited to the rising requirement for durable and lightweight materials in the automotive and construction industries. Furthermore, this metal foil is also utilized in many applications like shielding, filtration, and EMI/RFI protection, leading to market growth in the region in the upcoming years.

Expanded metal is a kind of metal sheet that can be stretched and cut to form a diamond-shaped mesh-like material. It is mostly utilized for grates and fences or as a metallic lath to support stucco or plaster. This metal is used to protect devices or equipment in the home or industrial sector. Expanded metal foils are generally used for decorative use, filtration process, security purposes and screening, and ventilation.

Top 5 Steel Exporting Countries For 2024

| Top 5 Steel Exporting Countries | Steel Export Data |

| China | 88.3 billion |

| India | 12.7 billion |

| Japan | 7.2 billion |

| The United States | 6.9 billion |

| Russia | 6.6 billion |

| Report Coverage | Details |

| Market Size by 2034 | USD 4.10 Billion |

| Market Size in 2025 | USD 2.76 Billion |

| Market Size in 2024 | USD 2.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.50% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Mesh Size, Shape, Substrate, End Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Growth in the construction and infrastructure industry

The expanded metal foils market products can be used in many building applications, especially in cladding, flooring, and roofing. The infrastructure and construction industry are huge and heavy-duty, which results in an increasing number of installations in residential and commercial buildings. In addition, these metal foils are also used in the construction sector, like tunnels, bridges, and stadiums. Also, the surging infrastructure and construction sectors in developing countries can boost market growth further.

Complex installation procedures

Complicated installation procedures are the major factor restraining the expanded metal foils market, particularly in developing economies. Also, strict regulatory requirements associated with adverse environmental impact and safety standards can create challenges for manufacturers. Moreover, stringent certifications and testing need to fulfill industry-specific standards, which can increase overall costs.

The surge in global consumption of packaged and processed food products

The market is witnessing growth due to increasing consumer choices towards packaged and processed foods. Portability and convenience are important factors fuelling the demand for expanded metal foils, such as aluminum foils, in the food and beverage sector. Furthermore, the pharmaceutical industry uses metal foil for blister packaging that provides benefits like raised product shelf life and tamper-evident features.

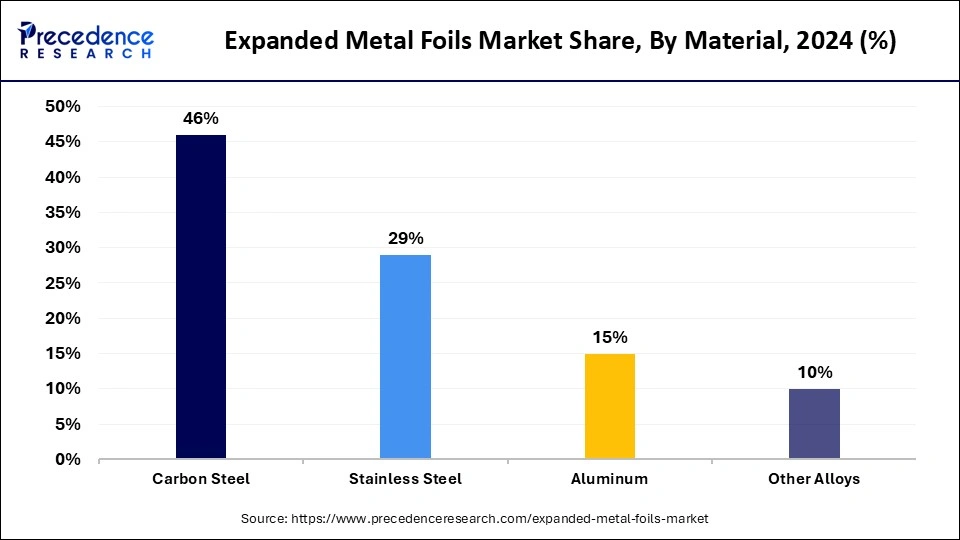

The carbon steel segment accounted for a considerable share of the expanded metal foils market in 2024. Carbon steel is the most widely used material due to its high strength, durability, and cost-effectiveness. It is commonly used in construction, automotive, and industrial applications. Carbon steel materials have been witnessing an upsurge in investment in recent years. The key players operating in the market are including carbon steel foils in their portfolios.

The 3.0 mm-4.0 mm segment dominated the expanded metal foils market in 2024. The dominance of the segment can be attributed to the increasing demand for expanded metal foils in automotive, construction, and other applications. Additionally, major market players are growing their R D expenditure to improve the quality and performance of products, propelling the market growth soon.

The 1.5 mm-2.0 mm segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rising use of this size mesh in filtration and separation processes, particularly in pharmaceutical companies where, during the manufacturing process, filtration is necessary. Also, many end-use industries use this size mesh for other industrial applications too.

The flat-shape segment led the global expanded metal foils market in 2024. The dominance of the segment can be driven by increasing applications of flat-shaped metal foils in various end-user industries because of their cost-effectiveness, easy installation, and handling. The applications of this segment extend from lithium-ion batteries to photovoltaic solar modules surface finishing, fuses, and flexible printed circuit boards.

The corrugated-shaped segment is projected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to its high rigidity and strength, which makes it convenient for applications that necessitate durability and structural support. Commonly, these metal sheets are manufactured from aluminum, steel, and galvanized metal and coated for corrosion resistance.

The polypropylene segment led the expanded metal foils market in 2024 and is expected to grow at the fastest rate over the studied period. The dominance and growth of the segment can be linked to the increasing use of Polyethylene in the agricultural and packaging industry. Furthermore, Polypropylene has excellent chemical resistance and superior strength-to-weight ratio and is extensively used in the packaging, automotive, and construction sectors.

In 2024, the building and construction segment held the largest expanded metal foils market share. The dominance of the segment is due to the rising demand for durable and lightweight materials in the construction industry. Moreover, the construction industry is booming in developing economies like China and India, which further necessitates the expanded metal sheets widely.

The automotive segment is anticipated to grow at a significant rate during the projected period. The growth of the segment is because of the increasing demand for fuel-efficient and efficient vehicles across the globe. In addition, in the automotive sector, these foils reduce the vibration, noise, and harshness, propelling the overall segment's growth soon.

By Material

By Mesh Size

By Shape

By Substrate

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

April 2025

January 2025

January 2025