November 2024

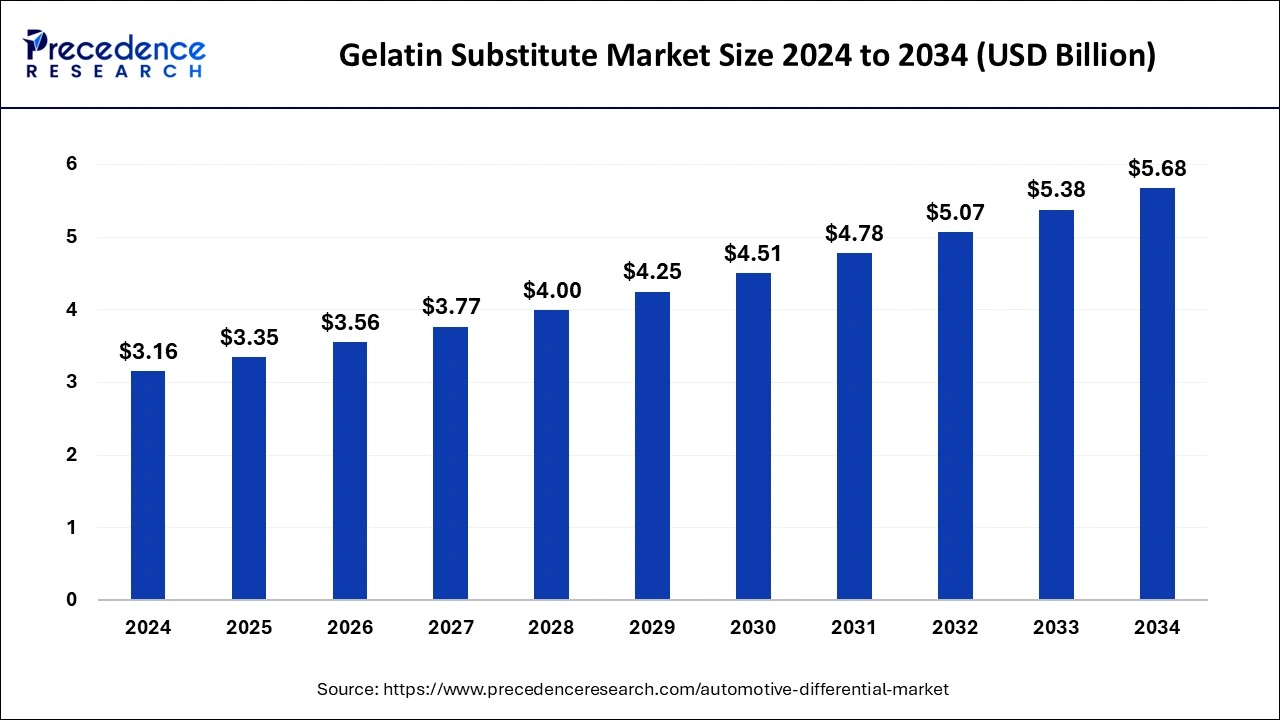

The global gelatin substitute market size is calculated at USD 3.35 billion in 2025 and is forecasted to reach around USD 5.68 billion by 2034, accelerating at a CAGR of 6.04% from 2025 to 2034. The Asia Pacific gelatin substitute market size surpassed USD 1.21 billion in 2025 and is expanding at a CAGR of 6.15% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global gelatin substitute market size was estimated at USD 3.16 billion in 2024 and is predicted to increase from USD 3.35 billion in 2025 to approximately USD 5.68 billion by 2034, expanding at a CAGR of 6.04% from 2025 to 2034. The development of plant-based gelatin substitutes may be an opportunity for the market to grow.

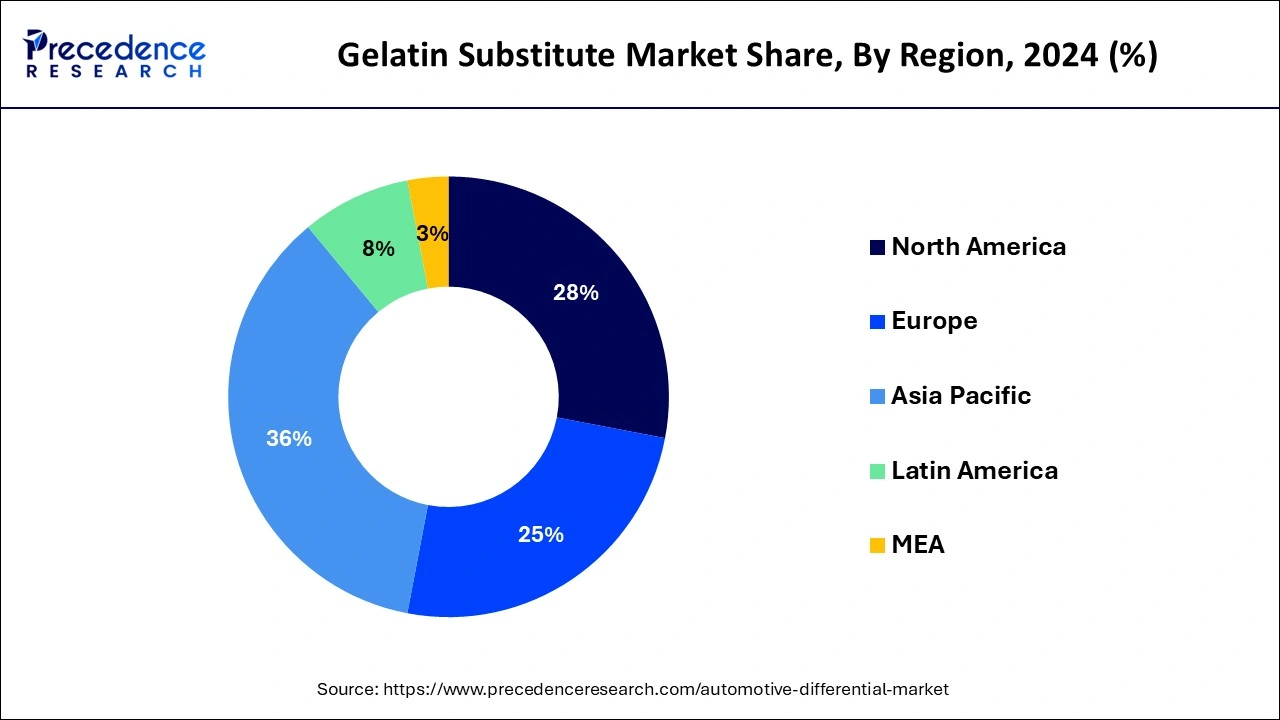

The Asia Pacific gelatin substitute market size surpassed USD 1.14 billion in 2024 and is expected to be worth around USD 2.07 billion by 2034 at a CAGR of 6.15% from 2025 to 2034.

Asia Pacific dominated the gelatin substitute market by region in 2024. A significant proportion of the world's population, including highly populated countries like China and India, reside in the region. The need for a broad range of consumer items, such as food, drinks, medications, and cosmetics, is rising along with the population, and these are important markets for gelatin alternatives.

Plant-based diets and products have become increasingly popular in the region owing to a number of issues, including environmental concerns, ethical considerations, and health consciousness. Consequently, the food, pharmaceutical, and other industries are seeing an increase in demand for plant-based gelatin alternatives. Consumers in Asia Pacific are searching for items that they believe to be healthier and more natural as a result of growing awareness about health and wellness.

Europe is expected to grow to the highest CAGR in the gelatin substitute market by region during the forecast period. The widespread adoption of diets based on plants and associated goods has increased significantly in Europe as a result of ethical, environmental, and health-conscious factors. Food, pharmaceutical, cosmetic, and other industries are seeing an increasing demand for plant-based gelatin alternatives.

Manufacturers and suppliers are investing more and trying to expand their markets in Europe's gelatin alternative market. It is anticipated that companies will propel growth in the region by concentrating on growing their product portfolios, enhancing their distribution networks, and boosting market penetration.

Gelatin substitutes are an irreversibly hydrolyzed form of collagen in which the hydrolysis breaks down protein fibrils into smaller peptides. The molecular weight of the peptides varies widely, contingent on the physical and chemical denaturation processes. The gelatin substitute market refers to gelatin, which is a transparent, flavorless, and colorless food component that is often made from collagen extracted from animal tissues. When dry, it is brittle; when wet, it becomes rubbery.

Following hydrolysis, gelatin substitutes can alternatively be referred to as hydrolyzed collagen, collagen hydrolysate, gelatine hydrolysate, hydrolyzed gelatine, or collagen peptides. It is frequently employed as a gelling ingredient in food, drinks, pills, pharmaceuticals, vitamin or prescription capsules, papers, films for photography, and cosmetics. Gelatinous compounds are defined as those that operate similarly to gelatin or that contain gelatin.

The gelatin substitute market is fragmented with multiple small-scale and large-scale players, such as GELITA AG, Cargill, AGARMEX S.A. DE C.V., Incorporated, B&V SRL., Java Biocolloid, Special Ingredients Ltd, Brova Limited, AF Suter, NOW Foods, Great American Spice Company, Niblack Foods, Inc.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.04% |

| Market Size in 2025 | USD 3.35 Billion |

| Market Size by 2034 | USD 5.68 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Function, By Form, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Functionality of gelatin

The functionality, including thickening and gelling of gelatin, may boost the gelatin substitute market. The thickening & gelling function of gelatin helps to form a gel-like structure when it is dissolved in water and cooled. The thickening & gelling functionality of gelatin makes it widely used in food, pharmaceuticals, and other industries to thicken and provide texture to products.

Low consumer acceptance

Consumer acceptance is low due to the poor texture and taste of gelatin substitutes, which may slow down the gelatin substitute market. The gelatin has a distinctive taste and texture that many people have been accustomed to, so choosing the gelatin substitute can be hard, which leads to slowing down the market.

Development of plant-based gelatin substitute

The development of plant-based gelatin substitutes may be an opportunity for the growth of the gelatin substitute market. The development of plant-based gelatin substitutes includes the choice of suitable plant sources with the same properties as animal-based gelatin, like agar, carrageenan, pectin, and konjac.

Additionally, researchers of plant-based gelatin are exploring the methods for extraction and processes of these substances to mimic the texture and functionality of traditional gelatin while meeting the growing demand for vegan and vegetarian alternatives.

The agar-agar segment dominated the gelatin substitute market by type in 2024. Agar-agar is a jelly-like material made of polysaccharides extracted from the cell walls of various red algae species, particularly "tongues" (Gelidiaceae) and "ogonori" (Gracilaria). Agaropectin, a heterogeneous combination of smaller molecules, and agarose, a linear polysaccharide, are the two components that makeup agar as it occurs in nature. When boiling, it releases from the supporting structure found in the cell walls of some species of algae. These algae are referred to as agarophytes, and they are members of the phylum Rhodophyta or red algae.

Agaropectin is eliminated during the preparation of food-grade agar, leaving practically pure agarose in the commercial product. Agar has been utilized as a solid substrate to hold culture medium for microbiological study and as an ingredient in desserts all throughout Asia. Agar has several uses, including laxatives, appetite suppressants, vegan gelatin substitutes, thickening ingredients for soups, clarifying agents for brewing, sizing agents for paper and textiles, fruit preserves, ice cream, and other desserts.

The carrageen segment is expected to grow at a significant CAGR in the gelatin substitute market by type during the forecast period. The red edible seaweeds are the source of the naturally occurring linear sulfated polysaccharides. Due to their gelling, thickening, and stabilizing qualities, they are extensively utilized in the food industries. Because of their significant binding to dietary proteins, their primary use is in dairy products and meat products.

As carrageen mimics native glycosaminoglycans, they have emerged as a prospective contender for applications in tissue engineering and regenerative medicines. Carrageen has been used in tissue engineering, drug delivery, and covering wounds. The large, incredibly flexible molecules called carrageenan curl into helical shapes. As a result, they can now create a wide range of gels at room temperature. They are extensively employed as thickening and stabilizing agents in the food and other sectors.

The thickening & gelling segment dominated the gelatin substitute market by function in 2024. The thickening & gelling function of gelatin helps to form a gel-like structure when it is dissolved in water and cooled. The thickening & gelling functionality of gelatin makes it widely used in food, pharmaceuticals, and other industries to thicken and provide texture to products. This can grow the market.

During the forecast period, the stabilizers segment in the gelatin substitute market is expected to experience significant growth in terms of function. Stabilizers are chemicals that are utilized to prevent the degradation of certain products, such as food. The presence of gelatin in ice cream helps to prevent the formation of coarse-grained ice crystals, thereby reducing the melting speed. As gelatin can be used in the production of ice cream, it has a diverse range of applications. To produce excellent ice cream, the ice cream manufacturer must carefully select the appropriate gelatin content.

The capsules segment dominated the gelatin substitute market by form in 2024. Pharmaceutical-grade gelatin, with its excellent film-forming and gelling qualities, is an essential excipient in the manufacturing of both soft and hard capsules. Gelatin films are primarily used to shield encapsulated medications, guarantee the secure delivery of active pharmaceutical ingredients, and cover up off-putting tastes and odors. It keeps the active bio-availability of APIs intact, facilitates easy storage, and shields the medications from light, moisture, and air.

Gelatin capsules can be rapidly dissolved in the stomach acid to guarantee prompt drug release within the body. The dosage form for granulated and powdered APIs is hard gelatin capsules. Its two-part shells, the body and cap, are mostly composed of gelatin, opacifying agents (such as titanium dioxide), pigments, and other substances.

The gummies segment is expected to grow at a rapid rate in the gelatin substitute market by form during the forecast period. Gelatin is the primary gelling agent in chewing gum. The other hydrocolloids commonly used to produce gums include pectin, starch, carrageenan, agar, sodium alginate, and gellan gum. The famous gummy candies are gummy bears. Gelatin has the following properties: Crystal clear appearance and rich shine, elastic texture, good chew ability, melts in the mouth, and rich flavor.

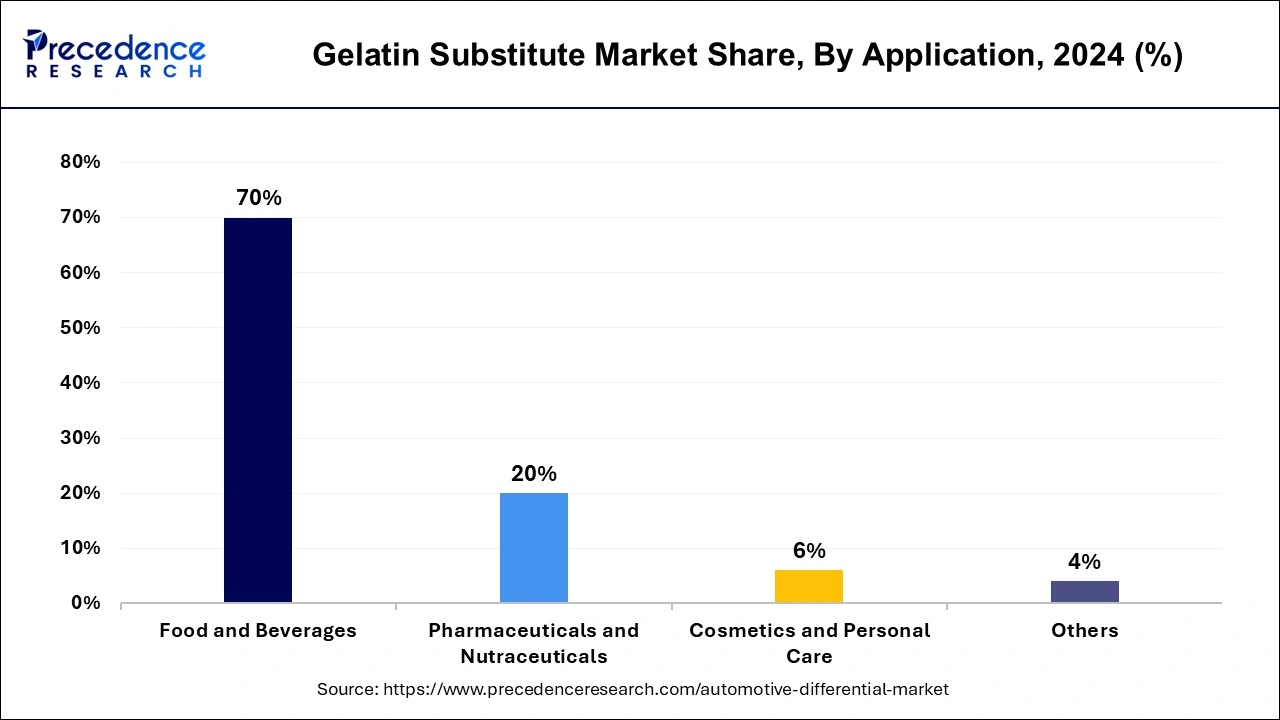

The food & beverages segment dominated the gelatin substitute market by application in 2024. The demand for plant-based and vegan diet options has increased along with the trend away from animal-derived items like gelatin. In response to this demand, the food and beverage industry created and added gelatin alternatives to a range of goods.

Food scientists and researchers have been working hard to create novel plant-based gelatin alternatives, including carrageenan, pectin, and agar-agar. These gelatin alternatives are suitable for a variety of food and beverage applications because they have mouthfeel, binding, and textures similar to those of gelatin. Customers are looking for products that they believe to be healthier options as they become more health conscious.

The pharmaceuticals & nutraceuticals segment is expected to grow to the highest CAGR in the gelatin substitute market by application during the forecast period. Pharmaceuticals and nutraceuticals are among the industries that are moving toward plant-based substitutes as a result of the surge in vegan and vegetarianism. Since gelatin is sourced from animals, it is inappropriate for these customers. As a result, it is anticipated that this market will see a sharp rise in demand for plant-based gelatin alternatives.

Gelatin alternatives are a good option that might meet some regulatory standards more closely, particularly for products meant for a wider range of consumers, including those with dietary restrictions. Innovative gelatin replacements that can replicate the qualities of conventional gelatin while being produced from plant sources have been developed as a result of advancements in food science and technology.

By Type

By Function

By Form

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024