What is Healthcare Cloud Computing Market Size?

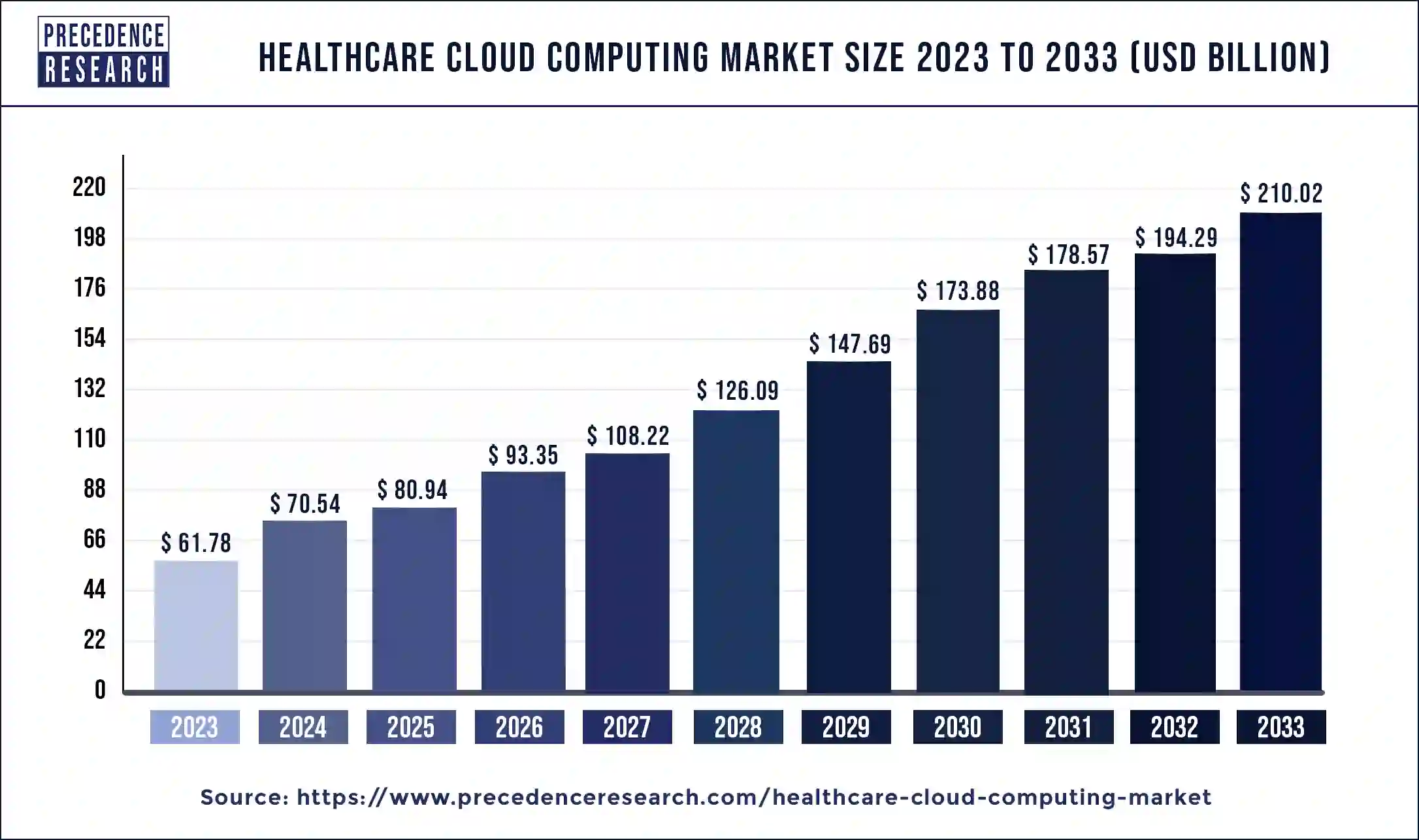

The global healthcare cloud computing market size is valued at USD 63.9 billion in 2025 and is predicted to increase from USD 75.17 billion in 2026 to approximately USD 312.97 billion by 2035, expanding at a CAGR of 17.22% from 2026 to 2035.

Market Highlights

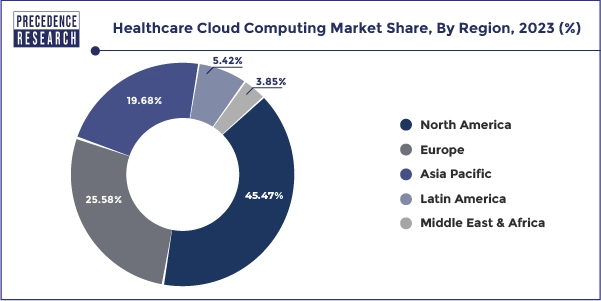

- North America dominated the global market with the largest market share of 41% in 2025.

- Asia Pacific is expected to be poised to grow at a CAGR from 2025 to 2035.

- By cloud deployment, the private segment captured the biggest market share in 2025.

- By Application, the non-clinical information system segment held the highest revenue share in 2025.

- By Offering, the services segment contributed the largest market revenue share in 2025.

- By End Users, healthcare providers will generate the major market share in 2025.

Healthcare Cloud Computing Market Growth Factors

Several healthcare establishments can harness the advantages of the cloud more than ever due to recent technological advancement and augmented security . With the technological advancement such as remote monitoring, natural language processing APIs and telehealth cloud technology will endure to advance to fit novel digital health settings in multiple important means during years to come. As per Analytics Survey of HIMSS, more than 83% of healthcare organizations are now making use of cloud services .

Numerous healthcare facilities desire to take these cloud computing solutions to the next level by implementing groundbreaking technology. Instead of gathering and transferring data to the cloud, the system examines and works on it at the point of gathering. The propagation of high-speed internet and execution of promising controlling acts are also predictable to deliver growth prospects to the healthcare cloud computing market across the world. Yet, concerns connected to data portability obstacles, data privacy, and increasing number of cloud data breaches are curtailing the advancement of healthcare cloud computing market worldwide. Further, deficiency of accomplished IT professionals has decelerated implementation of this technology. Competent specialists are in great demand on account of the struggle in finding professionals with HIPAA expertise. This aptitude drought will expected to decelerate the shift to cloud computing systems.

What is the Role of AI in the Healthcare Cloud Computing Market?

The rise of technologies like Artificial Intelligence (AI) and Machine Learning (ML) is playing an influential role in attracting significant demand for analyzing datavolumes. AI tools like image recognition software use cloud-hosted medical images to detect abnormalities in patients with higher accuracy. Additionally, the data analyzing capabilities of AI are also helping in creating personalized treatment plans for the patients. The rising digitalization is also leading towards several cyber threats that influence the adoption of AI, as it helps in detecting unusual access to these threats. The rising wearable and sensor trend is playing a crucial role in tracking patient data remotely, which can help to detect symptoms of any chronic disease.

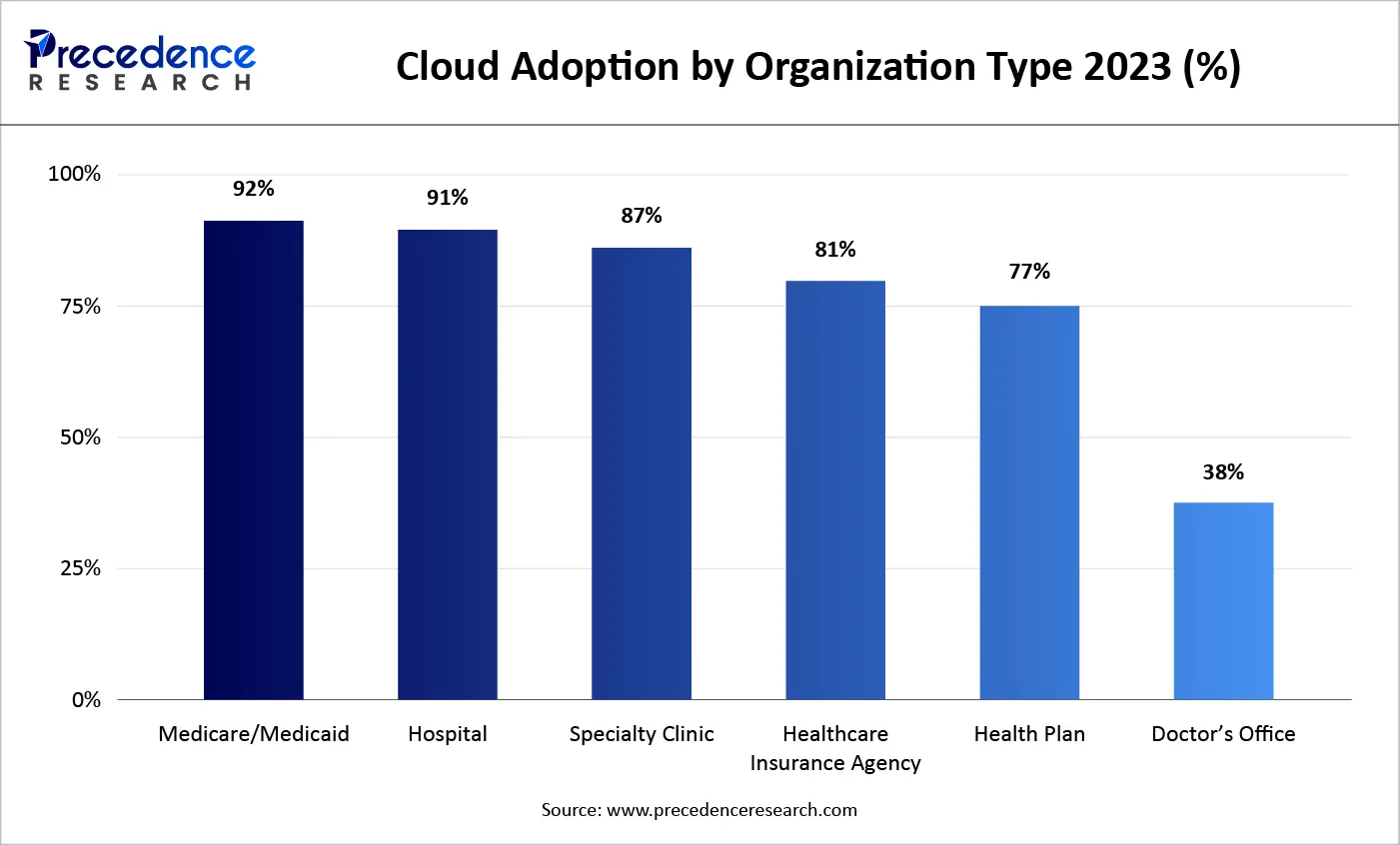

The healthcare cloud computing market shows the highest penetration among large, institutionally integrated organizations, led by Medicare and Medicaid entities and hospital systems. Survey data indicate that 92% of respondents working within Medicare and Medicaid organizations currently rely on cloud computing and cloud storage infrastructure, placing them at the forefront of cloud migration across the healthcare ecosystem.

This early adoption is closely linked to long-standing federal digitization efforts, particularly the Health Information Technology for Economic and Clinical Health Act of 2009, which accelerated electronic health records adoption and broader healthcare IT modernization across government-linked programs. Hospitals follow closely, with 91% of hospital employees reporting active use of cloud infrastructure, reflecting the operational complexity of large hospital networks, multidisciplinary care delivery, and data-intensive workflows. Together, these trends highlight how regulatory alignment, scale, and operational demands have made public health programs and hospital systems the primary drivers of cloud adoption within the healthcare sector.

Market Outlook

- Industry Growth Offerings - Industry growth in the market is driven by increasing adoption of telehealth, electronic health records, and AI analytics. Companies offer secure, scalable cloud platforms, real-time data access, and interoperability solutions to improve patient care, operational efficiency, and cost-effectiveness.

- Global Expansion- Global expansion of the market is fueled by rising digital health adoption, increasing chronic disease prevalence, and government initiatives for healthcare digitalization. Providers and tech companies are expanding across regions with scalable, secure, and AI-enabled cloud solutions.

- Startup ecosystem- Startups in the market focus on AI-powered analytics, secure data platforms, telehealth integration, and interoperability solutions. They drive innovation by offering cost-effective, scalable, and user-friendly cloud services, improving patient care, data management, and operational efficiency.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 63.90 Billion |

| Market Size in 2026 | USD 75.17 Billion |

| Market Size by 2035 | USD 312.97Billion |

| Growth Rate from 2026 to 2035 | CAGR of 17.22% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Cloud Deployment, Application, Service, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

A Rise in the Industry's Delivery of Emergency Medical Services:

There are various ways in which the pandemic has been unprecedented. To combat the pandemic and construct new facilities, set up a secure method of mass screening, or get the vaccine on the market, time was of the essence. It is possible to rely on cloud technology to accelerate the release of critical tech solutions in the industry.

For instance, Spoedtestcorona, a network of testing facilities offering Covid-19 quick diagnostic tests, had a hurdle when attempting to create a cross-platform web application on time while aiming to provide safe and inexpensive testing in the Netherlands and Belgium. The software was supposed to reduce face-to-face contact and make testing secure for patients and medical professionals.By selecting Amazon Web Application services, they could meet both the stringent regulatory requirements involved with managing medical and personal data and execute the app in the record-breaking two-week time frame.

Restraints

Increasing Provider Lock-in:

- Organizations might encounter significant obstacles while attempting to migrate from one cloud platform to another owing to differences in vendor platforms. Programs from the current cloud service could experience setup difficulties, reliability issues, and increased expenses if they were hosted and operated on a different site. The company data could be exposed to security risks as a result of potential translation issues.

Growing Possibility of Threat:

- Since every component of company data is accessible in the cloud, keeping data could pose serious problems with data theft. Even the majority of organizations have encountered safety lapses, so it is possible that cloud computing could encounter one. Even if the cloud is equipped with advanced security measures, it might still be problematic to maintain private information there. As a result, attack vulnerability is considered.

Opportunity

Cloud Computing's Expanding Use in Healthcare Provides Access to Big Data Applications:

There are greater prospects for big data applications to improve patient outcomes due to the expanding espousal of cloud-based data storehouse techniques in the healthcare industry. For instance, medical professionals in the US previously maintained patient records on paper. The amount of potentially valuable data in EMRs of the patient has always been enormous. This data could be utilized to forecast when a pandemic could start, find minute patterns in patient sicknesses that might indicate the disorder's origins, or determine which treatments were most successful for a particular symptomatic group.

All data previously locked away in filing storerooms can now be scoured via and analyzed by the most sophisticated computer algorithms owing to the use of cloud computing in hospitals and medical practices. Healthcare professionals will soon be able to identify and address hazards to the public's health that could previously go undetected until far in their life cycles.

Segment Insights

Application Insights

Clinical information system segment involves telehealth solution, computerized physician order entry, population health management (PHM) solutions, electronic medical records, pharmacy information system, radiology information system, others.

Over the past two decades, clinical information systems (CIS) have proliferated and are currently present in every environment where healthcare is provided. CIS is everywhere, from modest facilities to major tertiary care facilities, pharmacies, and blood banks. These systems could be made up of standalone software programs or intricately interconnected modules that come together to form a more complicated approach. The software mainly provides a wide range of healthcare functions that once-simple medical devices are now minicomputers that must be connected to the more extensive electronic health record.

Since encrypted messaging has become a viable option for provider-patient communication, telehealth enables care delivery outside of an organization's physical boundaries. Health information exchanges allow communication between providers and organizations. Records use the patient information gathered to better track problems and the services provided for prevention and treatment. Due to the development of these systems, new developments are possible that will advance healthcare technology significantly.

Clinical information systems segment gathered sizable market share in terms of revenue in 2023 credited to snowballing demand for maintaining raw data produced from physicians and doctors. This information involves notes made by pharmacists, physicians, doctors and prescriptions. Meanwhile, massive clinical data is produced every year which creates radical need for laboratory information management and health information system. All these factors contribute toward the growth of this segment.

Deployment Insights

Healthcare cloud computing market is classified based upon the deployment into hybrid cloud, private cloud and public cloud. The private cloud segment accounted for the considerable revenue stake in 2024. This is due to need for storage of extremely sensitive patient data in a protected way to evade data privacy breach which might emerge legal ramifications.

A strategy that is gradually moving up in healthcare is the hybrid cloud. The hybrid cloud combines on-premises infrastructure with public and private cloud services, enabling businesses to shift workloads across virtual servers rapidly and safely to meet changing demands for IT resources.

The transition of healthcare organizations' IT assets to modern, adaptable infrastructures must be accelerated. By combining the advantages of public cloud and on-premises infrastructure, a hybrid cloud enables business apps and information to be more agile and scalable. All components of the healthcare ecosystem, including healthcare providers and payers, life sciences, and consumer health, can benefit from switching to a hybrid cloud architecture.

In addition, over the past five years, players in the healthcare and life sciences industries have adopted hybrid cloud or made substantial headway in doing so, and they're currently moving into the next stage with increased ambition, investments, and interest. For instance, In a recent IBM Global C-suite analysis, 82 % of healthcare and life sciences leaders identified as pioneers who mainly integrate data into their operations, strategies, and culture anticipated making sizable investment opportunities in the hybrid cloud.

Services Insights

Different types of services assessed in this market study are infrastructure-as-a-service , software-as-a-service and platform-as-a-service . In 2025, the SaaS services of the market occupied leading revenue share on account of multiple benefits delivered by this model including safety, quicker deployment time, less total charge of ownership, and lower up-front capital expenditures.

Several SaaS products are self-learning and autonomous; fortunately, healthcare businesses and organizations are increasingly interested in AI. The most successful IT companies more than 81% of them have started working on AI technologies, which are transforming corporate operations, boosting productivity, and complementing human talents while automating monotonous chores.

Many healthcare organizations will work to improve their capacity to store, handle, analyze, and safeguard crucial healthcare data as they get more experience using a variety of cloud providers. As a result, such coherent techniques will spread more widely in place of employing different cloud providers for distinct applications or disaster recovery.

Recently, firms have been able to approach big data differently thanks to APIs like Google Health. Therefore, the number of companies utilizing cloud-based apps is anticipated to rise by 19.6%.

End User Insights

The healthcare payers are predicted to experience sustainable growth in the projected period. Insurance firms, health plan sponsors (employers and unions), and third-party payers are all examples of healthcare payers. Payers are quickly implementing cloud computing solutions for fraud protection, insurance claim settlement, secure data collecting and storage, and risk assessment. Insurers have traditionally had difficulty managing high-risk patient populations and high use. To reduce the increase in healthcare costs, payers are implementing these cutting-edge technology systems and solutions. Cloud computing also enables payers to grow their businesses, raise reliability, lower administrative costs, and enhance services.

Alliances that distinguish, collect payments, service prices, manage claims, and pay provider claims, are known as payers in the healthcare sector. Instances of payers are Medicare, health program providers, and Medicaid. For instance, there are numerous payers across the market, With around 900 health insurance providers operating across the country. These companies supply 34.4% of public health care and 67.3% of private health care through their health plans.

Regional Insights

U.S. Healthcare Cloud Computing Market Size And Growth 2026 to 2035

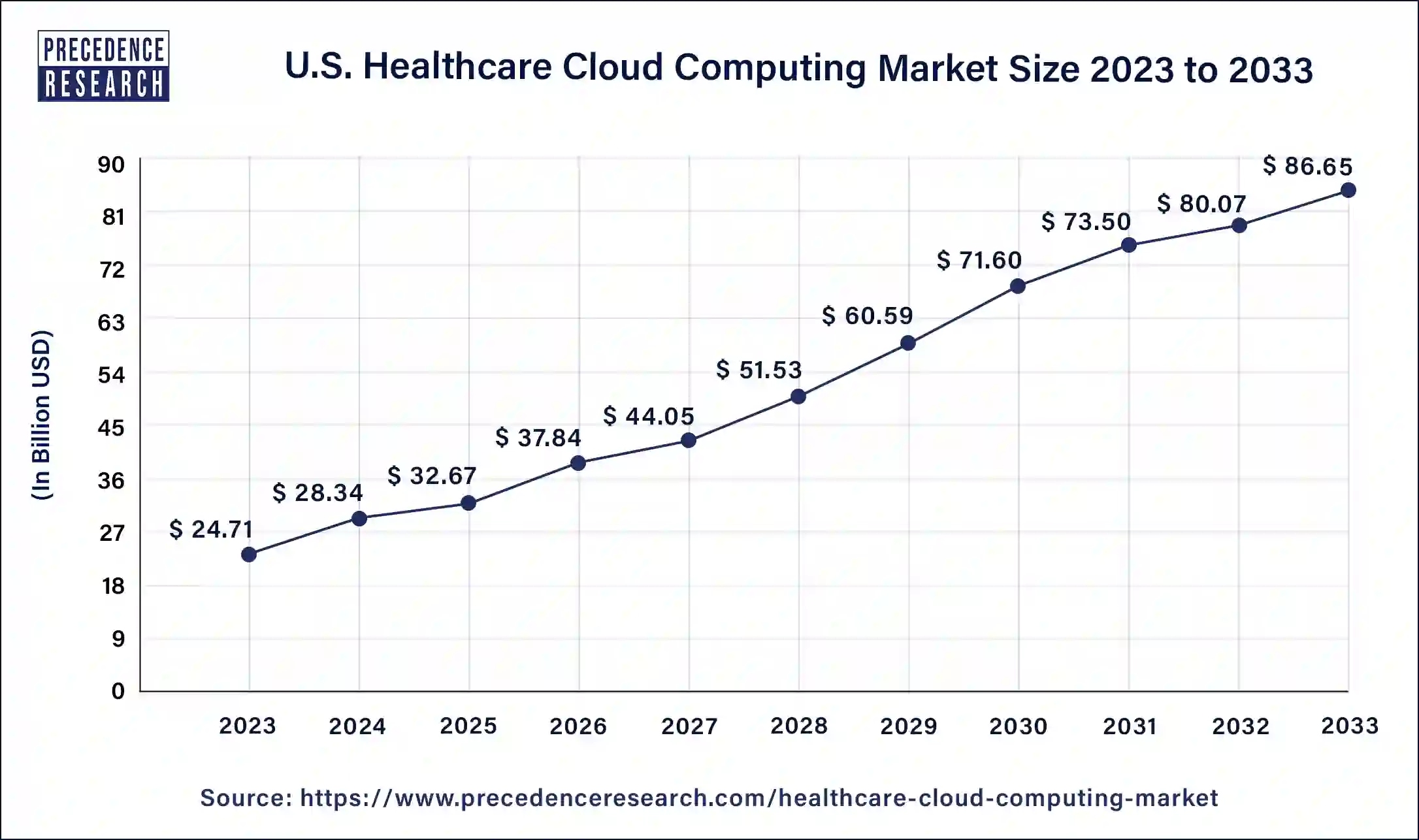

The U.S. healthcare cloud computing market size accounted for USD 23.58 billion in 2025 and is estimated to reach around USD 117.9billion by 2035, growing at a CAGR of 17.46% from 2026 to 2035.

North America Leads as Patient portals Drive a New Era of Connected care

Geographically, North America is embrace a prevalent markets take in the healthcare cloud computing sector and is estimated to mirror analogous trend during years to come deprived of considerable fluctuations. U.S is a front-runner in the healthcare cloud computing arena, majorly on account of its high acceptance rate of healthcare IT services and unceasing support from the government organization.

North America is predicted to portray the largest market share in the projected period. Patients are encouraged to use the patient portal by their healthcare provider access and use the site more frequently than those least encouraged. An online gateway for patients provides quick, round-the-clock access to their personal health information from any location with a network connection. Patients can take charge of their health and care with the help of the patient portal. Patient portals can also assist care between visits, facilitate communication with the doctor, and save time. More patients than ever are using portals. For instance, around 77% of health executives are spending money on improved smartphone websites and applications. According to a survey by Intrado Healthcare on patient management trends for 2022, more than 50% intend to invest in systems to communicate with patients via messaging.

How is Canada's Evolving Healthcare Systems Driving the Adoption of Healthcare Cloud Computing?

In Canada, the panorama of health insurance is evolving. The Canadian healthcare system would experience less strain as a result of the use of modern telehealth, which will also result in shorter wait times. The province-specific availability of several telehealth resources for Canadians varies. For instance, Telehealth Ontario offers anonymous, free medical guidance and data. Day or night, seven days a week, a healthcare professional would answer the phone.

Also, the region's ageing population, which is more likely to suffer chronic conditions including neurological diseases, hypertension, diabetes, and cardiovascular disease, is projected to raise demand for mobile health, which will help the market expand. For instance, the United Nations Population Fund's 2022 data show that 65% of Canada's population will be living in 2022 and primarily composed of people aged 15 to 64. Also, according to the same source, 19% of the population will be 65 or older in 2022.

U.S. Healthcare Cloud Computing Market Trends

The United States stands as a dominant country in the healthcare cloud computing market due to the wider digital health adoption. The healthcare institutions in the country have one of the largest digital healthcare systems, which attracts investments on healthcare IT. The U.S. government is highly supportive as they have implemented the HITECH ACT (Health Information Technology for Economic and Clinical Health) that boosts the demand for cloud integration.

On the other hand, healthcare cloud computing market in Europe is also expected to show robust growth throughout the prediction period. This is on account of growing awareness associated with obtainability of higher quality cloud computing solutions for healthcare. Besides, budding elderly population which is highly vulnerable to numerous diseases upsurges the amount of hospital admissions. All these aspects together are considered to have positive outlook on demand of healthcare cloud computing software in the Europe.

Why is Cloud Computing Adoption Accelerating in Asia Pacific's Healthcare Sector?

Asia Pacific is anticipated to witness lucrative growth in the global market over the forecast period. Growing adoption of digital health solutions such as telemedicine platforms, electronic health records (EHR) and healthcare analytics are creating the need for efficient and cost-effective cloud computing solutions for the management of huge volumes of patient data, improving access to data and for streamlining administrative tasks. Key regional players like China, India, South Korea and Japan are actively incorporating cloud computing in their rapidly expanding healthcare infrastructure. Furthermore, initiatives for digitalization of healthcare by various governments and the growing influence of leading cloud service providers such as Amazon Web Services (AWS), Google Cloud and Microsoft Azure in Asia Pacific is bolstering the market growth.

Japan Healthcare Cloud Computing Market Trends

Japan is one of the leading countries in the Asian region due to its advanced healthcare infrastructure. The hospitals and clinics in the country are mostly equipped with electronic medical records (EMRs), diagnostic imaging systems, and many other technologies. The NIH data states that in Japan, the adoption of Electronic Medical Records (EMRs) varies by hospital size. Approximately 73.3% of hospitals use EMRs, with a higher adoption rate in larger hospitals. While the majority of hospitals have adopted EMRs, the complete paperless system is still limited. Additionally, the rising number of the aging population is driving a constant demand for remote patient monitoring, which is leading towards advancements in telehealth.

Europe Accelerate Digital Care: Cloud Computing Transformation of Healthcare Systems

Europe's market is growing due to the rising adoption of digital health records, increased use of telemedicine , and the need for secure, scalable data management solutions. Strong government support for healthcare digitalization, strict data protection regulations like GDPR, and growing demand for AI-driven analytics are accelerating cloud integration. Additionally, hospitals are shifting toward cost-efficient, interoperable IT systems to improve patient outcomes and operational efficiency.

UK Healthcare Goes Cloud-First: Driving Smarter, Connected Care Ecosystems

The UK market is growing due to the rapid digitalization of healthcare services, increasing adoption of electronic health records, and expanding use of telehealth platforms. Cloud solutions offer secure, scalable data storage and improved care coordination across NHS and private providers. Strong government initiatives for digital transformation , rising demand for AI-enabled analytics, and the need for cost-effective IT infrastructure further drive market expansion.

Value Chain Analysis

- Clinical Trials

Enables efficient data management and secure storage for large-scale trials.

Supports remote patient monitoring and decentralized study participation.

Uses AI-powered patient matching to optimize recruitment and outcomes.

Speeds up collaboration and trial timelines across research sites.

Key Players: IBM Watson Health, Oracle Health Sciences, Medidata Solutions, AWS, Microsoft Azure. - Regulatory Approvals

Focus on ensuring data privacy, security, and compliance with patient information regulations.

Approvals evaluate the entire system, not just the cloud platform, to meet regional legal frameworks.

Requirements vary by jurisdiction, such as HIPAA in the U.S. and GDPR in Europe.

Key Players: Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud. - Patient Support and Services

Enhances accessibility and engagement via telehealth, patient portals, and remote monitoring.

Provides real-time, secure access to patient data for both providers and patients.

Enables personalized care plans and improves overall patient experience and health management.

Key Players: Epic Systems, Cerner Corporation, Allscripts, Microsoft Azure, Amazon Web Services (AWS), Google Cloud.

Top Vendors and their Offerings

- Cisco Systems Inc:offers secure networking, cloud infrastructure, and collaboration tools for healthcare, supporting telehealth, data management, and real-time patient monitoring.

- IBM Corp: Provides cloud-based healthcare analytics, AI solutions, and secure data platforms to optimize clinical workflows, research, and patient care.

- Oracle Corp: Delivers cloud applications, data management, and interoperability solutions for hospitals and providers, enabling efficient health information exchange and analytics.

- EKC Corp: Offers cloud infrastructure, healthcare IT solutions, and secure data storage for hospitals and clinics to enhance operational efficiency and patient care.

- Dell Inc.: Provides cloud servers, storage, and virtualization solutions for healthcare organizations, supporting data security, telemedicine, and scalable IT infrastructure.

Healthcare Cloud Computing Market Companies

- Allscripts Healthcare Solution Inc

- Microsoft Corp

- Iron Mountain Inc

- Qualcomm Inc

- AthenahealthInc

- GNAX Health

- EMC Corp

- VMware Inc

- Others

Recent Developments

- In April 2025, Health Edge, a key provider of next-generation core administrative processing systems, payment integrity and care management solutions, launched its innovative HealthEdge Provider Data Management platform facilitating health payers in automating the tedious and critical task of upholding accurate and updated information on healthcare providers. PEHP Health & Benefits, a division of Utah Retirement Systems offering dental, medical, life and long-term disability insurance plans to public employees is first healthcare organization deploying this platform in their workflows.

- In March 2025, Fangzhou Inc., a leading Internet healthcare solutions company, entered into a strategic collaboration with Tencent Health and Tencent Cloud for accelerating the development of AI-powered healthcare solutions with the integration of the DeepSeek open-source AI Model on Fangzhou's upgraded "AI Agent 2.0" platform. By leveraging DeepSeek's analytical capabilities and Tencent's Hunyuan model, the "AI Agent 2.0" platform will be deployed for enhancing the efficiency of pharmaceutical logistics and online healthcare services.

- In March 2025, GE HealthCare launched an innovative cloud-suite of enterprise imaging solutions, the Genesis portfolio which is a software-as-a-service (SaaS) based model designed for improving patient care coordination, reducing operational costs while maintaining stringent security regulations. Commercial release of the Genesis cloud solution will offer four new features – edge, storage, vendor neutral archive and data migration which will help to enhance workflows in digitally transforming healthcare organizations.

- In January 2023, AWS in Melbourne, the second Amazon Web Services infrastructure region in Australia, has been inaugurated, according to Amazon Web Services, a subsidiary of Amazon.com, Inc. There will be more options for startups, developers, enterprises, and businesses, as well as for nonprofits, educational institutions, and the government, to host their apps and provide end-user services from Australian AWS data centers.

- In October 2022, Oracle offered specific supply chain solutions for the healthcare sector to assist healthcare businesses in fostering a more connected patient experience. The latest sector-specific solutions that form a part of Oracle Fusion Cloud SCM support the particular requirements of healthcare firms and aid them in delivering better care to patients by streamlining planning, enhancing accessibility throughout the supply chain, and automating procedures.

- In September 2022, To deploy Airtel's edge computing platform in India, which will contain 120 network data facilities spread over 20 locations, Bharti Airtel, a leading provider of communication services with approximately 358 million active users in India and IBM, declared their intention to collaborate.

Segments Covered in the Report

By Product

- Healthcare Provider Solutions

- Clinical Information Systems

- EHR/EMR

- Telehealth Solutions

- PACS/VNA

- PHM Solutions

- LIS

- PIS

- RIS

- Non-clinical Information Systems

- RCM Solutions

- HIE Solutions

- Financial Management Solutions

- SCM Solutions

- Billings and Account Management Solutions

- Clinical Information Systems

- Healthcare Payer Solutions

- Claims Management Solutions

- Payment Management Solutions

- Provider Network Management Solutions

- Fraud Management Solutions

- CMR Solutions

By Deployment

- Public

- Private

- Hybrid

By Application

- Clinical Information System

- Telehealth Solutions

- Computerized Physician Order Entry

- Population Health Management (PHM) Solutions

- Electronic Medical Records

- Pharmacy Information System

- Radiology Information System

- Others

- Non-clinical Information System

- Revenue Cycle Management (RCM)

- Billing & Accounts Management Solutions

- Claims Management

- Others

By Service

- Platform as a service (Paas)

- Infrastructure as a service (Iaas)

- Software as a service (Saas)

By End Users

- Healthcare Providers

- Healthcare Payers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting