January 2025

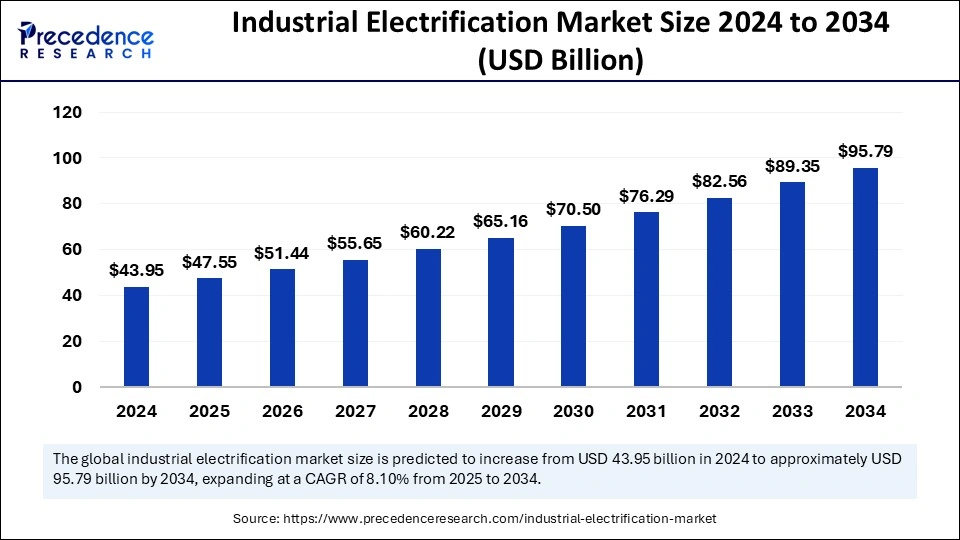

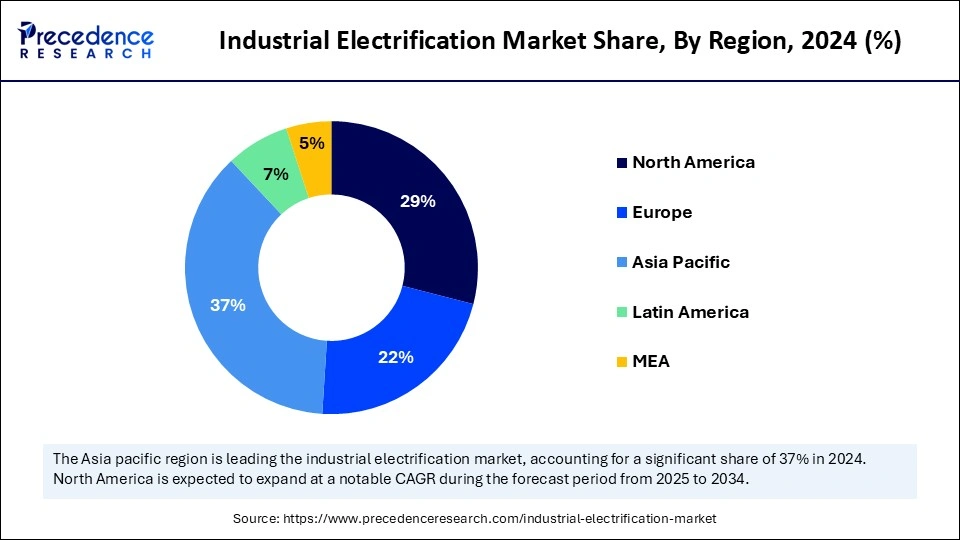

The global industrial electrification market size is calculated at USD 47.55 billion in 2025 and is forecasted to reach around USD 95.79 billion by 2034, accelerating at a CAGR of 8.10% from 2025 to 2034. The Asia pacific market size surpassed USD 16.14 billion in 2024 and is expanding at a CAGR of 8.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial electrification market size was estimated at USD 43.95 billion in 2024 and is predicted to increase from USD 47.55 billion in 2025 to approximately USD 95.79 billion by 2034, expanding at a CAGR of 8.10% from 2025 to 2034. The market growth is attributed to rising industrial automation, stringent decarbonization policies, and increasing adoption of energy-efficient electrification technologies.

Modern-day industrial electrification receives transformative power from artificial intelligence through its ability to improve energy management while maximizing maintenance predictions and optimizing operational processes. AI analytical systems enhance power grid stability through improved predictions that optimize the delivery of energy to multiple industrial facilities.

By utilizing AI-powered automation systems, industrial facilities minimize downtime since these systems detect impending system failures to perform scheduled maintenance ahead of time. Power consumption patterns that are enhanced through machine learning algorithms assist industries in reducing their waste output while reaching sustainability objectives. The real-time monitoring and decision-making functions of smart grid technology become superior through AI integration, thereby boosting operational efficiency.

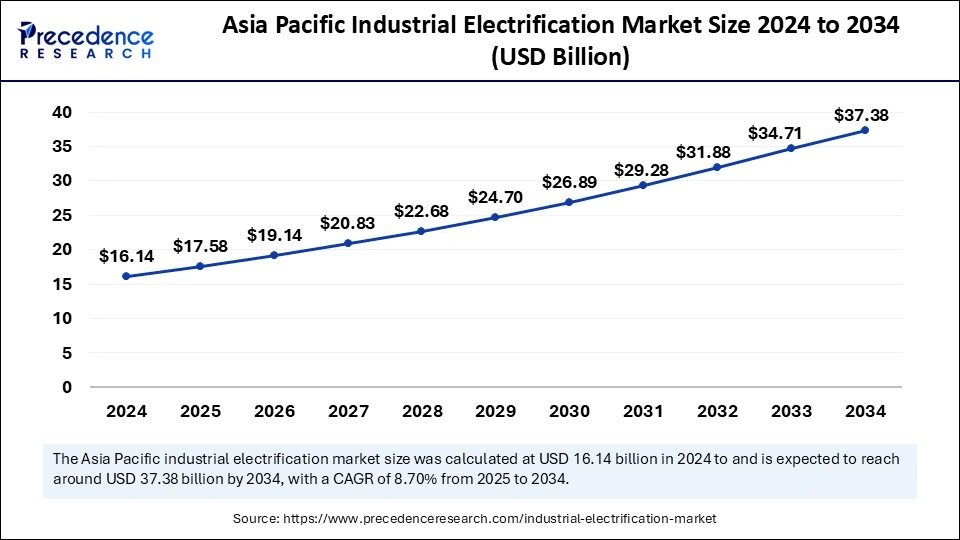

The Asia Pacific industrial electrification market size was exhibited at USD 16.14 billion in 2024 and is projected to be worth around USD 37.38 billion by 2034, growing at a CAGR of 8.70% from 2025 to 2034.

Asia Pacific held the dominating share of the industrial electrification market in 2024 due to its fast-paced industrial development, together with urban expansion. The region expanded because government policies encouraged renewable energy integration and industrial processes toward electrical operation. The need for sustainable practices triggered industrial operators to implement electric machinery while they improved energy efficiency and cut down carbon emissions. The World Health Organization confirmed that solar photovoltaic systems paired with battery storage systems evolved into economical, adaptable solutions, which accelerated the power-up process across the region.

China and India released remarkable growth in their manufacturing operations together with infrastructure development, which caused electricity demand to increase. The nation achieved its most substantial renewable energy infrastructure expansion while advancing its manufacturing sector through electrical transformation, thus further fuelling the demand for the industrial electrification market.

Europe is projected to host the fastest-growing industrial electrification market in the coming years as governments continue to back this sector while patients adopt digital healthcare solutions and scientists conduct advanced biomedical research. The European Commission’s Digital Health Strategy promotes smart medical device integration with AI diagnostics to create increased demand for flexible electronics in remote patient monitoring and telehealth applications. Under the United Kingdom’s National Health Service (NHS) Long-Term Plan, the organization supports the implementation of wearable biosensors within preventive healthcare systems to increase early disease detection capabilities. The European Medicines Agency (EMA) supports flexible medical implants along with diagnostic tools, which creates optimal market conditions.

The World Health Organization (WHO) documented fundamental digital healthcare transformation progress during 2023 throughout Europe. The Spanish healthcare sector dedicates funding to digital platforms for health and supports telemedicine development and flexible biosensor-based remote patient tracking. Italy drives the growth of smart hospitals and upgrades healthcare tracking through wearable medical devices and electronic patches. Furthermore, Europe demonstrates its dedication to healthcare innovation through these developments, which establish its position as a market leader for flexible electronics products.

North America holds a notable presence in the global industrial electrification market, owing to the governments investing heavily in clean industry sectors and creating favorable policies. The implementation of greenhouse gas emission reduction goals and energy independence initiatives hastened industrial electrification throughout numerous business sectors. North America shows excellent potential for industrial electrification advancement due to its dedication to sustainable practices and technological improvements. The Inflation Reduction Act of 2022 created powerful financial boosts that encouraged businesses to electrify their operations, which reinforced regional strength.

The policies of Canada at both the federal and provincial levels pushed for industrial electrification through programs that built clean energy distribution networks and electrified transportation systems. The government aims to eliminate power plants that generate electricity through unclean fossil fuel sources but simultaneously support industrial electrification. Furthermore, the government continues to develop its electrical infrastructure by enhancing renewable power generation systems specifically for manufacturing purposes, thus further fuelling the market in this region.

The industrial electrification market is expanding rapidly due to worldwide efforts in sustainability, which combine electric power with decarbonization initiatives. Electric technologies replace fossil fuels in production processes while making operations efficient and decreasing atmospheric GHG emissions. According to the International Energy Agency shows that businesses implementing electricity in low- to medium-heat processing units achieve optimal results for reducing industrial carbon emissions, covering more than half of the sector.

High-temperature heat pumps and electric arc furnaces have been installed across food and beverage factories, paper producers, and light industrial facilities to support the electrification movement. The International Energy Agency projects that global electricity usage will rise at its highest annual rate this century as manufacturing expands. According to IEA reports, converting industrial operations to electric power presents a fundamental chance to reduce pollution while increasing process efficiency, especially for applications using heat below 500 degrees Celsius that generate fifty percent of industrial emissions. The essential part played by industrial electrification remains crucial to global sustainability initiatives.

| Report Coverage | Details |

| Market Size by 2034 | USD 95.79 Billion |

| Market Size in 2025 | USD 47.55 Billion |

| Market Size in 2024 | USD 43.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.10% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Technology, End-Use Industry, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing adoption of renewable energy sources

Growing reliance on renewable energy sources is projected to drive the industrial electrification market as industries seek sustainable and cost-effective power solutions. Such transformations improve national security in energy supplies while decreasing world reliance on fossil fuels. The adoption of government policies focused on emission reduction and carbon neutrality speeds up the industrial process transition to electrical operations.

The modernization of heavy industry and manufacturing alongside transportation moves toward sustainable objectives as it facilitates progress to sustainable energy methods. Furthermore, the rapid expansion process of renewable energy acceptance and growing investment in these types of renewable technology further creates demand for industrial operations, thus fuelling the market.

Annual Investment in Clean Energy by Countries and Regions for 2024

| Country/Region | Investment (USD billion) |

| China | 359 |

| United States | 85 |

| European Union | 106 |

| India | 37 |

| Latin America | 41 |

| Southeast Asia | 15 |

| Africa | 22 |

High initial investment requirements

High initial investment requirements are anticipated to slow the industrial electrification market as companies struggle to allocate substantial capital for infrastructure upgrades. Electrifying conventional power systems demands huge investments to develop distribution networks, storage systems, and automated control technology. The financial limitations of small and medium-sized enterprises (SMEs) restrict their adoption of electrified procedures. Renewable energy integration and advanced smart grid systems raise the financial load. Despite government and private funding for electrification projects, the long duration until funds are returned creates resistance to quick adoption levels, which prevents widespread adoption in industries.

Growing investments in smart grid infrastructure

Growing investments in smart grid infrastructure are anticipated to create immense opportunities for the players competing in the industrial electrification market. Smart grid investments drive industrial loading electrification since they enhance both power distribution and manage industrial consumption. Advanced nations, alongside China, dominated 80 percent of total worldwide grid investments. However, Latin American countries raised their spending to double their previous level: Colombia, Chile, and Brazil. Businesses implement smart meters alongside demand-response systems, which help them maximize energy consumption efficiency and decrease electrical expenses.

Industrial sectors benefit from increased electrification as decentralized power generation activities incorporate microgrids and distributed energy resources. The cost increases of components alongside supply chain management difficulties prevent transmission grid infrastructure development from moving forward, which creates major challenges for grid developers. Furthermore, smart grid investments prove essential for both industrial electrification and worldwide sustainability, thus fuelling the market.

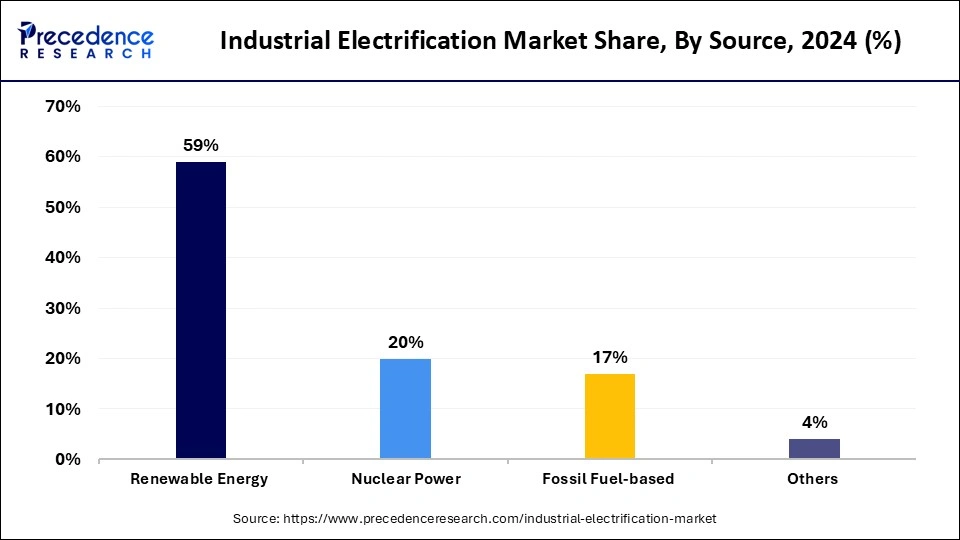

The renewable energy segment held a dominant presence in the industrial electrification market in 2024 due to the growing global efforts to reduce carbon emissions and the increasing cost-competitiveness of renewable technologies. The International Energy Agency (IEA) reported that renewable energy's contribution to global power generation increased from 22% in 2023 to 25% in 2025, reflecting a substantial shift toward cleaner energy sources.

Under the renewable energy segment, the solar energy sub-segment holds a significant market share due to declining photovoltaic costs and supportive government policies, making it an attractive option for industrial applications. Furthermore, the exceptional development of solar energy resulted from falling photovoltaic prices together with government backing, which established it as an ideal industrial choice.

The nuclear power segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034. Advancements in nuclear technologies, such as small modular reactors, are expected to enhance safety and reduce costs, making nuclear energy a viable option for industrial use. Additionally, the consistent output of nuclear power complements the intermittent nature of renewable sources, including solar and wind, ensuring a reliable energy supply for industrial operations. These factors collectively position nuclear power as a key contributor to the future growth of industrial electrification.

Industrial Electrification Market Revenue, By Source, 2022-2024 (USD Billion)

| Source | 2022 | 2023 | 2024 |

| Renewable Energy | 22.32 | 23.90 | 25.81 |

| Nuclear Power | 7.50 | 8.08 | 8.78 |

| Fossil Fuel-based | 6.05 | 6.51 | 7.00 |

| Others | 1.46 | 1.55 | 1.65 |

The heat pump segment accounted for a considerable share of the industrial electrification market in 2024 due to its high energy efficiency characteristics while offering process heat at 160°C maximum temperature, which sufficed to meet 44% of industrial process heat demands. The paper and food and chemicals industries represent the industrial segments with the biggest heat pump potential, as these sectors have a major total heating capacity that heat pumps satisfy.

The electric resistance heating segment is anticipated to grow with the highest CAGR during the studied years. The technological features of precise temperature control and speedy heating allow its use in different industrial processes. Electric resistance heating systems integrate into current industrial setups through minimal modifications, which makes them desirable to implement. The speed of electric resistance heating adoption rises as industries need to decarbonize while utilizing renewable energy sources and achieving efficiency. Furthermore, the industrial importance of electric resistance heating continues to rise due to new breakthroughs.

Industrial Electrification Market Revenue, By Technology, 2022-2024 (USD Billion)

| Technology | 2022 | 2023 | 2024 |

| Heat Pumps | 13.30 | 14.24 | 15.38 |

| Electric Resistance Heating | 4.87 | 5.24 | 5.69 |

| Electric Arc Heating | 9.66 | 10.37 | 11.23 |

| Electric Boilers | 5.30 | 5.70 | 6.17 |

| Energy Storage | 3.78 | 4.06 | 4.39 |

| Others | 0.97 | 1.02 | 1.09 |

In 2024, the manufacturing segment led the global industrial electrification market, as businesses chose sustainable operations along with efficient production processes. The growing implementation of electric machinery with industrial heat solutions has created a reduction in fossil fuel dependence as it supports international decarbonization efforts. The adoption of electrified manufacturing technologies increased extensively as the industrial energy transition policies enhanced market leadership. Furthermore, official government documents demonstrated how industrial electrification worked to minimize emission levels in specific facilities while maintaining industrial sector control.

The construction segment is projected to expand rapidly in the coming years as electric heavy equipment and green building technologies gain quick market acceptance. The rising number of environmental regulations meant to decrease project emissions created a necessity for this industrial shift. Different industry reports from 2023 demonstrated the growing acceptance of solar-powered construction sites combined with battery-operated machinery throughout various regions.

By Source

By Technology

By End-Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

July 2024

July 2024