November 2024

IoT Chips Market (By Hardware: Processor, Sensor, Connectivity IC, Memory Device, Logic Device, Others; By Industry Vertical: Automotive, Banking Financial Services and Insurance, Retail, Others, Healthcare, Consumer Electronics, Industrial) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

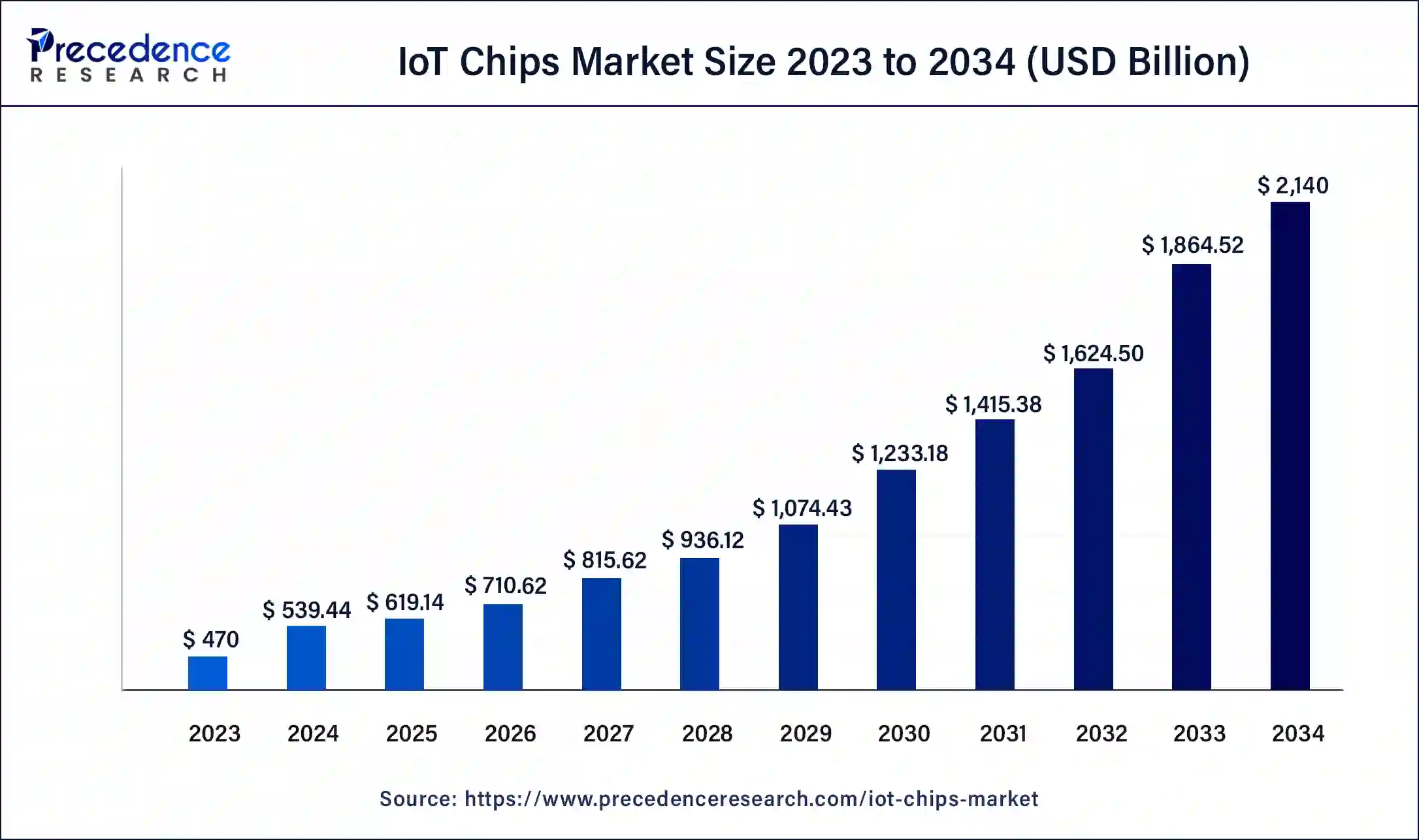

The global IoT chips market size was USD 470 billion in 2023, accounted for USD 539.44 billion in 2024 and is expected to reach around USD 2,140 billion by 2034. The market is expanding at a solid CAGR of 14.77% over the forecast period 2024 to 2034. The North America IoT chips market size reached USD 173.90 billion in 2023. The IoT chips market is driven by the creation of safe, low-power semiconductors that guard against security lapses.

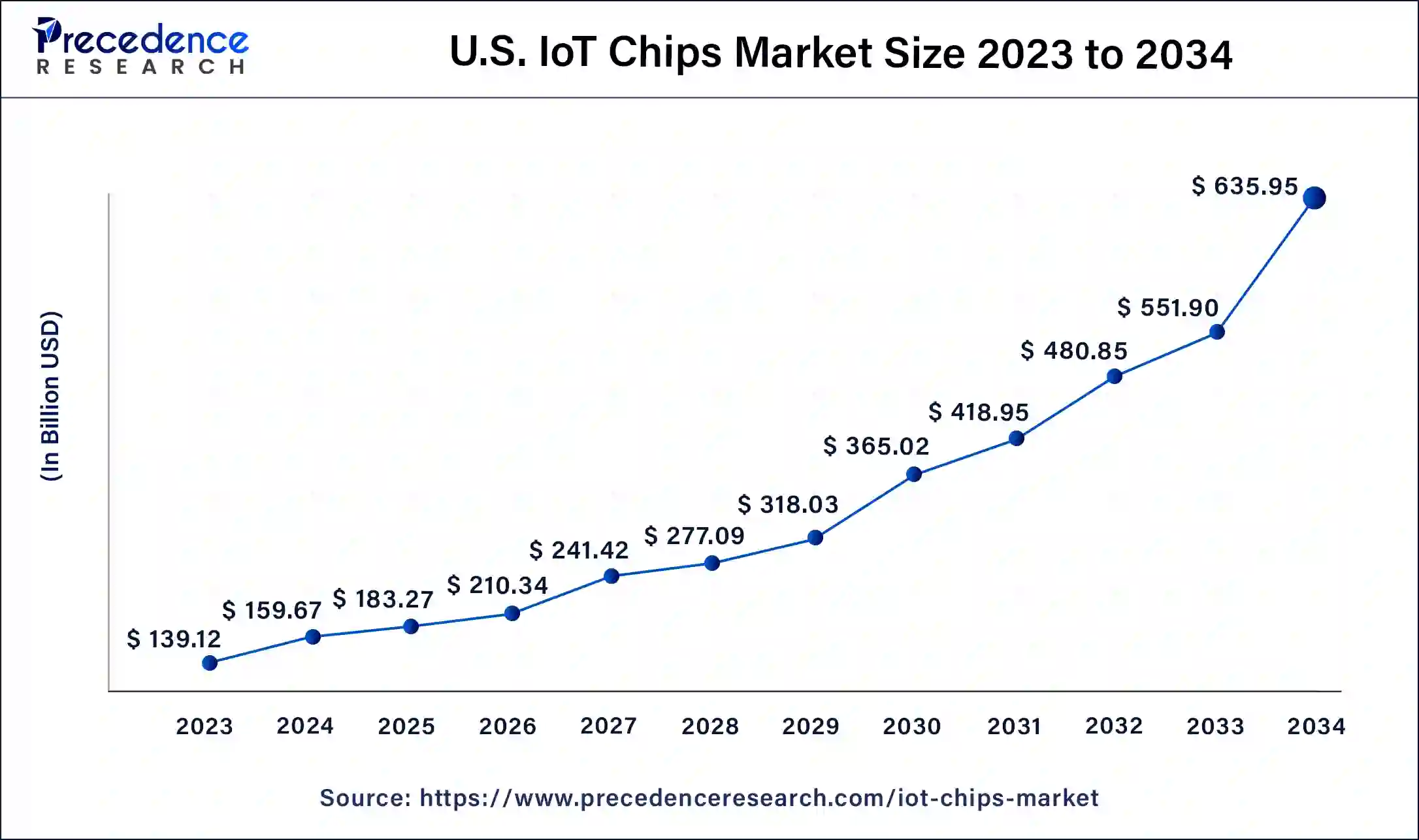

The U.S. IoT chips market size was exhibited at USD 139.12 billion in 2023 and is projected to be worth around USD 635.95 billion by 2034, poised to grow at a CAGR of 14.81% from 2024 to 2034.

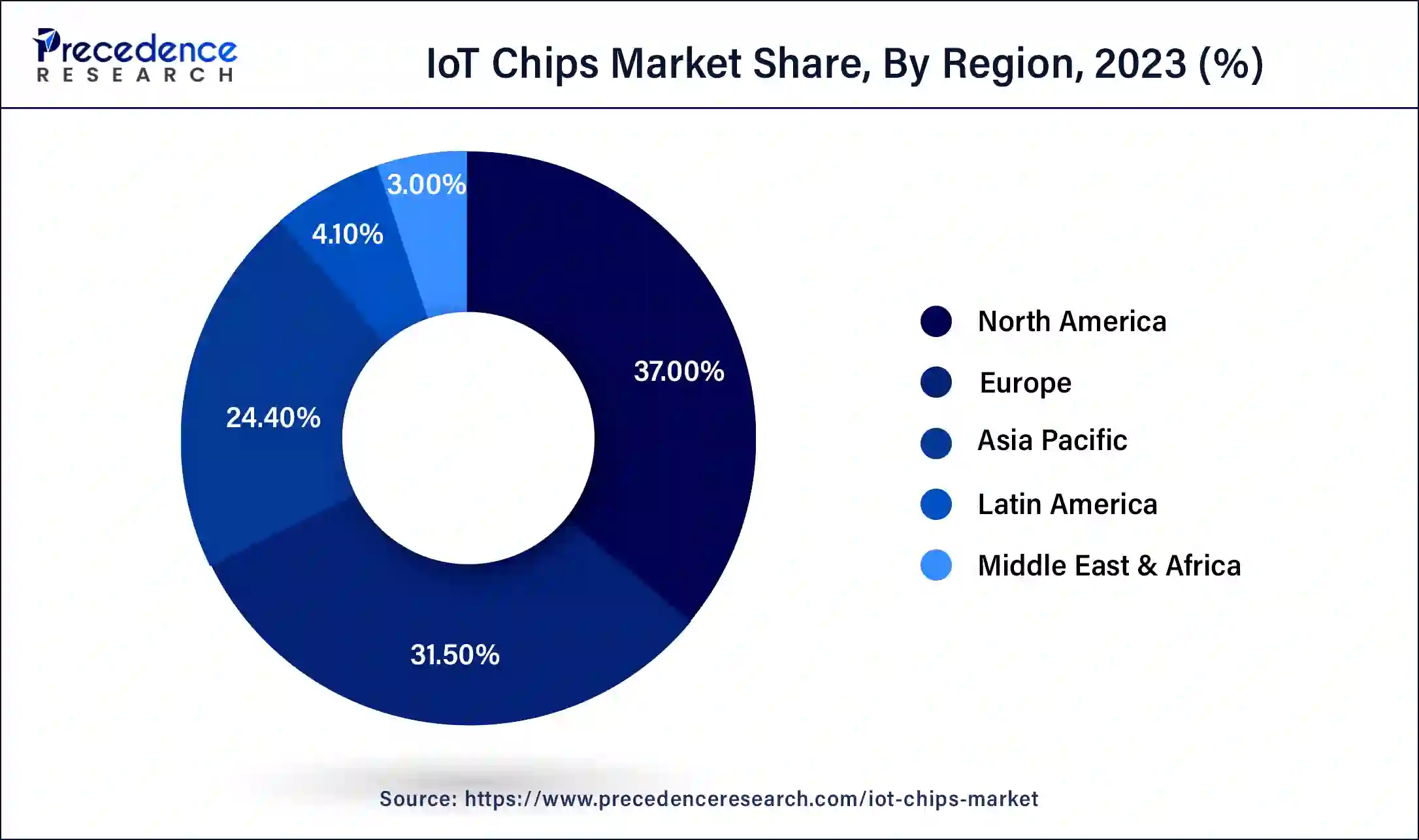

North America dominated in the IoT chips market in 2023. Academic institutions, well-established businesses, and tech startups coexist in a thriving ecosystem in North America. This ecosystem accelerates the development of IoT technology and promotes collaboration. Having access to venture capital funding supports small businesses and startups developing cutting-edge Internet of Things solutions, stimulating innovation.

Being a part of international and regional consortiums, including the Industrial Internet Consortium and the Internet of Things, enables North American businesses to remain on the forefront of IoT standards and technology development.

Asia-Pacific is observed to be the fastest growing in the IoT chips market during the forecast period. Technological improvements in IoT are driven by Asia-Pacific firms' high investments in R&D. Electronics and semiconductor technology innovation is well-known in nations like South Korea and Japan. IoT applications are greatly aided by the quick deployment of 5G networks throughout the area, which provide the infrastructure needed for fast, low-latency connectivity.

The growing middle class in nations such as China and India raise disposable income, which drives demand for IoT-enabled goods and services. The region's robust economic growth encourages industry expansion and the adoption of cutting-edge technology, such as the Internet of Things.

Due to the Internet of Things (IoT), billions of smart devices can communicate with one another through the almost universal Internet Protocol. Almost every system utilizes the Internet and cloud computing ecosystems to innovate and improve the intelligence and awareness of a wide range of devices. The broad availability of low-cost, low-power embedded components and high-quality, reliable wireless communication is propelling the development of various internet-connected devices.

The increased demand for IoT devices is the main factor propelling the growth of the IoT chips market. The growing acceptance of automation in various end-user verticals, such as healthcare, consumer electronics, automotive, BFSI, and retail, is driving up the use of IoT chips in different IoT devices.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,140 Billion |

| Market Size in 2023 | USD 470 Billion |

| Market Size in 2024 | USD 539.44 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.77% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Hardware, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Investments in the IoT Chips Market

| S.No. | Acquirer | Acquired Company | Deal Size | Category |

| 1. | Kontron | Bsquare | $38 M | IoT platform/data/analytics |

| 2. | LumenRadio | Radiocrafts | $7.8 M | IoT connectivity |

| 3. | Nokia | Fenix Group | NA | Industrial IoT/defense |

| 4. | Vontas | Orion Labs | NA | IoT connectivity |

| 5. | KORE Wireless | Twilio – IoT business | NA | IoT connectivity |

Increasing adoption of IoT devices

Consumer electronics (smartphones, wearables), industrial applications (predictive maintenance, automation), healthcare (remote monitoring devices), and smart cities (traffic management, smart grids) are just a few of the industries that use IoT devices. Due to their widespread application, the demand for Internet of Things chips is high. IoT chips are becoming increasingly necessary as consumers and businesses look to use IoT technology for more convenience, efficiency, and innovation.

The cost of IoT chips is lowered by manufacturers' economies of scale, which are attained when the use of IoT devices rises. IoT technology can now be incorporated into more products to lower costs. This drives the growth of the IoT chips market.

Growth in smart cities

Smart cities use IoT sensors and gadgets to optimize traffic flow, lessen congestion, and increase safety. Many IoT chips are needed for the sensors found in cameras, smart car systems, and traffic lights. Smart street lighting systems that modify brightness in response to occupancy and environmental factors require Internet of Things (IoT) chips. These methods decrease both operating expenses and energy usage. Building management systems use Internet of Things (IoT) chips to regulate security, HVAC, lighting, and ventilation. These chips make automated and effective control of building operations possible.

Concerns regarding the security and privacy of user data

IoT devices are especially susceptible to hacks because they frequently have limited processing capacity and resources built into them. These flaws can be used by hackers to obtain unauthorized access, change data, or interfere with the operation of devices. Prominent assaults, like the Mirai botnet, have illustrated how large-scale IoT networks can be breached, leading to severe disruptions in operations and data leaks. These kinds of occurrences increase consumer and business knowledge and anxiety, making them reluctant to adopt IoT solutions that use these chips. This limits the growth of the IoT chips market.

Technological limitations that affect the IoT’s functionality

The computational power of IoT devices is frequently insufficient for local data processing. This results in a dependence on cloud computing, which adds latency and network connectivity requirements for data processing. The onboard memory of IoT chips restricts the amount of data that may be locally saved and processed. This limits the functioning of IoT devices in applications that need quick responses and impairs their ability to make real-time decisions.

Rise of autonomous and connected vehicles

Advanced driver assistance systems (ADAS) such as automated emergency braking, adaptive cruise control, and lane-keeping assistance are supported by IoT chips. Real-time data processing and communication are essential to these aspects, and IoT technology makes this possible. It is necessary to protect cars from cyberattacks as they grow more networked. Strong encryption and security features on IoT chips are crucial for preventing hacking and data leaks.

Integration of AI capabilities and edge computing in IoT devices

Reducing dependency on cloud infrastructure through local data processing results in lower costs for cloud services and data storage. The ability of edge devices to manage growing workloads independently also makes it possible for more scalable systems. AI integration and edge computing can result in more energy-efficient processes. This is important for battery-operated IoT devices because it allows devices to optimize their power usage based on data and local conditions. With the deployment of sophisticated AI models on edge devices, which demand high processing power, complex activities such as image recognition, natural language processing, and predictive maintenance can be accomplished without the need for cloud support. This opens an opportunity for the growth of the IoT chips market.

The processor segment dominated the IoT chips market in 2023. The need for advanced processors has expanded dramatically due to the widespread use of smart devices, including wearable technology, home automation systems, smartwatches, and smartphones. The brains of the gadgets, these processors allow for sophisticated features and effective operation. Real-time data processing is necessary for many Internet of Things applications to work correctly. For applications like industrial automation, healthcare monitoring systems, and driverless cars, processors guarantee that data is analyzed and acted upon in real-time.

The sensor segment is observed to be the fastest growing in the IoT chips market during the forecast period. The need for different kinds of sensors has grown dramatically as smart homes, smart cities, and smart industrial applications become more common. Sensors are essential in smart cities for energy management, public safety, traffic control, and environmental monitoring. Security systems, home automation, energy management, and health monitoring all use sensors in smart homes.

The industrial segment dominated the IoT chips market in 2023. IoT chips are utilized in many different safety applications, like monitoring dangerous situations and guaranteeing worker security. Sensor data collected in real-time might prompt quick reactions to possible safety risks. Through monitoring and surveillance systems, IoT chips also contribute to the security of industrial sites. Enabling real-time access point tracking and control ensures strong security measures.

The consumer electronics segment is observed to be the fastest growing in the IoT chips market during the forecast period. The market for smart home appliances, including voice assistants, security cameras, lighting controls, and thermostats, is expanding. IoT chips play a significant role in the functionality and connectivity of these devices. The growing popularity of wearable technology, such as fitness trackers, smartwatches, and health monitoring gadgets, pushes demand for sophisticated IoT processors. IoT chips are used in smart TVs, streaming gadgets, and game consoles to improve user experiences, connectivity, and streaming capabilities.

Segments Covered in the Report

By Hardware

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024