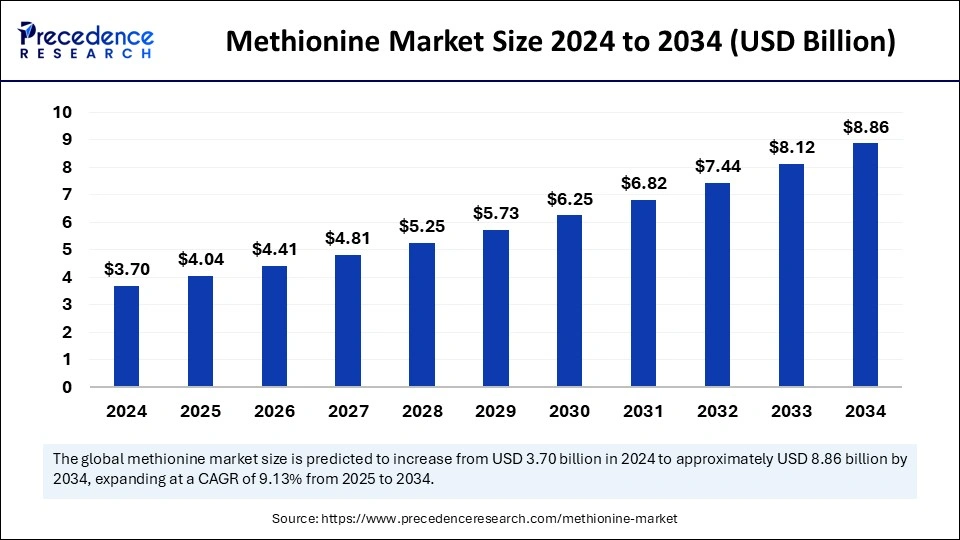

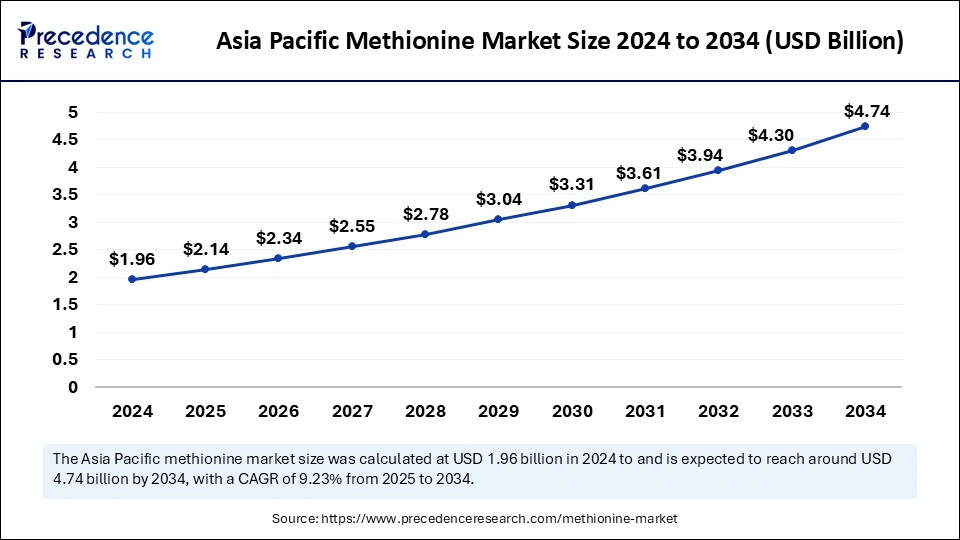

The global methionine market size is calculated at USD 4.04 billion in 2025 and is forecasted to reach around USD 8.86 billion by 2034, accelerating at a CAGR of 9.13% from 2025 to 2034. The Asia Pacific market size surpassed USD 1.96 billion in 2024 and is expanding at a CAGR of 9.23% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global methionine market size was estimated at USD 3.70 billion in 2024 and is predicted to increase from USD 4.04 billion in 2025 to approximately USD 8.86 billion by 2034, expanding at a CAGR of 9.13% from 2025 to 2034. Increasing demand for methionine across the globe due to its benefits is the key factor driving market growth. Also, growing investment in research and development by market players coupled with the surging demand for animal-based products can fuel market growth further.

Artificial Intelligence systems can help to analyze a consumer's dietary habits, health metrics, health goals, and genetic data to make a cater supplement plan that is compatible with consumers' unique profile. Furthermore, AI can be utilized to assess extensive repositories of clinical studies, scientific literature, and emerging research to sort out the most recent data on supplement efficiency and safety. AI-powered virtual assistants and chatbots can present knowledge capsules such as infographics, articles, video content, and visuals.

The Asia Pacific methionine market size was exhibited at USD 1.96 billion in 2024 and is projected to be worth around USD 4.74 billion by 2034, growing at a CAGR of 9.23% from 2025 to 2034.

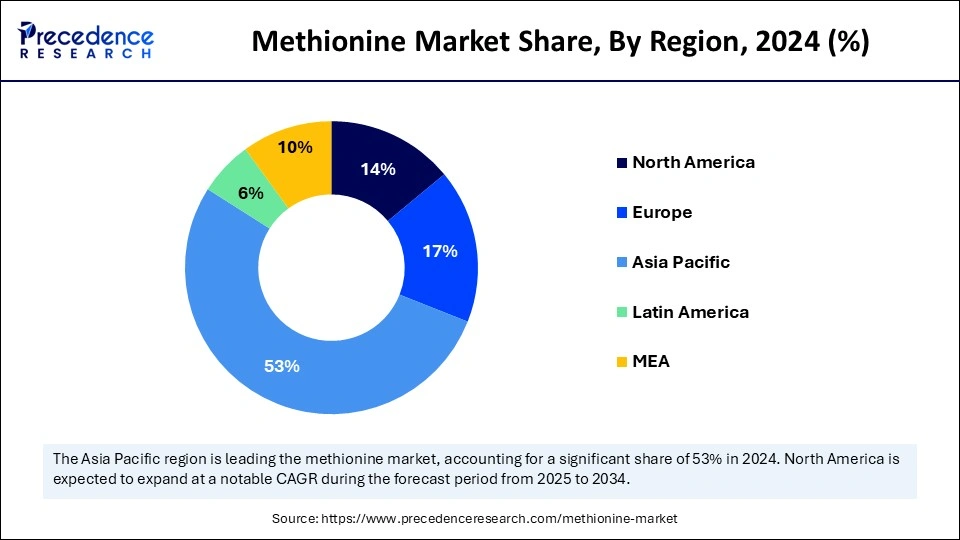

Asia Pacific dominated the global methionine market in 2024. The dominance of the region can be attributed to the increasing disposable income coupled with the rapid urbanization in the region. The growing demand for meat has optimized the growth and the requirement for methionine in emerging economies such as China and India. Moreover, these countries are major players in aquaculture and leaders in the seafood market.

North America is expected to grow at the fastest rate in the methionine market during the forecast period. The growth of the region can be credited to the region's established food and pharmaceutical industries, which heavily depend on methionine, which is an important element in various products. In North America, the U.S. led the market owing to the large-scale production of swine, poultry, and cattle in the country that requires methionine supplements for animal diets.

Methionine is an amino acid compound containing sulfur. It is an essential amino acid in the human body. Methionine stimulates the growth of various cells in the body and has many health benefits. The sulfur present in methionine helps protect cells from contaminants and induces the growth and development of the human body. Innovative approaches to bio-based compound production offer end users friendly alternatives to traditional synthetic methods.

Top 5 nutraceutical companies of 2024

| Company | Revenues (2023) |

| Nestlé | USD 16.98 billion |

| Danone | USD 8.92 billion |

| BASF | USD 8.69 billion |

| Herbalife | USD 5.2 billion |

| Ingredients | USD 4.93 billion |

| Report Coverage | Details |

| Market Size by 2034 | USD 8.86 Billion |

| Market Size in 2025 | USD 4.04 Billion |

| Market Size in 2024 | USD 3.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.13% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Increasing demand for animal feed

The growing demand for animal feed is the major factor impacting the methionine market due to increasing global meat consumption and growing requirements for high-quality livestock products. Methionine is an indispensable amino acid that plays an important role in the well-being and growth of various animal groups. In addition, the growing need for top meat quality, in turn, resulted in the use of methionine in the formulation of feed, generating demand to raise consumption.

Implementation of strict regulatory frameworks

Regulatory norms such as quality standards, maximum allowable limits, and other safety regulations can facilitate complexity and compliance costs for producers in the methionine market. Sticking to these requirements may sometimes need substantial investments in research and documentation, influencing market competitiveness and creating major hurdles for market participants. Moreover, raw material prices are increasingly fluctuating.

Rising demand from the pharmaceutical and cosmetics sector

The growing demand for the compound from the pharmaceutical and cosmetics industry can create lucrative opportunities in the methionine market. Methionine is used in the formulation of pharmaceutical and cosmetic products and preparations due to its unique characteristics. Furthermore, the increasing need for methionine as an ingredient in both industries can impact market growth positively. Also, rising consumer awareness regarding wellness, health, and nutrition can propel the demand for dietary supplements with methionine further.

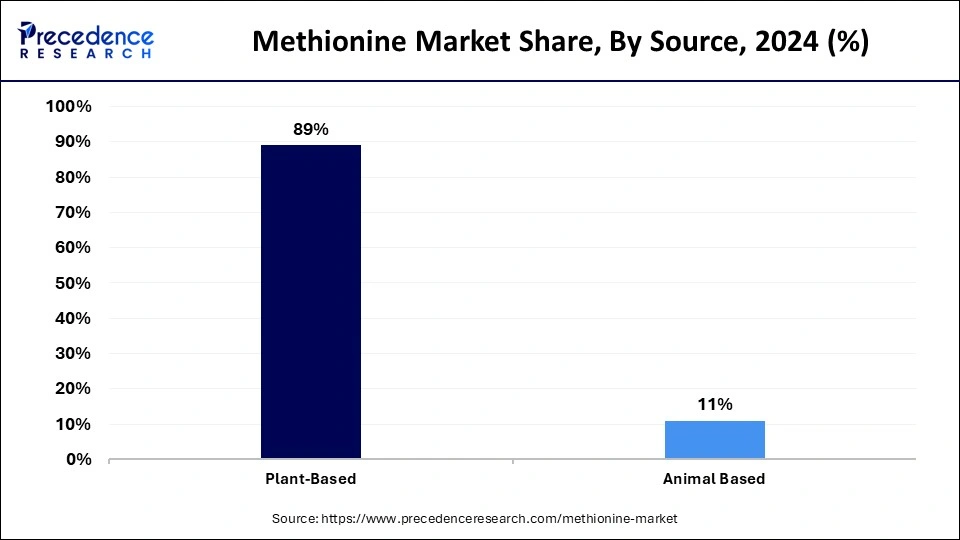

The plant-based segment led the global methionine market in 2024. The dominance of the segment can be attributed to the increasing trend towards ethical and sustainable consumption practices, which has facilitated a trend towards plant-based goods and boosted demand for this segment. In addition, market players are adapting to fulfill this demand using methionine's diversity in animal supplements, feeds, and pharmaceuticals to generate revenue from its many applications. Plant-based methionine can easily be included in animal and human nutrition without any ethical concerns.

The animal-based segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the sustainability and dietary concerns associated with a plant-based source. The grade of methionine extracted from animal sources has a superior quality than that of plant-based sources. As an essential amino acid, methionine is necessary for maximum animal health and can't be created by the body on its own. However, animal-derived methionine possesses a superior bioavailability, promising efficient synthesis.

The animal feed segment dominated the methionine market in 2024. The dominance of the segment can be credited to the surging population growth, changing lifestyle and dietary habits, and increasing urbanization. The necessary calls for the manufacturing of more convenient and high-quality animal feeds are on the rise, which keeps animals productive and healthy. Additionally, the increasing need for good feed conversion ratios in the aquaculture sector boosted the dominance of animal feed in the market.

The pharmaceuticals segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment is driven by increasing demand for this compound from the pharmaceutical industry due to its various health benefits. To achieve the highest level of purity, pharma-grade methionine is necessary for end products. Furthermore, the pharma industry is very selective when it comes to choosing raw materials for product manufacturing. To fulfill these strict requirements, methionine suppliers use substantial resources that meet industry standards.

By Source

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client