April 2025

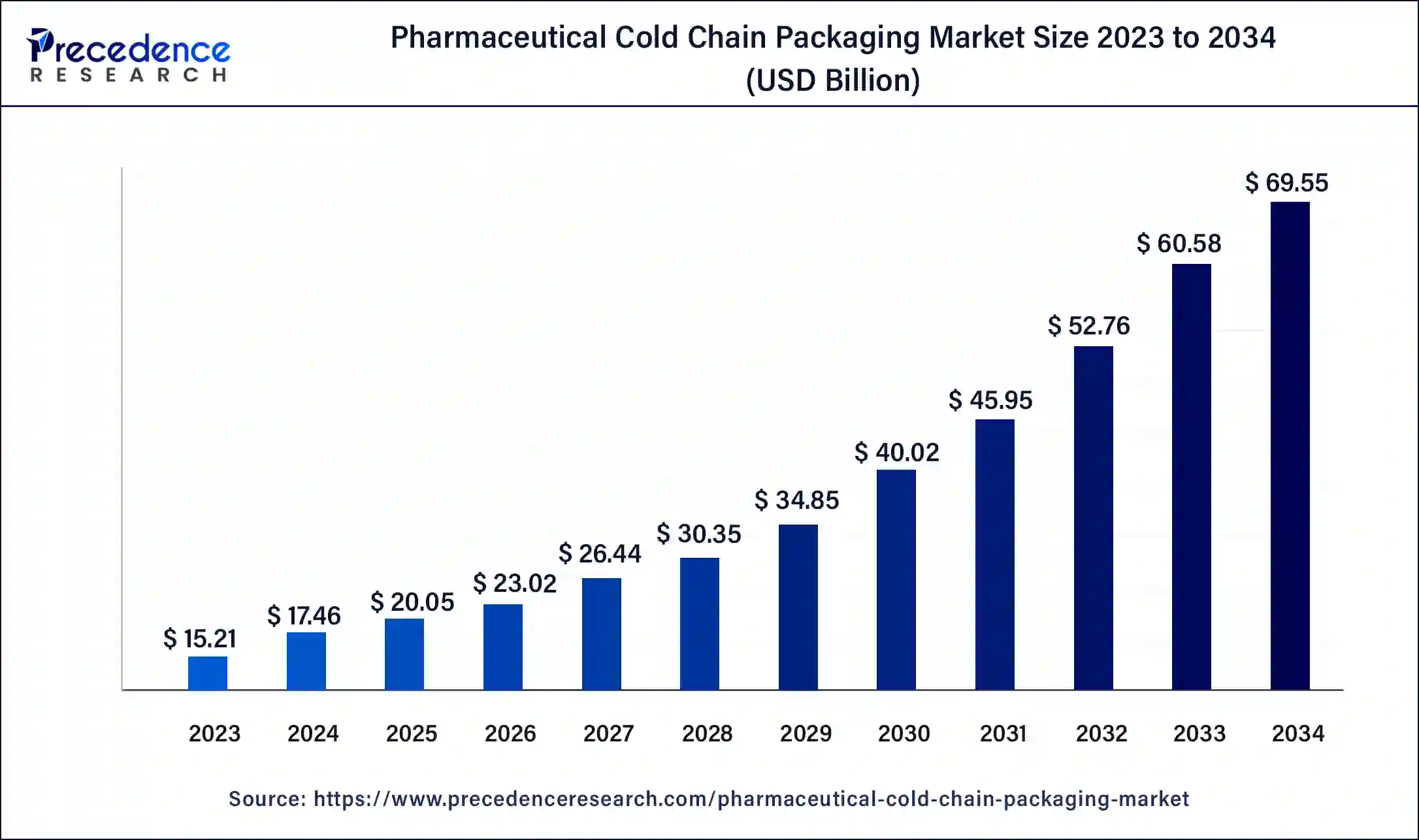

The global pharmaceutical cold chain packaging market size surpassed USD 15.21 billion in 2023 and is estimated to increase from USD 17.46 billion in 2024 to approximately USD 69.55 billion by 2034. It is projected to grow at a CAGR of 14.82% from 2024 to 2034.

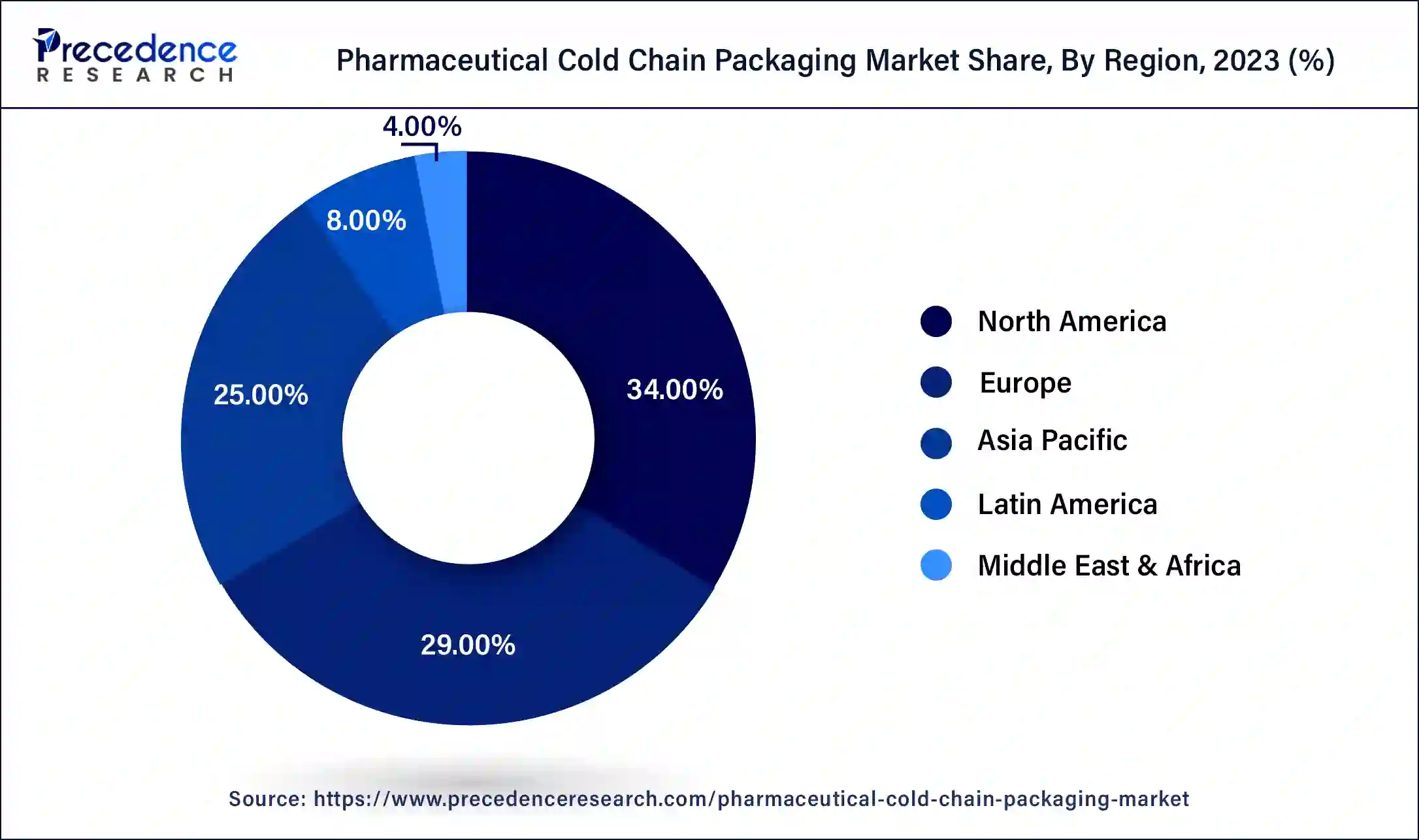

The global pharmaceutical cold chain packaging market size is projected to be worth around USD 69.55 billion by 2034 from USD 17.46 billion in 2024, at a CAGR of 14.82% from 2024 to 2034. The North America pharmaceutical cold chain packaging market size reached USD 5.17 billion in 2023. Strong cold chain packaging solutions are required to preserve product efficacy due to the increase in the manufacture and distribution of biologics and vaccines that are temperature sensitive. This drives the growth of the pharmaceutical cold chain packaging market.

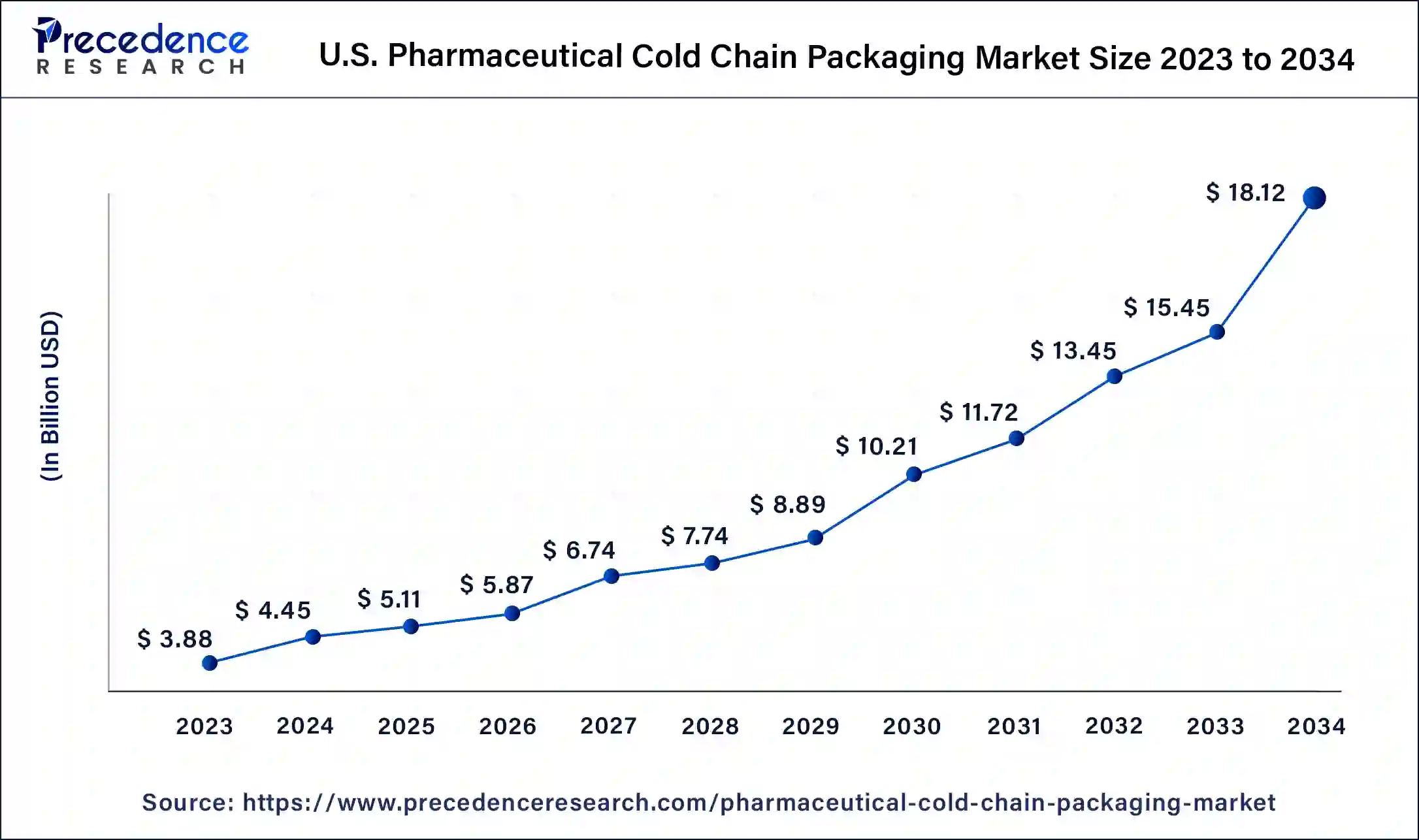

The U.S. pharmaceutical cold chain packaging market size was exhibited at USD 3.88 billion in 2023 and is projected to be worth around USD 18.12 billion by 2034, poised to grow at a CAGR of 15.03% from 2024 to 2034.

North America held the largest share of the pharmaceutical cold chain packaging market in 2023. In order to ensure the safe and efficient transportation and storage of pharmaceutical products that are sensitive to temperature, the pharmaceutical cold chain packaging market in North America is an essential part of the pharmaceutical supply chain. Strict temperature controls are frequently needed for these products, which increases demand for sophisticated cold chain packaging solutions. Strict regulations enforced by organizations such as the FDA regarding the transportation and storage of medications that are sensitive to temperature increase the demand for packaging solutions that meet these requirements. The effectiveness and dependability of cold chain packaging are improved by advancements in monitoring systems and packaging materials. The need for efficient cold-chain packaging is fueled by the expansion of pharmaceutical production and delivery in North America.

Asia Pacific is expected to host the fastest-growing pharmaceutical cold chain packaging market during the forecast period. The demand for dependable cold chain packaging solutions has been pushed by the rising incidence of chronic illnesses and the requirement for vaccinations, especially COVID-19 vaccines. The demand for sophisticated cold chain packaging solutions is rising as governments in Asia Pacific nations impose strict requirements to guarantee the safe storage and transit of pharmaceutical products that are sensitive to temperature. The efficiency and dependability of cold chain packaging are being improved by advancements in packaging materials and technologies, such as vacuum-insulated panels (VIPs) and phase change materials (PCMs). Asia Pacific's pharmaceutical sector is growing quickly due to rising R&D spending, increased investment, and rising biologics and biosimilar manufacturing.

The pharmaceutical cold chain packaging market consists of specialized packaging options made to preserve pharmaceutical products' temperature integrity during storage and distribution. Growing demand for vaccines and biopharmaceuticals, which need strict temperature control to remain effective, is driving the market. Regulations pertaining to the quality and safety of products also play a role in the expansion.

This category comprises temperature-monitoring equipment (data loggers, RFID tags), insulated shippers, and refrigerants (gel packs, phase change materials). These technologies guarantee that goods travel within predetermined temperature limits. Product categories like refrigerants, temperature monitoring equipment, insulated shippers, and containers are used to divide the market. Every one of them is essential to keeping the cold chain intact.

Due to their sophisticated healthcare systems and strict regulations, North America and Europe are important markets. The booming pharmaceutical industries and rising healthcare spending are driving the rapid growth of emerging markets in Latin America and Asia Pacific. Stakeholders must contend with high cold chain logistics costs, regulatory compliance, and the ongoing need for packaging technology innovation.

Anticipated trends influencing the market's future include improvements in thermal insulation technologies, a rise in the use of IoT-enabled monitoring solutions, and innovations in sustainable packaging materials. In general, the pharmaceutical cold chain packaging market drives ongoing innovation and investment in cold chain logistics solutions, which is crucial for guaranteeing the efficacy and safety of medications that are temperature-sensitive.

How can Artificial Intelligence Help Pharmaceutical Packaging?

The integration of robotics and automation in packaging industries has led to increased accuracy in complex tasks, product sorting, maintenance, and an overall reduction in manual errors. Through machine learning and data analytics, pharmaceutical companies ensure proper inventory management of therapeutics stock, making their supply chains more resilient. AI also helps to grow professional supply networks, manage customer service, and ensure correct tracking of on-site medicine deliveries.

Smart technologies like natural language processing and machine vision contribute to the identification of the packaging errors irrespective of regional language barriers. It ensures the correct labeling of medicinal products, detailed information on performance parameters, promising packaging of temperature or cold-sensitive healthcare products which enhance the efficacy of quality control systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 69.55 Billion |

| Market Size in 2023 | USD 15.21 Billion |

| Market Size in 2024 | USD 17.46 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.82% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Product, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Globalization of pharmaceutical supply chains

The global pharmaceutical cold chain packaging market is becoming more accessible to pharmaceutical corporations, especially in emerging economies. Strong cold chain logistics are required for this expansion to guarantee the efficient and secure transportation of temperature-sensitive goods over extended distances. Modern cold chain technologies, such as enhanced data logging, real-time temperature monitoring, and better insulating materials, increase the dependability and efficiency of international pharmaceutical supply chains.

The pharmaceutical cold chain packaging market is expanding as a result of these advances, as businesses are investing in cutting-edge solutions to preserve product integrity. Since biologics, vaccines, and specialty pharmaceuticals are more common and frequently temperature-sensitive, there is an increased demand for dependable cold-chain logistics. The need for high-performance cold chain packaging that can withstand strict temperature ranges is increased by this trend.

Limited infrastructure in emerging markets

It is challenging to guarantee the prompt and dependable delivery of temperature-sensitive medications due to inadequate transportation networks, such as dilapidated roads, and few air freight choices. Many areas lack modern cold storage facilities, which makes it difficult to maintain the temperatures needed for pharmaceutical items and increases the risk of product degradation. The lack of strict regulatory frameworks in emerging nations frequently results in inconsistent cold chain packaging and management quality standards. The expertise needed to handle the intricacies of cold chain logistics, from packing to compliance and monitoring, is frequently lacking in the workforce. The substantial upfront costs associated with setting up cold chain infrastructure discourage many competitors from entering the pharmaceutical cold chain packaging market. Furthermore, operating expenses may be unaffordable.

Expansion in emerging markets

Pharmaceutical production is increasing in emerging nations as a result of local manufacturing incentives and higher healthcare investments. Strong cold-chain packaging solutions are needed to ensure the safe transportation and storage of temperature-sensitive goods in light of this growth. In order to protect the integrity of these delicate pharmaceuticals, specialized cold chain packaging is becoming more and more necessary as chronic illness prevalence rises and biologics and biosimilars are used more widely in developing countries.

Reliable cold chain packaging solutions are more important as emerging pharmaceutical cold chain packaging market regulatory frameworks are strengthened to conform to international norms. Adherence to strict temperature control requirements guarantees the safety and effectiveness of products.

The plastic segment held the largest share of the pharmaceutical cold chain packaging market in 2023. Because plastics are so versatile, strong, and affordable, they play a significant role in the pharmaceutical cold chain packaging market. Expanded polystyrene (EPS), polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) are examples of common polymers. The superior insulating qualities of these materials are essential for preserving the necessary temperature range throughout storage and transit. Plastic waste's effects on the environment are a major problem. Recyclable and biodegradable plastics, among other sustainable solutions, are becoming more popular in the business. Businesses are spending money on R&D to produce environmentally friendly plastic polymers that operate just as well. The market for pharmaceutical cold chain packaging is expanding due to rising demand for vaccines and biopharmaceuticals.

The metal segment is expected to grow at the fastest rate in the pharmaceutical cold chain packaging market during the forecast period. The metal segment of the pharmaceutical cold chain packaging market often refers to packaging options made of metals like stainless steel or aluminum. These materials are selected because they are strong, resistant to temperature changes, and capable of preserving product integrity in cold chain storage and transit. Insulated boxes, vials, or even unique metal containers made to maintain pharmaceutical items within the specified temperature range are examples of metal packaging solutions. Throughout the distribution process, this section is essential to maintaining the effectiveness and safety of medications and vaccines that are temperature-sensitive.

The small boxes segment held the largest share of the pharmaceutical cold chain packaging market in 2023. The tiny box segment in the pharmaceutical cold chain packaging market is essential to ensure the safe transportation and storage of medications that are sensitive to temperature. The integrity and efficacy of pharmaceuticals, vaccines, and biologics are safeguarded throughout transit by the design of these boxes, which maintain specified temperature ranges. They are frequently employed in situations where exact temperature control is crucial or for smaller shipments. These boxes play a critical role in preserving the necessary temperature conditions throughout storage and transportation, protecting the integrity and effectiveness of pharmaceutical items that are sensitive to temperature changes, including biologics, vaccines, and other drugs. These little boxes are essential to maintaining the safety and efficacy of drugs by ensuring that they travel between the maker and the end user within predetermined temperature ranges.

The pallets segment is expected to grow at the fastest rate in the pharmaceutical cold chain packaging market during the forecast period. Pallets are essential to the safe and effective transportation and storage of pharmaceutical items that are sensitive to temperature in the pharmaceutical cold chain packaging market. Throughout the supply chain, these pallets are made to keep certain temperatures constant, safeguarding the effectiveness and integrity of pharmaceuticals, immunizations, and biologics. Pallet design for thermal insulation, durability, regulatory compliance, and integration with temperature monitoring and control systems are important considerations in this market. This reduces the possibility of spoiling or degradation by ensuring that medications stay within designated temperature ranges during storage and transit. From pharmaceutical manufacturing facilities to end-users like hospitals, clinics, and pharmacies, this sector is essential for maintaining pharmaceutical quality and adhering to strict regulatory criteria.

The biopharmaceutical companies segment held the largest share of the pharmaceutical cold chain packaging market in 2023. Biopharmaceutical businesses are significant players in the pharmaceutical cold chain packaging market because of their concentration on biological goods, which are sensitive and need careful temperature control along the supply chain. To preserve the effectiveness and security of their goods, these businesses make significant investments in cutting-edge cold chain packaging solutions. Among the well-known biopharmaceutical firms operating in this sector are Pfizer, Novo Nordisk, Amgen, Roche, and Biogen. In order to guarantee adherence to legal requirements and to develop creative packaging solutions that improve product stability and shelf life, they frequently work in tandem with packaging suppliers. To guarantee that biologics, vaccines, and other temperature-sensitive medications are delivered and kept under controlled circumstances, keeping their potency and safety, these companies need specific packaging solutions.

The hospital segment is expected to grow at the fastest rate in the pharmaceutical cold chain packaging market during the forecast period. Hospitals are important end consumers in the pharmaceutical cold chain packaging market. For the safe storage and delivery of biologics and medications that are sensitive to temperature, dependable cold-chain packaging solutions are needed. To maintain the effectiveness and safety of pharmaceuticals from storage to administration, hospitals frequently require packaging that stays within particular temperature ranges. Solutions that assist hospitals in adhering to legal obligations and upholding patient care quality assurance range from temperature-monitoring devices to insulated containers. Demands and laws pertaining to these products may differ depending on the area, such as Asia Pacific or North America.

Segment Covered in the Report

By Material

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

February 2025

September 2024