February 2025

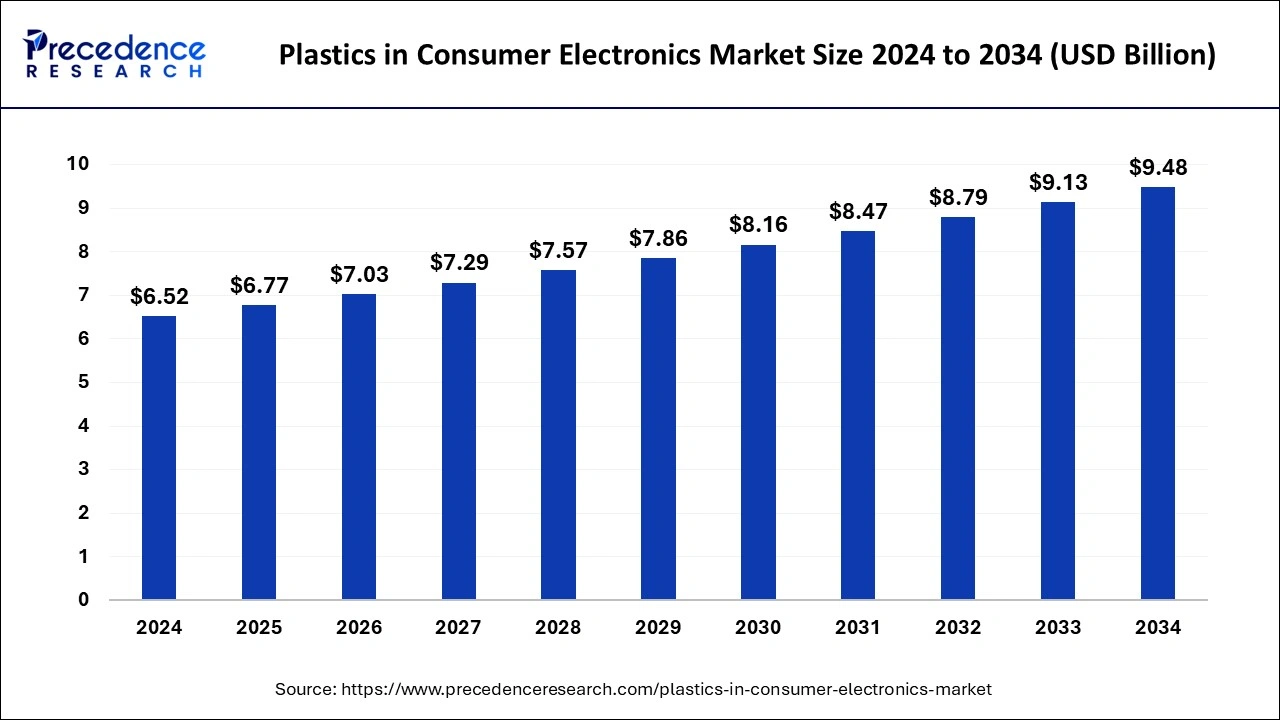

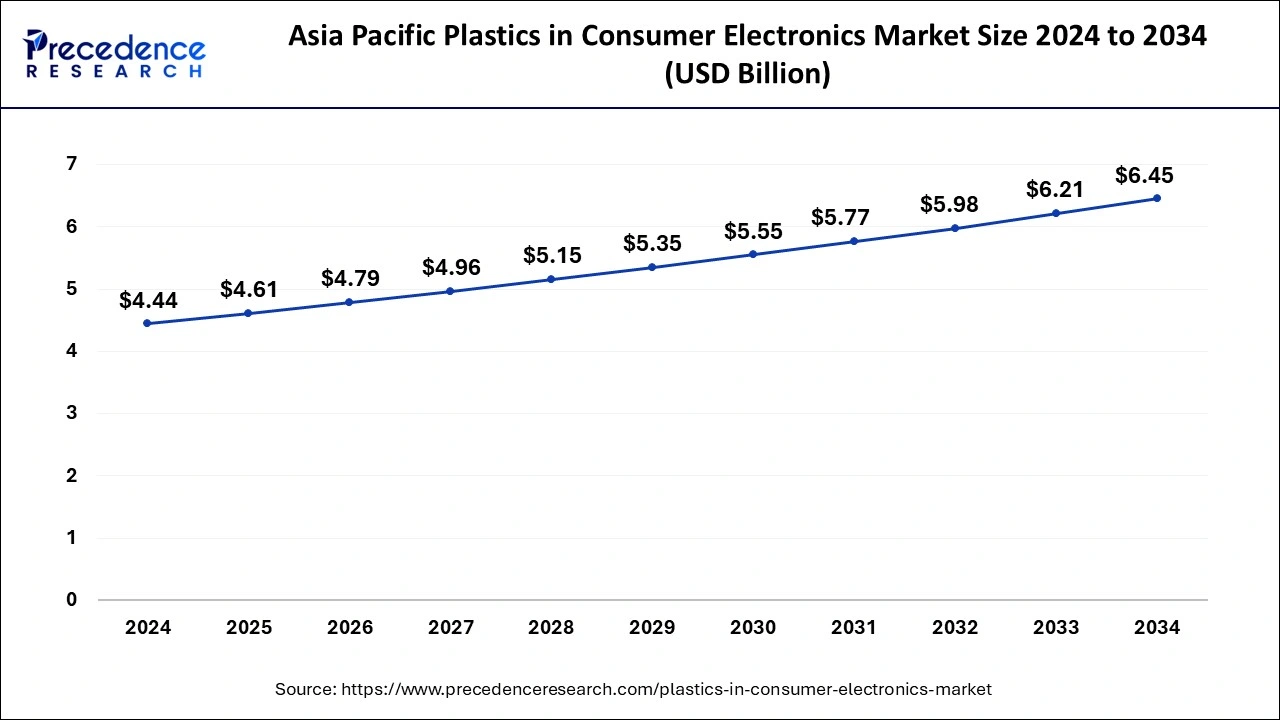

The global plastics in consumer electronics market size is calculated at USD 6.77 billion in 2025 and is forecasted to reach around USD 9.48 billion by 2034, accelerating at a CAGR of 3.81% from 2025 to 2034. The Asia Pacific market size surpassed USD 4.44 billion in 2024 and is expanding at a CAGR of 3.83% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global plastics in consumer electronics market size accounted for USD 6.52 billion in 2024 and is expected to exceed around USD 9.48 billion by 2034, growing at a CAGR of 3.81% from 2025 to 2034. The plastics in consumer electronics market growth is attributed to the increasing demand for advanced, lightweight, and durable plastic materials in a wide range of consumer electronic applications.

Artificial intelligence strategies are used to combine voice control, predictive actions, and energy-saving technologies into the plastics in consumer electronics market in an effort to make them more attractive to customers from the IT sector. AI enhances the capability of real-time data processing so that manufacturers enhance their real-time supply chain and minimize the loss of products in the course of production. With predictive modeling, markets, and customer trends are accurately estimated so that organizations offer products that fit into the market demands. Furthermore, dynamic automation through AI cuts production costs and speeds up the availability of fresh solutions, thereby increasing competitiveness in this dynamic industry.

The Asia Pacific plastics in consumer electronics market size was exhibited at USD 4.44 billion in 2024 and is projected to be worth around USD 6.45 billion by 2034, growing at a CAGR of 3.83% from 2025 to 2034.

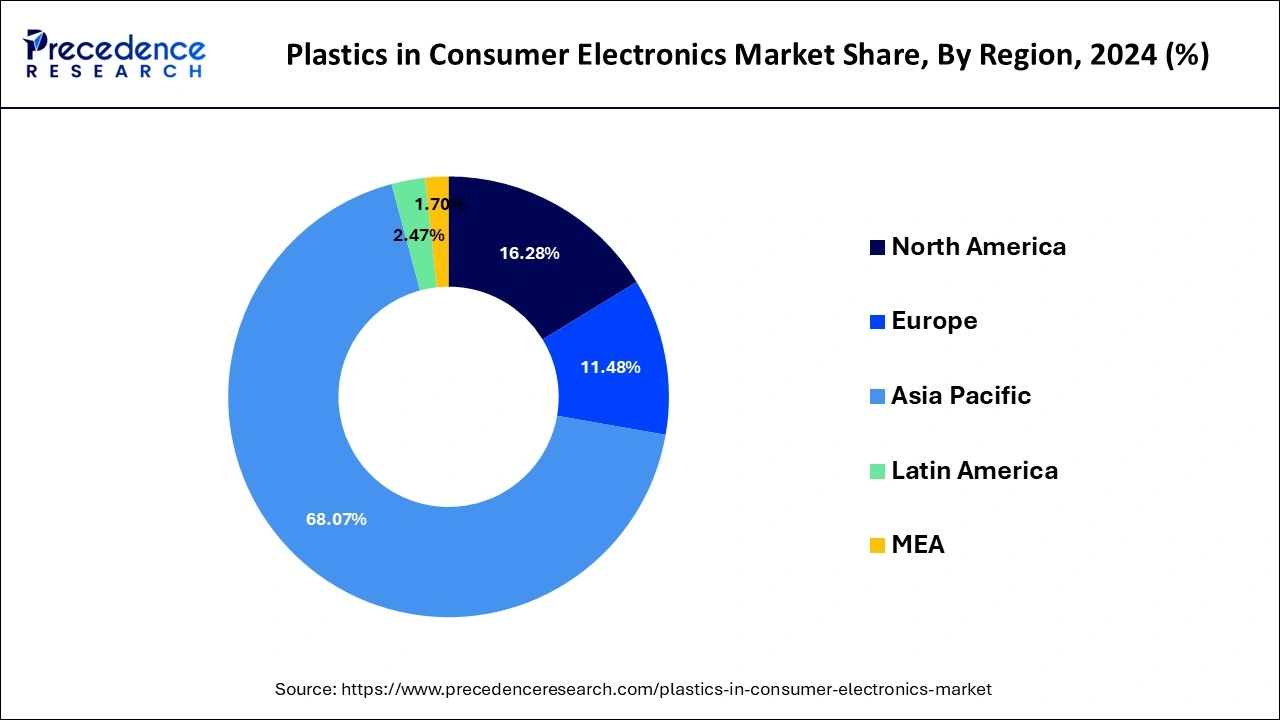

Asia Pacific dominated the global plastics in consumer electronics market in 2024, owing to the fast-growing electronics manufacturing industries in China, Japan, South Korea, and India. The region continues to be an important manufacturer of consumer electronics, with cheap labor, a technological edge, and electronics manufacturing giants.

China occupies a particularly important position in the plastics in consumer electronics market, as it is the largest supplier of consumer electronics in the world, including smartphones, tablets, and other portable electronics that use copious amounts of plastics. The electronics industry is a leading industry in China. Furthermore, an increased disposable income among consumers and an emerging need for electronic devices in emerging countries such as India and Southeast Asian countries drive market growth in this region.

North America is anticipated to grow at the fastest rate in the plastics in consumer electronics market during the forecast period due to developments in technology and the trend in which people use electronics in products such as healthcare products, automobiles, and consumer electronics, among others.

The U.S. plastics in consumer electronics market is driving this North America’s growth due to the significant advancements in high-tech electronics, including mobile phones, notebooks, smart wearables, and smart home gadgets. It was reported that the U.S. Environmental Protection Agency (EPA) has set new goals to cut down the usage of plastics with an aim to use and promote the use of recyclable and biodegradable plastics in manufacturing, which is expected to drive the utilization of sustainable technologies in the durables industry.

The demand for strong and lightweight materials in the plastics in consumer electronics market is rapidly growing in the automotive and consumer electronics industries. Polycarbonate, polycarbonate/acrylonitrile butadiene styrene, thermoplastic elastomers, and polyamide are common in the manufacturing of TV frames, laptop monitor encompassing, LCD panels, portable hand-held devices, wearables, mobile phone bodies, and appliances due to features such as flexibility, durability, and chemical and heat resistance.

| Report Coverage | Details |

| Market Size by 2024 | USD 6.52 Billion |

| Market Size in 2025 | USD 6.77 Billion |

| Market Size in 2034 | USD 9.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.81% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for lightweight and durable plastics in consumer electronics

Growing request for lightweight and high-durability materials is expected to drive the plastics in consumer electronics market in the coming years. Durability without adding extra weight is the choice of materials that manufacturers focus on to make portable products. Plastics provide strength while being light and portable, and this makes them appropriate for smartphones, laptops, and pocket-friendly devices. Furthermore, workability is an advantage that plastics possess over other materials because they allow for the formation of diverse and comfortable forms that lead to improved design and tool differentiation in the market.

Stringent environmental regulations

Stringent environmental regulations on plastic production and disposal are anticipated to restrain the plastics in consumer electronics market expansion. National and international governments and regulatory authorities have put measures in place to control the use of plastics. Furthermore, the increase in consumers' cognizance of the environmental threat posed by plastics increases pressure on firms to seek green substitutes, although these are not as cheap or elastic as plastics.

The 2024 EU Single-Use Plastics Directive (SUPD) seeks to mitigate the environmental impact of plastic waste by banning items such as single-use plastic cutlery, plates, and cups, among other disposable products. These policies bring about high manufacturing costs since the manufacturers are required to use sustainable materials or develop recycling ways. Adherence to these regulations also causes program timeliness in production.

High demand for sustainable plastic solutions in eco-friendly electronics

High demand for sustainable plastic solutions is expected to create significant opportunities for the eco-friendly plastics in consumer electronics market. Manufacturers want to adopt readily recycled and biodegradable plastics to meet current world trends and customers’ expectations. Traditional biodegradable plastics are short-complexed by various drawbacks.

PHA present themselves as less harsh solutions with comparable efficiency. Governments and NGOs offer tax credits and grants for these materials to ensure that investments set for the production of sustainable products are improved. Furthermore, the continued incorporation of sustainable policies inside the consumer electronics industry indicates vast-scale prospects for advancements.

The polyamide segment held a dominant presence in the plastics in consumer electronics market in 2024 due to its mechanical properties, which include high strength, impact resistance, and heat resistance. It is capable of being designed in different types, and it is transparent and light, which has made it the most-used product for the creation of long-lasting and good-looking electrical devices. The need for polycarbonate is likely to continue to be high primarily, as the material is very critical in the creation of high-performance, portable electronic products.

The liquid crystal polymer segment is expected to grow at the fastest rate in the plastics in consumer electronics market during the forecast period of 2025 to 2034, owing to its great mechanical and thermal properties, which endear it to high-performance applications in small and compact electronic devices. Due to its dimensional stability and electrical insulation, it has found a wide application in connectors, antennas, and microelectronic devices, especially as 5G technology increases. Additionally, demand for LCP is expected to rise as electronics shrink and require high-frequency, low-attenuation materials, positioning it as vital for future consumer electronic devices.

The mobile phone bodies segment accounted for a considerable share of the plastics in consumer electronics market in 2024, owing to the growing need for smartphones, the lightweight yet highly durable material known as plastics is ideal for use in the construction of the phone body. Polycarbonate, ABS, and polyamide are most popular in custom design for mobile phone casings because of their strength, impact, and design properties. Moreover, the rise in demand for consumer goods in emerging markets is the foremost driver of this increase in production.

The wearables segment is anticipated to grow with the highest CAGR in the plastics in consumer electronics market during the studied years, owing to the rising demand for health and fitness, fitness monitors, and the installation of intelligent circuitry in wearables such as smartwatches and fitness bands. Thermoplastic elastomer (TPE), polycarbonate, and soft rubber, among other materials, are widely used for the fabrication of wearables because of their flexibility, durability, and comfort. Furthermore, the integration of wearables into daily health management is expected to further fuel market growth, thus increasing the need for durable and eco-friendly plastic solutions.

The U.S. National Institutes of Health (NIH) 2024 report that millions of Americans leave for school or work each day wearing devices that count their steps, check their heart rates, and help them stay fit. The next generation of “wearables,” used by individuals in partnership with their healthcare providers, might be able to monitor vital signs, blood oxygen levels, and a wide variety of other measures of personal health.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

January 2025

August 2024