April 2025

US Hydrogen Generation Market (By Type: Blue Hydrogen, Gray Hydrogen, Green Hydrogen; By System Type: Merchant, Captive; By Source: Natural Gas, Coal, Biomass, Water; By Technology: Coal Gasification, Steam Methane Reforming, Partial Oxidation (POX), Electrolysis, Others; By Application: Methanol Production, Ammonia Production, Petroleum Refinery, Transportation, Power Generation, Others) - Regional Outlook and Forecast 2025 to 2034

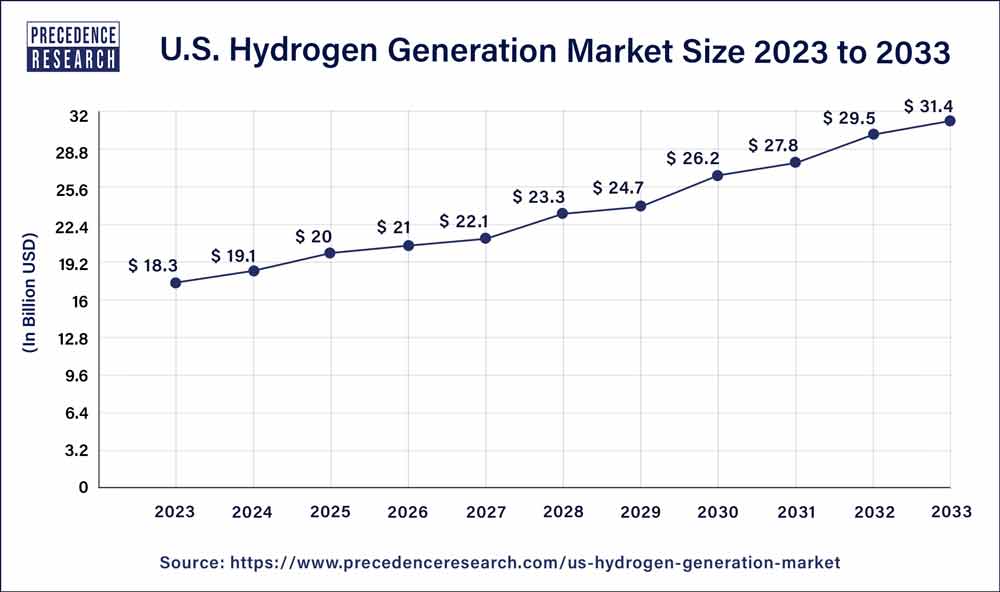

The US hydrogen generation market size is anticipated to reach around USD 31.4 billion by 2033, increasing from USD 18.3 billion in 2023 and poised to grow at a CAGR of 5.7% from 2024 to 2033. The U.S. hydrogen generation market is driven by a rise in the market for clean hydrogen.

US Hydrogen Generation Market Overview

The U.S. hydrogen generation market revolves around the processes associated with hydrogen as an essential component in many industrial processes, such as the creation of chemicals, the production of ammonia, and the refining of petroleum. The demand for sustainable hydrogen production methods is fueled by the rising use of hydrogen in hydrogenation reactions as companies work to reduce carbon emissions. It provides a versatile and dispatchable power-generating option for gas turbines and fuel cells to produce low- or zero-emission electricity. Technologies based on hydrogen-based power generation are anticipated to be essential components of the energy mix as the United States moves toward greener energy sources.

Efficiency, affordability, and scalability improvements are being made in electrolysis, especially in alkaline and proton exchange membrane (PEM) electrolysis. The capital and operating expenses of producing hydrogen are reduced by electrolyzer design and material science advances, making electrolysis more competitive with traditional techniques. Government initiatives and subsidies are significant factors propelling the market for hydrogen generation's expansion. Hydrogen-related projects are observed to receive financing, tax credits, and regulatory support in the United States through several federal and state-level initiatives that speed up research, development, and implementation.

Driver: Increasing investments and public-private partnerships

The investments support the advancement of cutting-edge technology research, the expansion of production capabilities, and the development of hydrogen infrastructure. Through public-private partnerships, government resources and private-sector innovation are combined to expedite the development of hydrogen generation and make it more affordable, accessible, and efficient. This partnership encourages the growth of hydrogen applications in several industries, including industrial processes, energy storage, and transportation.

Restraint: Limited policy support

Policies are essential to encourage investment, shape the regulatory landscape, and promote innovation. However, the development of hydrogen generation is hampered by the requirement for comprehensive and uniform policies. Businesses can fund hydrogen infrastructure development and technologies with the right regulations. Furthermore, the lack of regulations or long-term incentives to promote the use of hydrogen may discourage interested parties from investing in R&D and deployment.

Opportunity: Leveraging renewable resources

Sustainable and ecologically friendly hydrogen production is possible with the help of renewable energy sources, including solar, wind, and hydroelectric power. This aligns with international initiatives to mitigate climate change and cut greenhouse gas emissions. Utilizing renewable energy sources for hydrogen creation can lead to cheaper production costs than conventional fossil fuel based approaches as their cost keeps declining. As a result, hydrogen may become more widely accepted and competitive in the energy market.

Leveraging renewable resources in the hydrogen generation sector is further supported by government efforts and incentives such as tax credits, subsidies, and renewable portfolio requirements that promote renewable energy and decarbonization. These laws establish a supportive legal framework for funding and advancing hydrogen projects utilizing renewable energy sources.

The green hydrogen segment dominated the U.S. hydrogen generation market in 2023. Cleaner energy sources are becoming more popular as awareness of climate change and the need to cut carbon emissions grows. Green hydrogen is an environmentally friendly substitute for conventional hydrogen production techniques that rely on fossil fuels. It is created through electrolysis using renewable energy sources like the sun and wind.

Green hydrogen generation has also become more economical and efficient due to developments in renewable energy technology, which has fueled its broad acceptance. The green hydrogen industry has grown even faster thanks to government incentives, assistance, and regulatory support for renewable energy and hydrogen efforts.

The merchant segment dominated the U.S. hydrogen generation market in 2023. Cost-effective hydrogen production is made possible by merchant hydrogen generation plants' large-scale, highly efficient nature. Technological advances and constant innovation in hydrogen production techniques have made merchant providers even more competitive. These facilities are dedicated to hydrogen production only, allowing them to optimize technology and procedures for optimal output and efficiency.

The captive segment is the fastest growing in the U.S. hydrogen generation market during the forecast period. These businesses may meet their specialized needs for hydrogen with a dedicated and dependable source thanks to captive generation, which is frequently more efficient and economical than sourcing hydrogen from outside sources.

Furthermore, captive hydrogen generation is now more widely available and commercially feasible thanks to technological developments, particularly in electrolysis and steam methane reforming. This has enabled businesses to employ clean energy sources like solar and wind to manufacture hydrogen locally, helping them meet sustainability targets and cut greenhouse gas emissions.

The natural gas segment dominated the U.S. hydrogen generation market in 2023. The industry's most popular technique for producing hydrogen is steam methane reforming (SMR), which uses natural gas as a feedstock because of its abundant supply and affordable price. High-temperature reactions between natural gas and steam are used in SMR to create hydrogen. Furthermore, natural gas is preferable for producing hydrogen due to its established infrastructure and processing skills, particularly for industrial uses like ammonia manufacturing and refining.

The steam methane reforming segment dominated the U.S. hydrogen generation market in 2023. Due to its effectiveness and broad use in the industrial sector, SMR is a well-known technique that uses a high-temperature steam reaction to create hydrogen from natural gas as a feedstock. This process is the go-to approach for hydrogen production in the US because it is scalable, affordable, and yields high-purity hydrogen suited for a wide range of industrial uses.

The coal gasification segment is the fastest growing in the U.S. hydrogen generation market during the forecast period. Coal gasification involves converting coal into synthesis gas primarily composed of hydrogen and carbon monoxide. This process allows for efficient hydrogen extraction from coal, making it a viable source for hydrogen production. Further, technological advancements have made coal gasification more cost-effective and environmentally friendly, driving its adoption in the hydrogen generation industry.

The ammonia production segment dominated the U.S. hydrogen generation market in 2023. Large-scale activities are frequently used in ammonia production plants, and huge volumes of hydrogen can be produced as a byproduct. This scale makes it possible to generate hydrogen economically and efficiently. Numerous facilities that produce ammonia already have infrastructure for developing and distributing hydrogen, which gives them a market advantage. The integration of hydrogen generation into ammonia production processes is becoming more and more possible due to technological advancements. Since hydrogen may be sold or used in various industrial operations, producing hydrogen as a byproduct of ammonia manufacturing is generally more financially advantageous.

The power generation segment is the fastest growing in the U.S. hydrogen generation market during the forecast period. Shifting toward greener energy sources is becoming increasingly important in the fight against climate change and greenhouse gas emissions. Because it only releases water vapor when burned, hydrogen is regarded as a pure energy source. Recent developments in electrolysis technology, which uses electricity to split water into hydrogen and oxygen, have improved the efficiency and economics of hydrogen generation. Hydrogen also improves grid stability since it can be stored and used as a dependable backup power source for sporadic renewable energy sources like solar and wind. Finally, government programs and rewards are designed to advance hydrogen as a sustainable energy option.

Segments Covered in the Report

By Type

By System Type

By Source

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

May 2024

March 2025