January 2025

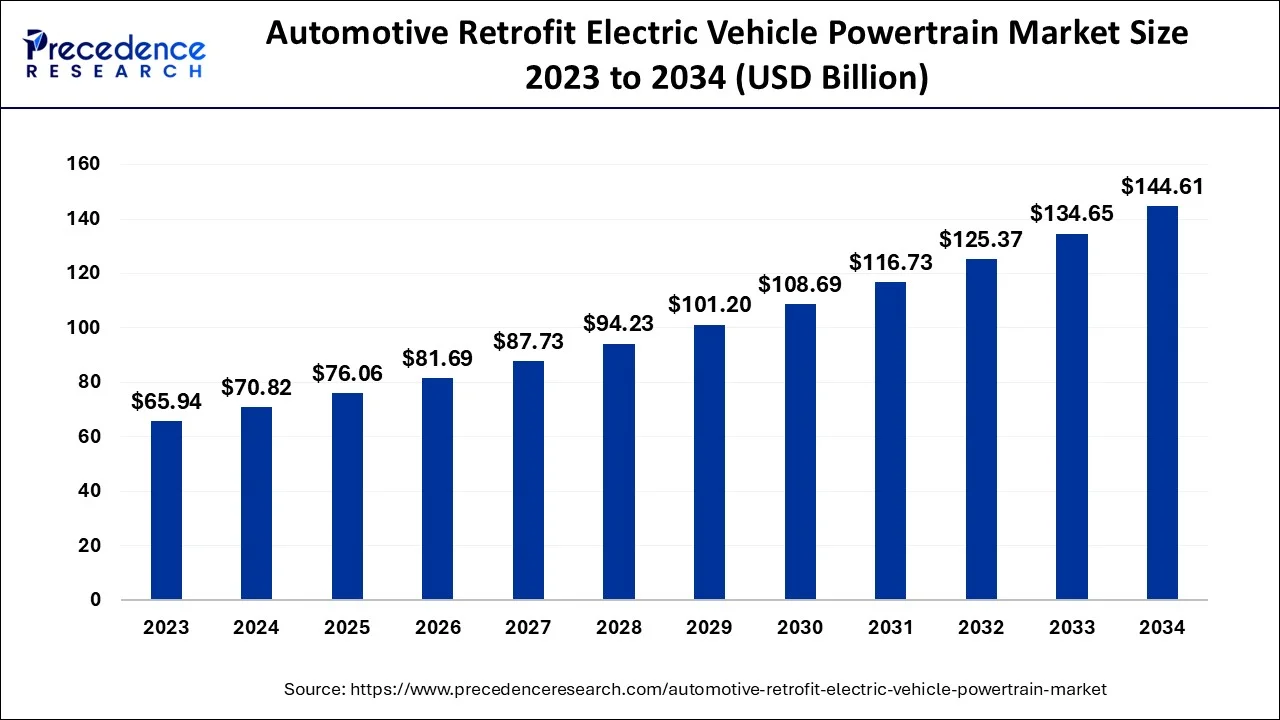

The global automotive retrofit electric vehicle powertrain market size accounted for USD 65.94 billion in 2024, grew to USD 70.82 billion in 2025 and is predicted to surpass around USD 144.61 billion by 2034, representing a healthy CAGR of 7.40% between 2024 and 2034.

The global automotive retrofit electric vehicle powertrain market size is accounted for USD 65.94 billion in 2024 and is anticipated to reach around USD 144.61 billion by 2034, growing at a CAGR of 7.40% from 2024 to 2034.

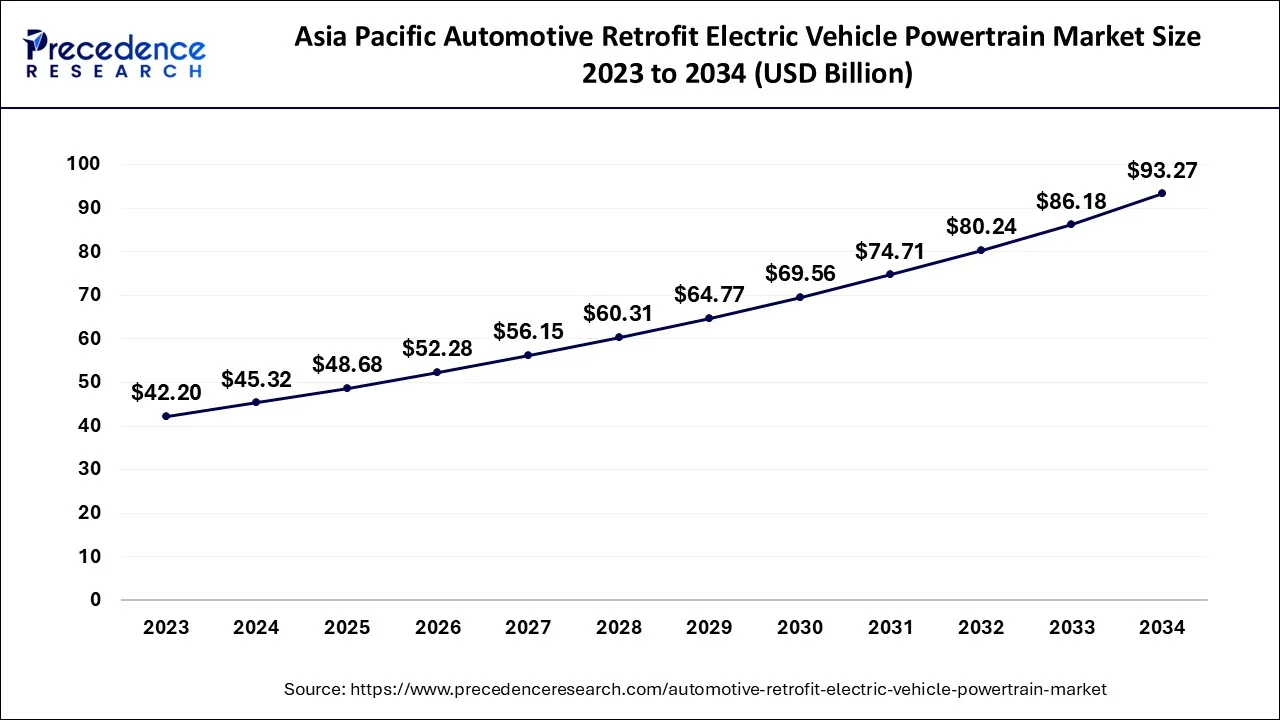

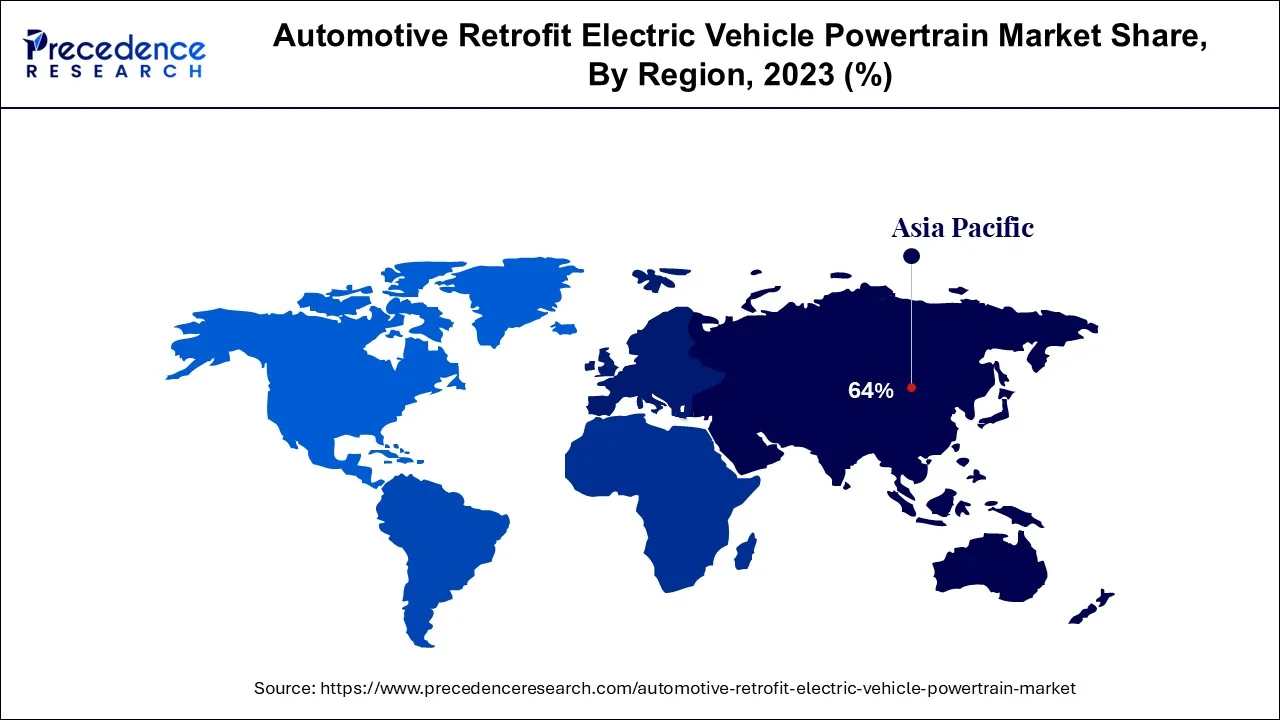

The Asia Pacific automotive retrofit electric vehicle powertrain market size is evaluated at USD 45.32 billion in 2024 and is predicted to be worth around USD 93.27 billion by 2034, rising at a CAGR of 7.48% from 2024 to 2034.

The Asia Pacific region is anticipated to increase significantly throughout the projection period. The main reason for the high market penetration is a number of legislative initiatives that encourage the purchase of EVs, such as EV sales quotas, fuel economy objectives, and benefits for EVs in the assignment of licence plates in nations like China. The market in this area is being driven by the adoption of severe emission laws like BS-VI in China and India.

Partnerships amongst top companies to create a charging infrastructure are also promoting market expansion in this area. For instance, Didi Chuxing from China and BP, the world's largest oil company, have partnered to build EV charging stations in China. Lithium deposits in China are encouraging further investment in the battery industry. Tesla also introduced the Model 3 with a significant price decrease in South Korea as a result of favourable government measures. These elements are most likely to contribute to APAC having the largest market share.

Over the course of the projected period, Europe is anticipated to dominate the market. The primary force in this area is the rule that every auto manufacturer must abide by regarding carbon emissions for newly registered automobiles. In addition, adoption of e-mobility and resistance to transportation powered by internal combustion engines are growing. These elements are promoting market expansion in this area.

In this market, North America is anticipated to have consistent growth. However, in some locations, particularly coastal areas, a more considerable market share of electric vehicle powertrains is projected, which is assisting the expansion in this field. Typical US consumers drive longer distances and prefer bigger cars.

The market for automotive retrofit electric vehicle powertrains is being driven by factors including rising of fuel prices, tightening emissions regulations, and growing desire for affordable solutions to switch to electric movement. In addition, government incentives are provided for electric cars to decrease air pollution levels, and boycotts of new internal combustion motor vehicle sales and the usage of IC motor vehicles older than 15 years are also contributing to the growth of the global market. A vehicle's gasoline-fuelled motor and any related parts, such as the axles, are replaced with electric motors, batteries, and numerous microelectronics, such as converters and regulators, as part of an electric vehicle retrofit.

Retrofitted cars are also provided with open matrices and chargers so they may be charged at home. Through the projected period, the market is anticipated to be driven by these various aspects. Retrofitting for electric cars is seen as a practical option for many vehicle owners to obtain electric vehicles without having to spend the money on brand-new ones. Additionally, retrofitting is increasingly being seen as a way to prolong the useful life and comfort of an old vehicle after it has served its purpose.

The need for automotive powertrains is also being fuelled by the rising demand for vehicle electrification in the automotive sector and the rising sales of electric automobiles. Additionally, it is anticipated that the industry would expand more quickly due to the rising need for automatic transmissions and engine downsizing to increase vehicle fuel economy.

| Report Coverage | Details |

| Market Size in 2024 | USD 65.94 Billion |

| Market Size by 2034 | USD 144.61 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.40% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component Type, Vehicle Type, Electric Vehicle Type, and Geography |

For this technology, the transmission market sector has the biggest market share. Most electric cars come with a single speed gearbox. But further research and development has been done to examine the economic viability of multiple-speed transmissions, such the Porsche Taycan. Leading producers of electric car transmissions are creating load shifting capabilities and multispeed transmission sailing operations. These elements are anticipated to support market expansion in this niche.

Over the projection period, the sector for power distribution modules (PDMs) is anticipated to develop at the quickest rate. The market expansion in this sector is being driven by the increased use of electric functionalities in EVs and the cost savings related with PDM. In this market, the electric motor sector is anticipated to have consistent expansion. Improved motor design was necessary due to the increased thermal limitations, which further reduced the cost of additional materials for the electric motor. This reason also contributes to the expansion of electric drivetrain motors. With producers developing new product lines to hasten integration in commercial vehicles, the converter category is predicted to have stable expansion in this market. Given that manufacturers want to outfit cars with an integrated unite that incorporates inverter and converter functionalities, the inverter category is anticipated to have modest development in this market.

Over the course of the projected period, the passenger vehicle category is anticipated to rule the market. The market for Electric Powertrains in this sector is expanding due to rising consumer demand for automobiles for daily transportation and the quick uptake of electric cars, particularly in emerging nations. In this industry, it is projected that the bus and coach segment would continue to rise steadily. The development of vehicle-to-grid services, improved grid solutions, and increased acceptance of electric buses by transit agencies, especially in China and India, are projected to fuel the growth of the EV powertrain market in this sector.

By Component Type

By Vehicle Type

By Electric Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

January 2024

January 2025