April 2025

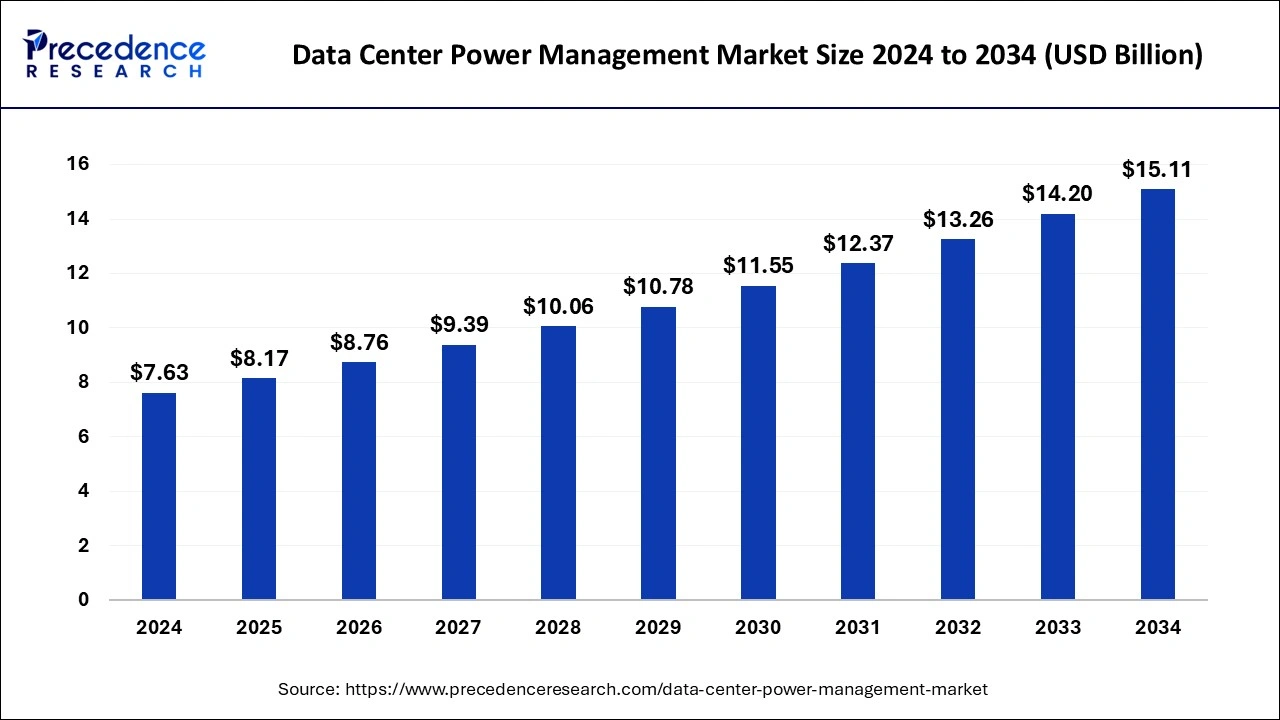

The global data center power management market size is calculated at USD 8.17 billion in 2025 and is forecasted to reach around USD 15.11 billion by 2034, accelerating at a CAGR of 7.07% from 2025 to 2034. The North America data center power management market size surpassed USD 2.75 billion in 2024 and is expanding at a CAGR of 7.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global data center power management market size was valued at USD 7.63 billion in 2024 and is anticipated to reach around USD 15.11 billion by 2034, growing at a CAGR of 7.07% from 2025 to 2034. The data center power management market is expanding rapidly due to increasing demand for data processing, ongoing technological advancements, and the rising focus on energy efficiency. Furthermore, the rising demand for cloud computing and the increasing digitization contribute to market growth.

Artificial intelligence (AI) significantly impacts the market in several ways. Firstly, AI algorithms are integrated into data centers to enhance efficiency and optimize power consumption. These algorithms analyze data and understand power usage patterns, which allows data centers to manage their energy consumption better. Secondly, machine learning algorithms are increasingly being used to make data center operations more efficient. These algorithms forecast future power needs, enabling data centers to allocate energy resources effectively. They also optimize cooling systems, increasing efficiency.

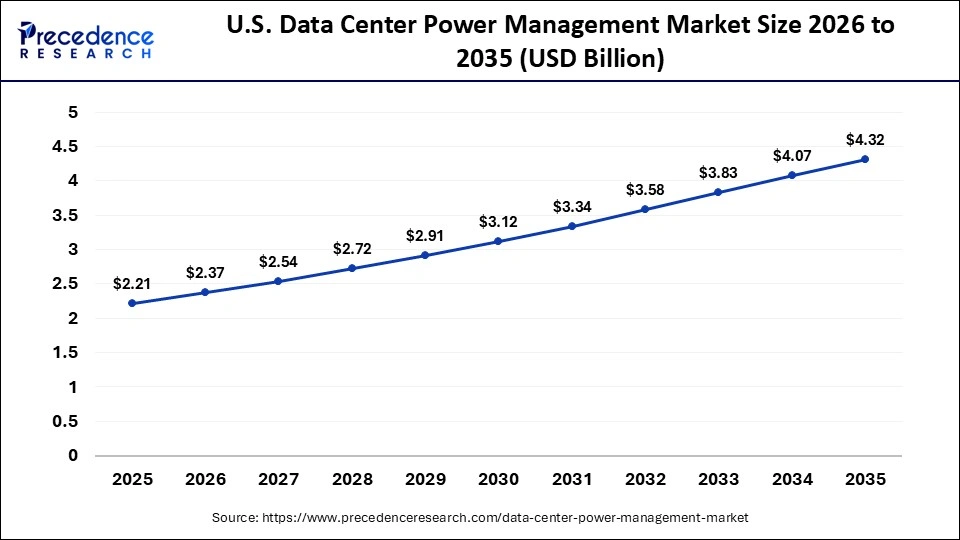

The U.S. data center power management market size reached USD 2.06 billion in 2024 and is projected to surpass around USD 4.07 billion by 2034 at a CAGR of 7.13% from 2025 to 2034.

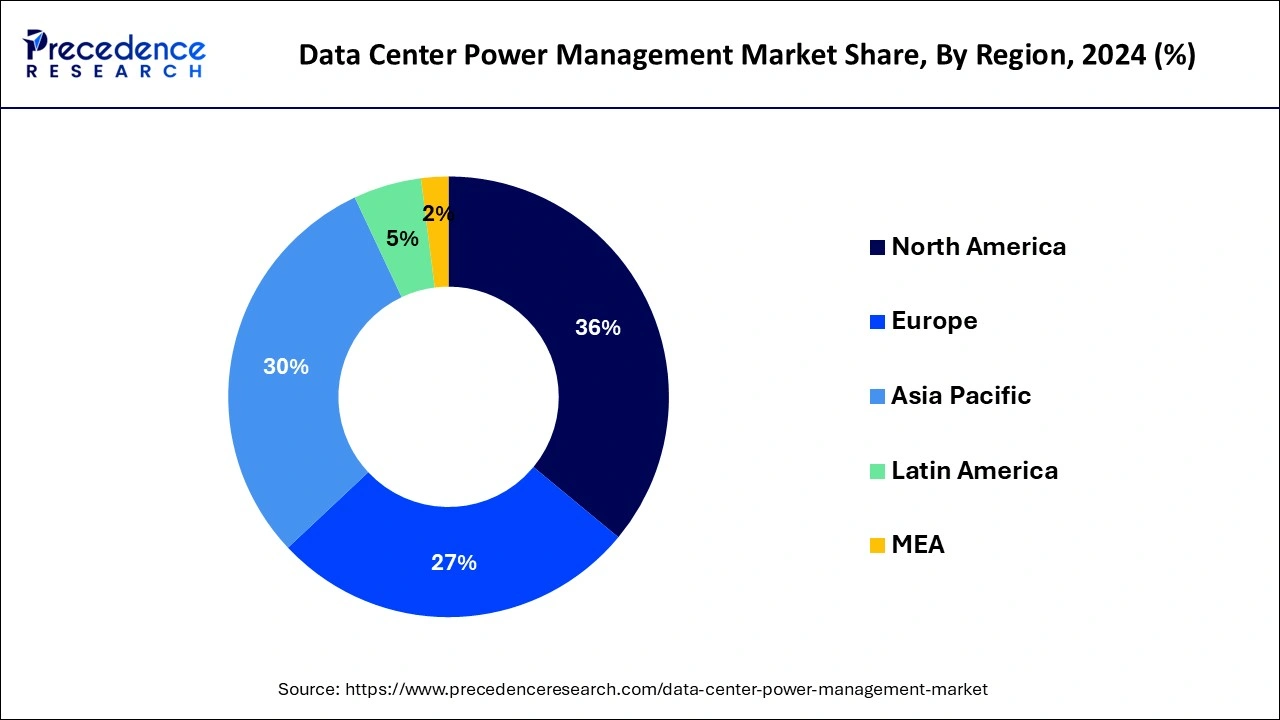

North America has contributed more than 36% of market share in 2024. Firstly, the region boasts a robust infrastructure for data centers, driven by the presence of numerous technology companies and cloud service providers. Secondly, North America has high levels of digitalization across various sectors, leading to increased demand for data center services. Additionally, the region prioritizes technological advancements and investments in energy-efficient solutions, contributing to the dominance of North America in the market for data center power management.

Asia-Pacific is witnessing rapid growth in the data center power management market due to several factors. Firstly, the region is experiencing significant digital transformation, leading to an increased demand for data center infrastructure. Additionally, rising internet penetration and expanding cloud services drive the need for efficient power management solutions. Moreover, governments are promoting sustainable energy practices, further fueling the adoption of energy-efficient power management technologies. With these combined forces, the Asia-Pacific region emerges as a key player in the global data center power management market, experiencing substantial growth and opportunities.

Meanwhile, Europe is experiencing notable growth in the data center power management market due to several factors. Firstly, increasing digitization across various industries drives the demand for data center services, necessitating efficient power management solutions. Additionally, stringent regulations regarding energy efficiency and environmental sustainability push data center operators to invest in advanced power management technologies. Moreover, the rise of edge computing and cloud services fuels the expansion of data center infrastructure, further driving the demand for power management solutions to ensure reliability, efficiency, and compliance.

The data center power management market offers strategies and technologies used to efficiently control and distribute electricity within data center facilities. It involves ensuring that the power supply meets the demands of the various equipment and systems housed in the data center while also prioritizing energy efficiency and reliability. This includes tasks such as monitoring power usage, regulating voltage levels, implementing backup power systems like uninterruptible power supplies (UPS), and optimizing cooling systems to maintain ideal operating conditions. Effective power management helps prevent downtime, protects sensitive equipment from power fluctuations, and reduces energy consumption and associated costs. It plays a crucial role in ensuring the continuous operation of data centers, which are essential for storing, processing, and accessing vast amounts of digital information in today's interconnected world.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.07% |

| Market Size in 2025 | USD 8.17 Billion |

| Market Size by 2034 | USD 15.11 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Data Center Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Escalating energy costs driving the need for optimization

Escalating energy costs are a significant driver in boosting the demand for data center power management solutions. As energy expenses continue to rise, data center operators face mounting pressure to optimize their power consumption to reduce operational costs. By implementing efficient power management strategies and technologies, such as intelligent cooling systems and energy-efficient UPS systems, data centers can minimize their energy usage without compromising on performance or reliability.

This heightened focus on optimization not only helps data centers cut down on their electricity bills but also aligns with broader sustainability goals. Many businesses are increasingly concerned about their environmental impact and are actively seeking ways to reduce their carbon footprint. As a result, the demand for energy-efficient power management solutions in data centers is surging, with operators looking to invest in technologies that can help them achieve both cost savings and environmental sustainability. In essence, the need to mitigate escalating energy costs is driving a strong demand for data center power management solutions that offer efficiency, reliability, and sustainability.

Security concerns related to IoT devices

Security concerns related to IoT devices serve as a significant restraint in the data center power management market. With the proliferation of IoT devices in data centers, there is an increased risk of cyberattacks and breaches, posing threats to the integrity and reliability of power management systems. Many IoT devices lack robust security features, making them vulnerable to hacking and unauthorized access, which can potentially disrupt critical power management functions. These security concerns deter data center operators from fully embracing IoT-based power management solutions, as they prioritize safeguarding their infrastructure against potential cyber threats. Without adequate security measures in place, the adoption of IoT devices for power management purposes remains limited, hindering the market demand for data center power management solutions.

As a result, industry stakeholders must address these security challenges by implementing robust cybersecurity protocols and enhancing the resilience of IoT devices to mitigate risks and foster greater trust and confidence in adopting IoT-enabled power management technologies.

Increasing demand for colocation and hyperscale data centers

The increasing demand for colocation and hyperscale data centers presents significant opportunities in the market for data center power management. Colocation facilities, where multiple tenants share data center space and resources, require efficient power management solutions to meet the diverse needs of different clients while optimizing energy usage and costs. As more businesses opt for colocation services to outsource their IT infrastructure, there is a growing need for power management systems that can accommodate varying workloads and scalability requirements.

Similarly, hyperscale data centers, which are massive facilities operated by technology giants to support cloud computing and digital services, demand advanced power management technologies to handle substantial power loads efficiently. These facilities require robust solutions for power distribution, backup power, and energy efficiency to ensure uninterrupted operations and support the rapid growth of digital services. As the demand for colocation and hyperscale data centers continues to rise, the market for data center power management is poised for growth, offering opportunities for innovation and expansion in delivering tailored solutions to meet the evolving needs of these facilities.

The solution segment held the highest market share of 65% in 2024. In the data center power management market, the solution segment comprises various components aimed at optimizing power distribution, monitoring, and backup within data center facilities. This includes uninterruptible power supply (UPS) systems, power distribution units (PDUs), energy storage solutions, and intelligent power management software. Trends in this segment focus on the integration of advanced technologies such as artificial intelligence and predictive analytics to enhance energy efficiency, reliability, and resilience of data center power infrastructures, meeting the evolving demands of modern data centers.

The service segment is anticipated to witness rapid growth at a significant CAGR of 8.2% during the projected period. In the data center power management market, the service segment encompasses various offerings provided by vendors to support the deployment, maintenance, and optimization of power management solutions within data centers. This includes services such as consulting, installation, integration, training, and ongoing support. A key trend in this segment involves the increasing demand for managed services, where vendors offer outsourced management of power infrastructure to help data center operators reduce operational complexity and focus on their core business activities.

The UPS segment has contributed the biggest market share in 2024. Several technologies are utilized to regulate the flow of power to the data centers and to protect critical information technology resources such as the UPS. Moreover, portable UPS systems have found applications in services, for example, High-Performance Computing, SaaS services, Streaming Media, and Online Gaming and this has helped to drive the segment.

The busway segment is anticipated to witness rapid growth over the projected period. Data-center busways are wiring systems that distribute electrical power to server racks in data center applications. The increase in the use of big data, real-time information, artificial intelligence, machine learning, and much more has called for robust computing systems. These systems provide a reliable method of conveying power to all racks and cabinets while at the same time keeping losses very low and the possibility of failure. Datacenter busways are significant in meeting the requirements of complex computational applications in a data center space by providing seamless service.

The design and consulting segment has contributed the biggest market share in 2024. Consulting services and designing services can assist the end users in making efficient ways and achieving energy-saving measures by using efficient equipment, overhauling the cooling systems, and applying intelligent power management. Data center power management and design consulting includes the ability to plan and design the power of a data center and the management of the infrastructure. These are the power supply systems, cooling systems, and other forms of backups that may be required.

The support & maintenance segment is anticipated to witness rapid growth over the projected period. This growth is also creating a demand for effective maintenance and support solutions for the enhanced operation of data center power supplies. Data centers contain sophisticated power distribution, UPS, PDUs, and cooling systems. Maintaining these systems in their peak efficiency and effectiveness is another thing that needs expertise and support. Thus, the market requires many support and maintenance services.

The IT & telecom segment has held the biggest market share in 2024. In the data center power management market, the IT & telecom segment primarily encompasses power management solutions tailored for information technology (IT) infrastructure and telecommunications networks. This includes uninterruptible power supply (UPS) systems, power distribution units (PDUs), and energy-efficient cooling solutions designed to support the critical operations of IT equipment and telecommunications hardware. Recent trends in this segment include the adoption of energy-efficient technologies, the integration of smart monitoring and control systems, and the deployment of modular power management solutions to enhance flexibility and scalability.

The healthcare segment is anticipated to witness rapid growth over the projected period. In the healthcare segment, data center power management involves ensuring reliable and efficient power supply to support critical medical applications, electronic health records (EHRs), and diagnostic imaging systems. Trends in this sector include the adoption of energy-efficient UPS systems and cooling solutions to minimize downtime and maintain data integrity. Additionally, there's a growing focus on implementing intelligent monitoring and analytics tools to optimize power usage, enhance system reliability, and ensure compliance with stringent regulatory requirements.

By Component

By solutions

By services

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

March 2025

January 2025