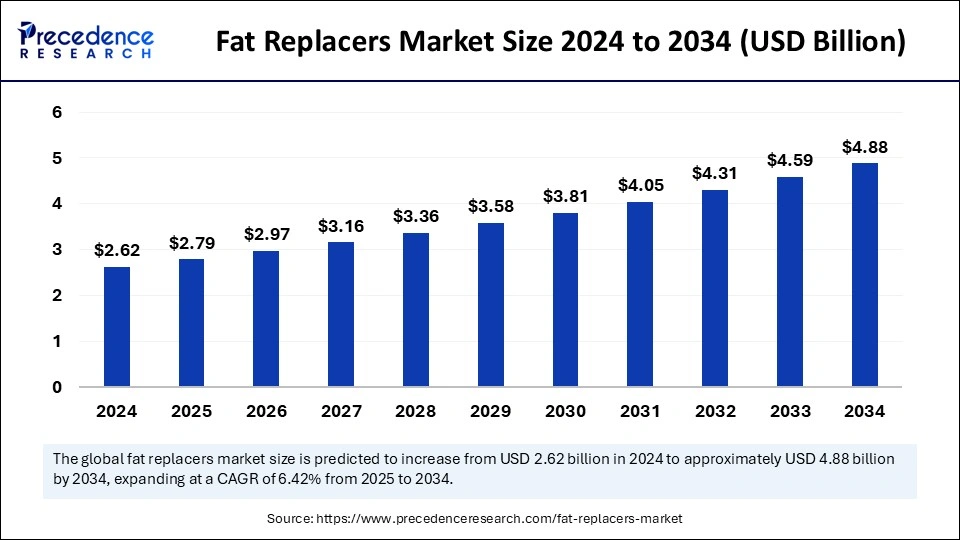

The global fat replacers market size is evaluated at USD 2.79 billion in 2025 and is forecasted to hit around USD 4.88 billion by 2034, growing at a CAGR of 6.42% from 2025 to 2034. The Asia Pacific market size was accounted at USD 1.10 billion in 2024 and is expanding at a CAGR of 6.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global fat replacers market size was estimated at USD 2.62 billion in 2024 and is predicted to increase from USD 2.79 billion in 2025 to approximately USD 4.88 billion by 2034, expanding at a CAGR of 6.42% from 2025 to 2034. Increasing consumer health consciousness regarding daily calorie intake is the key factor driving market growth. Also, surging R&D activities to develop innovative products coupled with ongoing urbanization across the globe can fuel market growth further.

Artificial Intelligence system analyses persons' weight, height, health status, dietary habits, and food preferences. It also analyses the nutritional status and gives advice to tackle nutritional deficiency. Furthermore, AI acts as a virtual coach in the fat replacers market. Weight loss applications provide the same suggestions as human coaches would. It will help individuals with their weight loss journey and also guide them in their overall weight management journey.

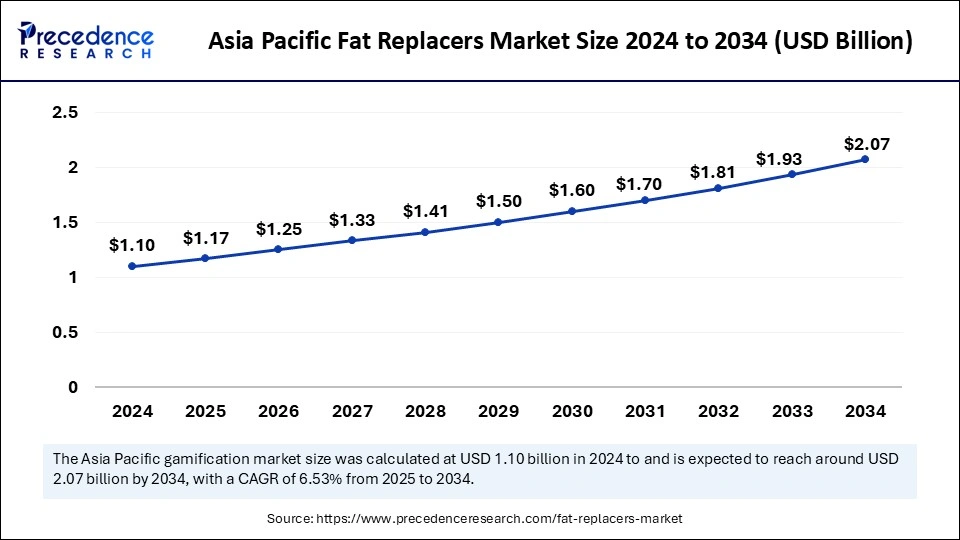

Asia Pacific fat replacers market size was evaluated at USD 1.10 billion in 2024 and is projected to be worth around USD 2.07 billion by 2034, growing at a CAGR of 6.53% from 2025 to 2034.

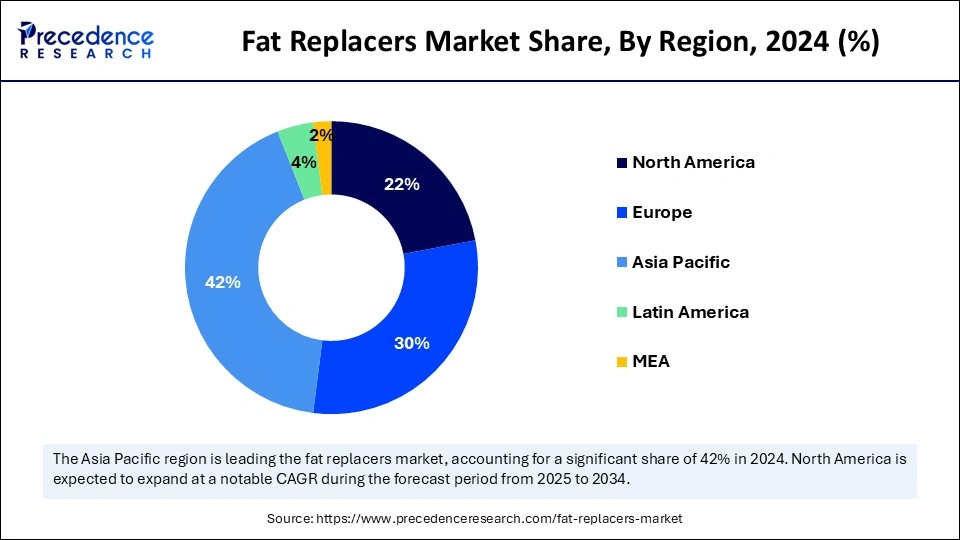

Asia Pacific dominated the global fat replacers market in 2024. The dominance of the region can be attributed to the ongoing urbanization coupled with the changing consumer lifestyles across the region. The surge in disposable incomes of consumers leads them to seek healthier food options. In the Asia Pacific, China has led the market owing to the growing inclination of Chinese consumers towards quality-oriented and healthy food options. Food market players are under pressure to improve the overall nutritional value of their products.

North America is expected to grow at the fastest rate in the fat replacers market over the studied period. The growth of the region can be credited to the presence of a high amount of people suffering from lifestyle diseases such as cholesterol and obesity-related complications. In North America, the U.S. held the largest market share due to the increasing need for clean-label ingredients like plant-based fat replacers. Various big local restaurants and fast-food chains in the country have launched low-fat solutions specific to health-conscious consumers.

Fat replacers are chemicals that replace part of the fat in a substance while keeping the same flavor, mouth feel, and texture. They lower the amount of fat in food and also lower the calorie content. Protein, carbohydrate, and lipid-based fat replacers are widely available in the fat replacers market. Flat replacers are highly adaptable in society because a high-fat diet can cause cancer, obesity, coronary heart disease, and high blood cholesterol. Food manufacturing companies always invest heavily in R&D activities to fuel market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.88 Billion |

| Market Size in 2025 | USD 2.79 Billion |

| Market Size in 2024 | USD 2.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.42% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for fat-free dairy items

The surging demand for fat-free dairy products across the globe is the major factor driving the fat replacers market. This product has the same taste and flavor as conventional dairy items, which in turn results in the development of a new fat replacer. In addition, market players are replacing costly butterfat with vegetable fat due to its various health benefits and cost-effectiveness.

Health issues associated with excessive use of emulsifiers

Fat has vital characteristics that help with mouthfeel, texture, and satiety. The fat replacers market assists with the sense of smoothness in flavor and overall food. Hence, paying for these properties in varieties of fat-free food is very challenging for food processors and potentially hampers market growth. Moreover, fat replacers do not improve the softness of the food, but their excess use can lead to decreased readability and increased stickiness.

Rising global demand for convenience food

The increasing demand for convenient food, including bread, cheese, ready-to-eat dry items, and salted food, is rising because of various factors. These include growing consumer choice towards convenient food solutions, increasing disposable income, and innovations in the cold chain infrastructure. Furthermore, consumers' demand for healthy food solutions increases along with their eating habits.

The carbohydrate-based segment held the largest fat replacers market share in 2024. The dominance of the segment can be attributed to the extensive adoption of carbohydrate-based fat replacers in the food industry. These fat replacers mimic conventional flavor, mouthfeel, and texture and have been widely researched in the food market. Additionally, carbohydrate-based fat replacers provide a cheap alternative to conventional fats. Market players are using ingredients like aloe vera, basil seeds, chia seeds, and guar gum to create new fat replacer solutions.

The protein-based segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the increasing incorporation of protein-rich food into the regular diet by consumers. Various studies have shown that replacing fat with protein-based fat replacers can tackle the bad repercussions related to protein interactions in low-fat diets. Also, many protein-based fat replacers are gaining traction because of sustainability benefits and clean-label approaches.

The bakery and confectionery segment led the global fat replacers market in 2024. The dominance of the segment can be credited to the increasing adoption of fat replacers in the bakery industry, and products such as fat replacers are important for decreasing fat levels in confections and baked goods while also maintaining the same quality. In addition, they improve the texture, shelf life, and mouthfeel of bakery products, optimizing healthier recipes without compromising taste. Common alternatives are hydrocolloids, emulsifiers, and fiber-based ingredients.

The processed meat segment is expected to grow at the fastest rate over the projected period. The growth of the segment can be driven by the increasing incorporation of fat replacers in various processed meat items by food companies. Furthermore, the incorporation of fat replacers does not manipulate the appearance of these food products but decreases overall fat consumption. The increasing need for healthier processed meat options can help in market expansion soon.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client