May 2025

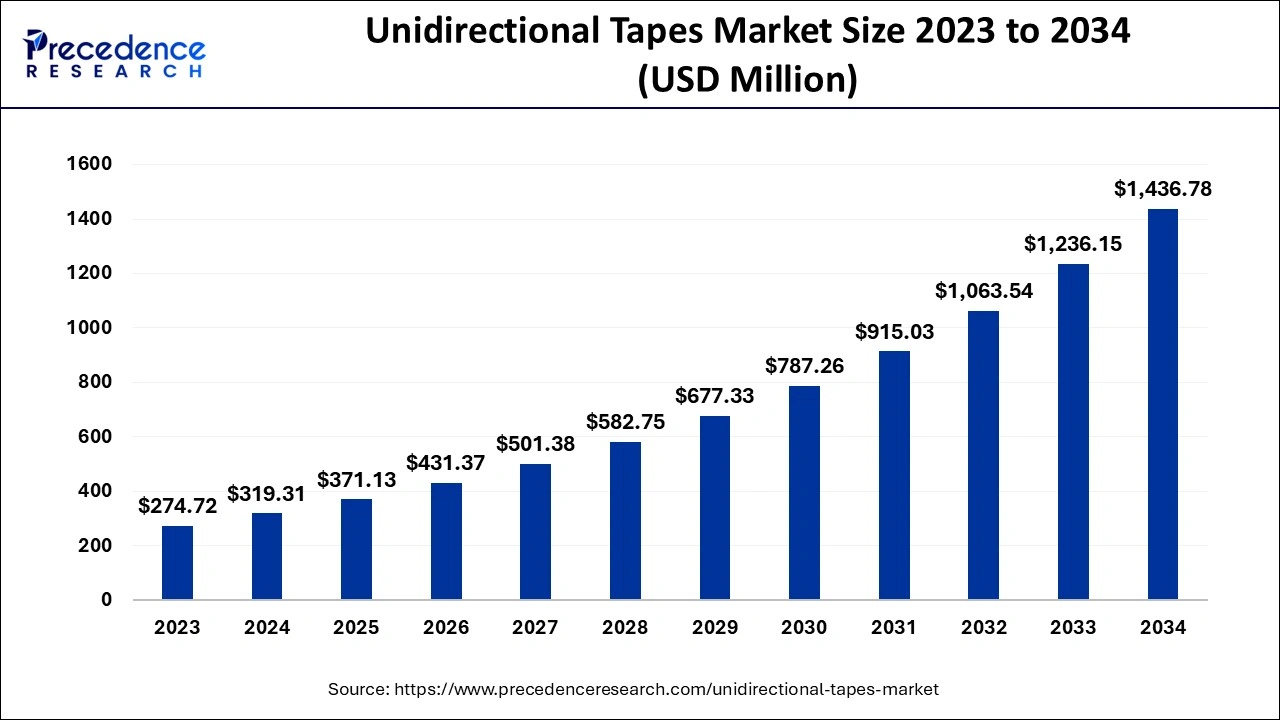

The global unidirectional tapes market size accounted for USD 319.31 million in 2024, grew to USD 373.13 million in 2025 and is expected to be worth around USD 1,436.78 million by 2034, registering a double-digit CAGR of 16.23% between 2024 and 2034. The North America unidirectional tapes market size is evaluated at USD 127.72 million in 2024 and is expected to grow at a notable CAGR of 16.36% during the forecast year.

The global unidirectional tapes market size is calculated at USD 319.31 million in 2024 and is predicted to reach around USD 1,436.78 million by 2034, expanding at a healthy CAGR of 16.23% from 2024 to 2034. The unidirectional tapes market growth is attributed to increasing demand for lightweight, high-performance materials in industries such as aerospace, automotive, and renewable energy.

Manufacturers in the unidirectional tapes market are adopting advanced technology to boost the development process of their products and facilitate the optimization of the supply chain. Artificial intelligence smart technologies include using machine learning algorithms and predictive analysis. This allows producers to gain better control in the production of high-performing tapes for areas including aerospace, automobile, and electronics, among others.

Due to the analytical capability of the AI, it has been easier to detect precursors to quality problems and, therefore, minimize the quality defects or poor products that are churned out in the unidirectional tapes market. Furthermore, AI optimizes customization options by enabling manufacturing firms to forecast market trends, thereby improving supply chain management.

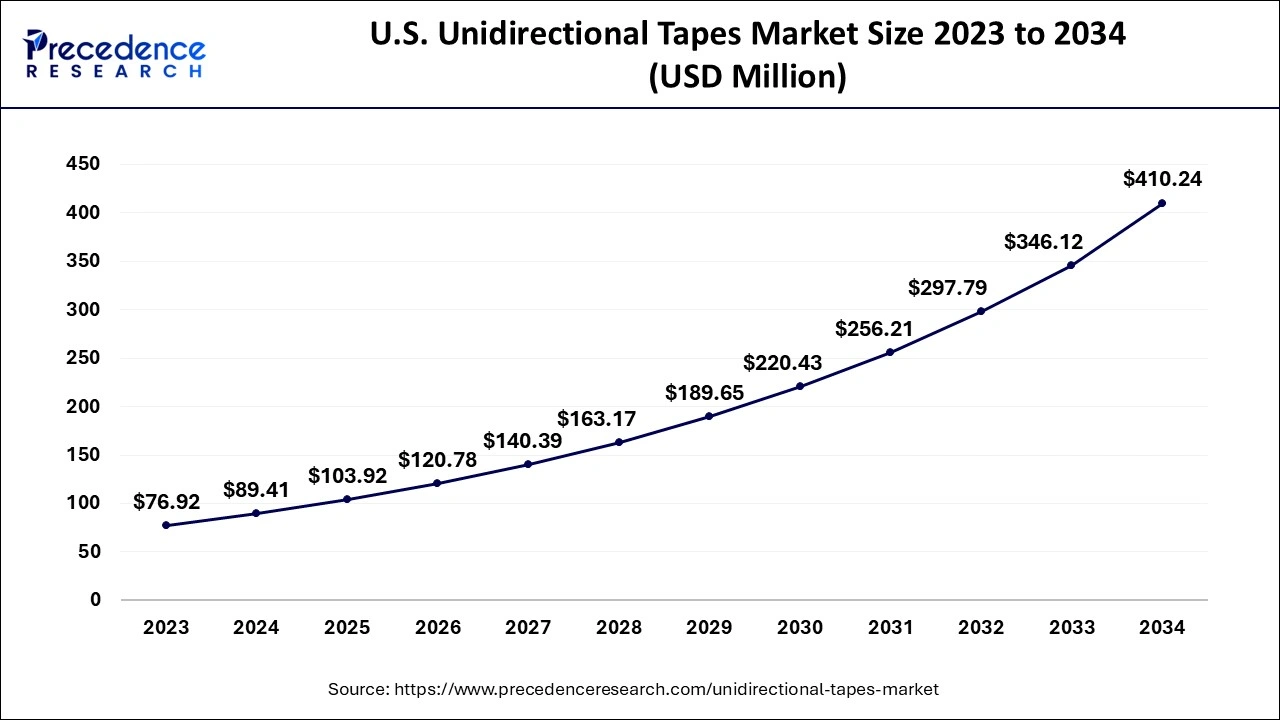

The U.S. unidirectional tapes market size is exhibited at USD 89.41 million in 2024 and is projected to be worth around USD 410.24 million by 2034, growing at a CAGR of 16.43% from 2024 to 2034.

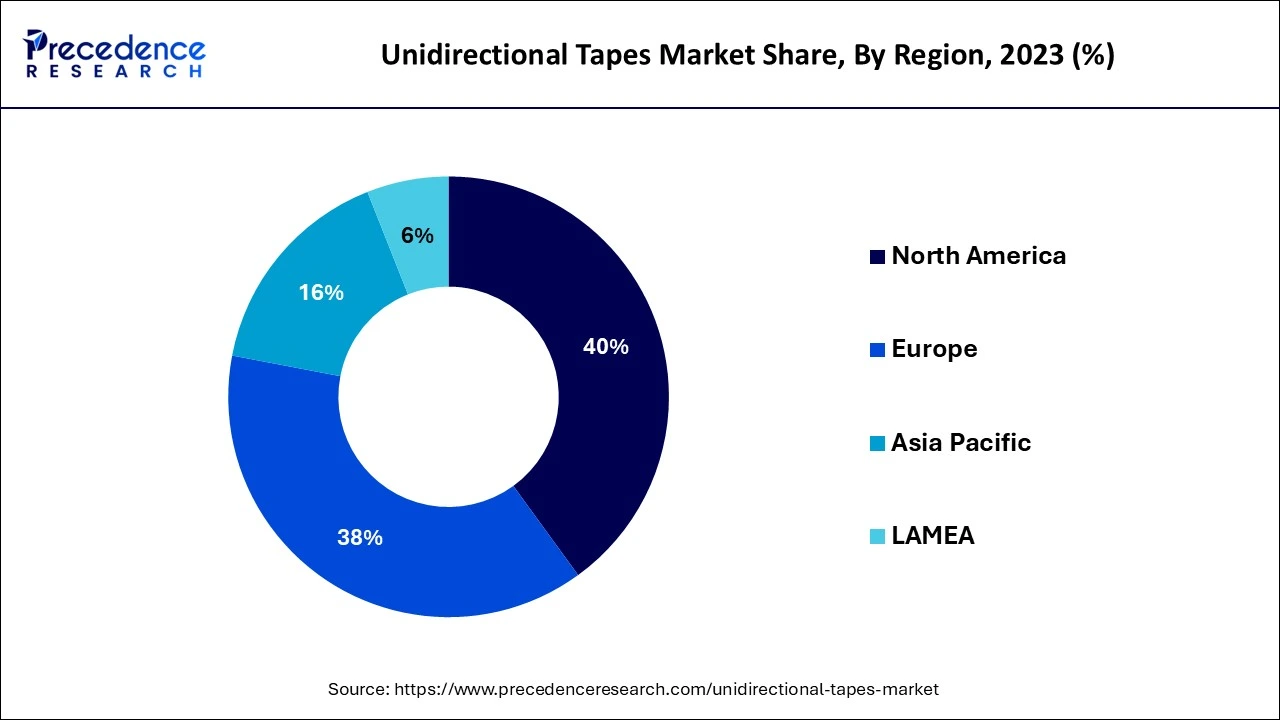

North America dominated the global unidirectional tapes market in 2023 due to the large energies of aerospace, defense, and automotive segments. The market in this region has been one of the most vital to the development of this market, attributable to the high concentration of aerospace activities in commercial and military aircraft by the region. Prepregs, particularly those made from carbon fiber, are used broadly in the creation of lightweight yet strong parts such as wing structures and the body of most aircraft. Furthermore, the increasing demand for lighter and more efficient systems, mainly in fuel applications.

Asia Pacific is projected to host the fastest-growing unidirectional tapes market in the coming years. Unidirectional tapes face massive demand in the automotive sector in Asia, where the automotive industry is growing and rapidly transitioning to electric vehicles, which require lightweight and high-strength materials to be integrated into their production. The trend of adopting new environmentally friendly technologies and higher requirements for environmental protection presumably creates high demands for materials that enhance fuel and lessen emissions. This growth is expected to continue, and as manufacturers pay more attention to the lightweight concept in the improvement of the performances of EVs, this will create increased demand for unidirectional tapes.

The unidirectional tapes market is evolving, as its application in aerospace, automotive, and renewable energy industries with lightweight material and high-performance materials. These tapes include material structures that are perpetually bonded fibers, including glass or carbon within resin. The identified properties include high strength, stiffness, fatigue endurance, and low weight.

Furthermore, improvements in manufacturing technologies such as AFP and advanced thermoplastic resin systems have lowered the production costs of the unidirectional tapes market products. Another strategy launched by the European Commission under the Horizon Europe program is aimed at enhancing the progress of composites, including UTs and unidirectional tapes, which will form the basis of more sustainable industries.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,436.78 Million |

| Market Size in 2024 | USD 319.31 Million |

| Market Size in 2025 | USD 373.13 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 16.23% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Fiber, Resin, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Increasing demand for lightweight materials

The rising demand for lightweight materials in industries such as aerospace, automotive, and sports equipment is expected to drive the growth of unidirectional tapes. The pressure for weight reduction facilitates the utilization of these types of tapes across industries. These materials are being adopted for their viability in saving fuel consumption. Aluminum, magnesium alloys, and carbon fiber composites are expected to play the largest part in the shift toward sustainable, effective, light vehicles. Furthermore, improving the efficiency of the light vehicle and increasing the all-electric range further creates the demand for these types of tapes.

The U.S. DOE has indicated that the replacement of conventional heavy steel parts with these materials decreases vehicle mass by between 10% and 60%, with a consequential increase in fuel efficiency of between 6% and 8%. DOE-funded research is being directed to enhance the strength, durability, and recyclability of such materials as well as their cost-effectiveness.

| Data Point | Value |

| Fuel economy improvement with 10% vehicle weight reduction | 6%–8% improvement |

| Fuel savings annually with lightweight material adoption (across 25% of U.S. vehicle fleet) | Over 5 million gallons of fuel |

| Weight reduction potential with advanced materials (carbon fiber composites, aluminum, etc.) | 10%–60% for individual components |

| Weight reduction in vehicle components using magnesium and carbon fiber composites | 50%–75% |

| Improvement in all-electric range in EVs using lightweight materials | Significant increase |

Technological challenges in manufacturing

The production of the unidirectional tapes market requires sophisticated manufacturing technologies, which hinders market expansion. Products manufactured by composite processes, such as pultrusion, filament winding, and resin transfer molding, demand a high level of accuracy and modern technology. Few manufacturers currently have the skills and facilities necessary to manufacture tapes to meet these demanding industry standards, particularly in the aerospace and automotive markets.

The level of technology implied by the implementation of advanced manufacturing technologies in the unidirectional tapes market is likely to increase the capital costs of acquiring and implementing such technologies. These operating costs in terms of the infrastructure required to support such technologies mainly affect small and medium enterprises (SMEs) that are not able to afford to invest in high-tech production facilities.

Growing advancements in composite materials technology

Growing advancements in composite materials technology are projected to create immense opportunities for the players competing in the unidirectional tapes market. The development of automated fiber placement (AFP) and filament winding technologies is anticipated to further improve the utilization of unidirectional tapes through improvements in speed, finish, and accuracy. These techniques allow for improved fiber orientation, which results in improved mechanical characteristics of the composite, such as higher tensile strength and improved fatigue strength.

The glass fiber segment held a dominant presence in the unidirectional tapes market in 2023 due to its high strength, durability, and lower cost in comparison with other high-performance fibers. Glass fiber has found its usage in fulfilling the need for lighter-weight vehicles for enhanced fuel efficiency. Consumers’ constant desire for fuel-efficient and environmentally friendly vehicles facilitates the demand for these types of tapes.

The carbon fiber segment is expected to grow at the fastest rate in the unidirectional tapes market during the forecast period of 2024 to 2034. Carbon fiber is characterized by high strength-to-weight proportions, corrosion, and other mechanical properties, which recommend its use in applications that demand higher performance and durability. Carbon fiber is also mentioned as central to achieving weight reduction and, therefore, enhancing the fuel efficiency of Aircraft in the 2023 Aerospace Technology Report published by the United States Department of Energy, where the authors point out that the demand for lightweight composite material in aircraft is expected to rise. Furthermore, the cost of carbon fiber is reduced due to advancements in technologies that help reduce the cost of manufacturing this product.

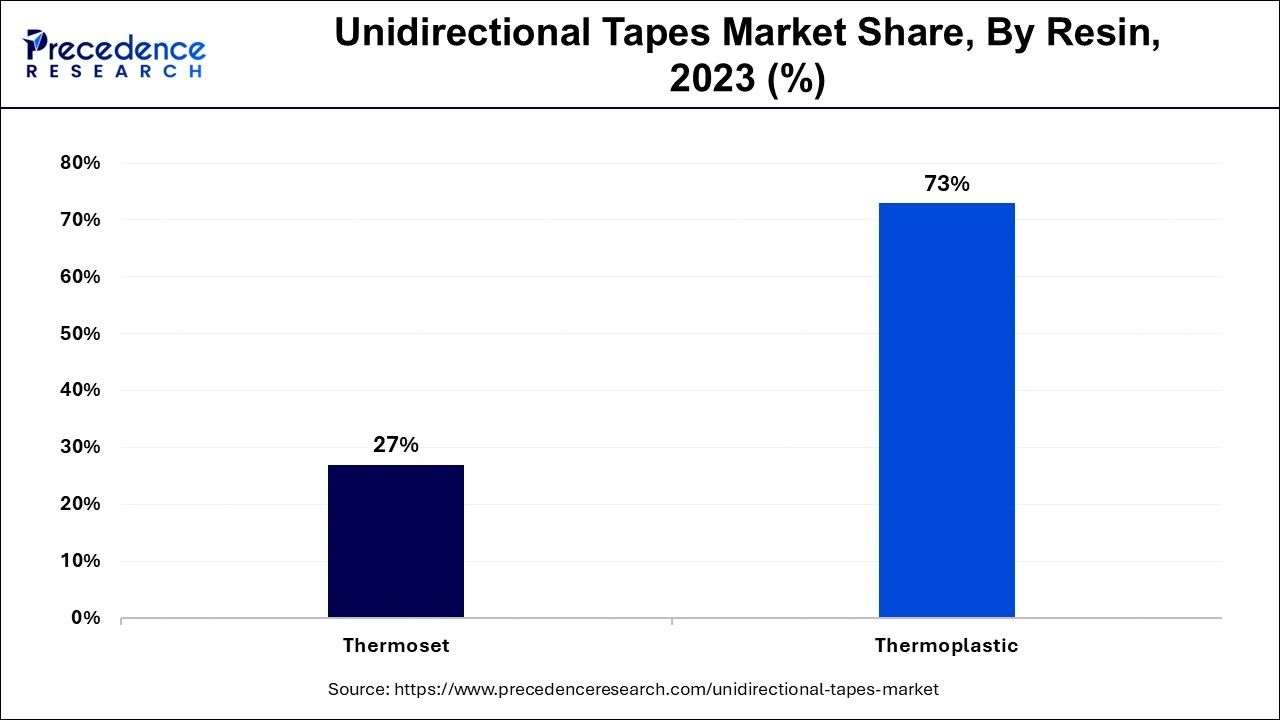

The thermoset segment accounted for a considerable share of the unidirectional tapes market in 2023. These resins will likely sustain the growth of the high-performance composite materials market in the aerospace, automobile, and construction sectors. Thermoset resins, especially epoxy type, enjoy very good mechanical properties, heat resistivity, and long-term dimensional stability, which is the reason why they find their application in highly stressed areas. As per the European Space Agency (ESA), the antenna industry and semiconductor manufacturing. This reveals prophecies of a higher growth rate through their high-performance reliability and competence in the production of structural parts for space travels involving spacecraft. This is expected to continue to support thermoset resins as the preferred option for unidirectional tapes in these applications.

The thermoplastic segment is anticipated to grow at the highest CAGR in the unidirectional tapes market during the studied years, owing to their production and tendency in the materials’ recyclability. In its insight report regarding the commercial vehicle industry in 2023, the U.S. Department of Energy recognized thermoplastic composites as vital components when it comes to enhancing the sustainability and recyclability of automobiles methodically, especially when it is based on product lightweight. Furthermore, the increasing importance of electric vehicles and related requirements for lightweight and high-energy-density components foster the demand for thermoplastic composites.

The aerospace & defense segment led the global unidirectional tapes market, as they are adopted in the manufacturing of lightweight and high-strength composite materials needed in the development of efficient aircraft structures and systems. The upward trend towards higher energy-efficient aircraft is expected to foster further integration of unidirectional tapes in aerospace applications, with increasing environmental concerns and high fuel costs. Due to the ability of these unidirectional tapes to combine high strength and relatively low density, especially in cases where carbon fiber-based products are used, these products are ideal when used in some of the most important aircraft structures like wings, fuselages, and turbine blades. Furthermore, the ongoing research on envelope-pushing next-generation aircraft and defense systems helps maintain the pace for high-performance materials such as unidirectional tapes.

The automotive segment is projected to expand rapidly in the unidirectional tapes market in the coming years. Automotive original equipment manufacturers (OEMs) are embracing composite materials, including unidirectional tapes, to manufacture lighter cars that elicit superior strength and safety features. The increasing obsession with environmentally sustainable products and solutions and increased standards for emissions are expected to bolster the demand for light automotive parts. This trend is expected to facilitate the demand for unidirectional tapes by automobile manufacturers who need to meet such high standards.

Latest Announcements by Industry Leaders

By Fiber

By Resin

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

January 2025

February 2025