November 2024

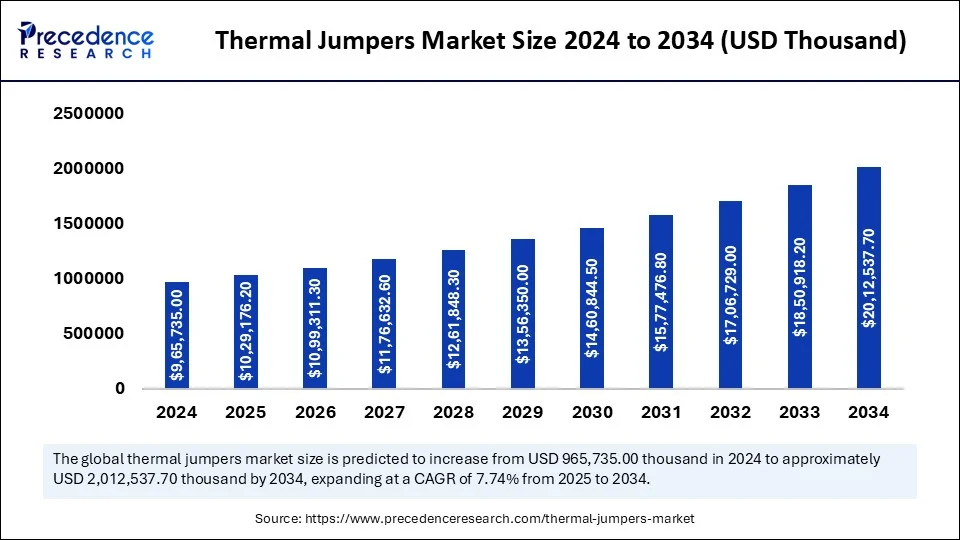

The global thermal jumpers market size is calculated at USD 10,29,176.20 thousand in 2025 and is forecasted to reach around USD 20,12,537.70 thousand by 2034, accelerating at a CAGR of 7.74% from 2025 to 2034. Asia Pacific market size surpassed USD 3,54,038.50 Thousand in 2024 and is expanding at a CAGR of 8.84% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global thermal jumpers market size accounted for USD 9,65,735.00 thousand in 2024 and is predicted to increase from USD 10,29,176.20 thousand in 2025 to approximately USD 20,12,537.70 thousand by 2034, expanding at a CAGR of 7.74% from 2025 to 2034. The demand for electronics cooling has increased, driving the global market. The increased requirement for thermal management in electric vehicles is fulfilling the market expansion.

As thermal management has become a concern, Artificial Intelligence integration is emerging as a promising solution. AI-powered predictive maintenance, real-time monitoring, and integration with the manufacturing process are improving the efficiency, performance, and manufacturing capabilities of the thermal jumpers market. AI is a promising technology to optimize the design of thermal jumpers with improved performance and cost-effectiveness.

Major challenges like limited materials and ability can be overcome through AI integration. The increased need for improved efficiency and reliability can be met by AI implementations in manufacturing. As the adoption of electronics has increased, the expectations from AI have also increased to enable new applications and utilities for thermal jumpers in autonomous vehicles as well as smart cities. The ability of AI to enhance performance is likely to provide novel market opportunities.

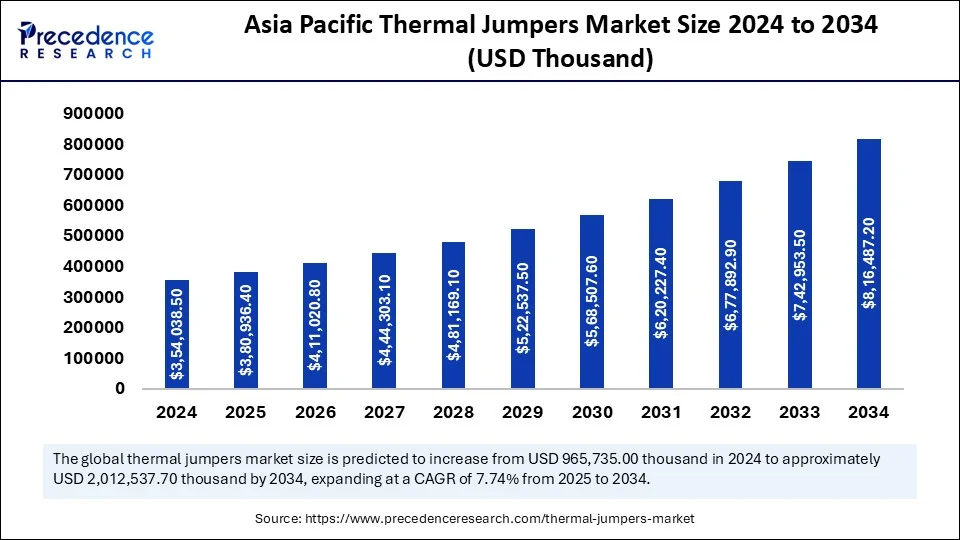

Asia Pacific thermal jumpers market size was exhibited at USD 3,54,038.50 thousand in 2024 and is projected to be worth around USD 8,16,487.20 thousand by 2034, growing at a CAGR of 8.84% from 2025 to 2034.

High Demand for Electronic Cooling Demonstrating in Asia Pacific

Asia Pacific has the major electronics manufacturers and a robust automotive industry. Countries like China, Japan, South Korea, Taiwan, and India are leading contributors to market growth. The advanced manufacturing capabilities and high adoption of technologies are fueling requirements for thermal jumpers in the region. Asia Pacific has witnessed rapid growth in demand for electronic devices, electric vehicles, and industrial automation. Furthermore, the region’s technological advancements and the high adoption of electronics have contributed to increased demand for electronic cooling systems.

The availability of a robust supply chain network and cost-effective manufacturing capabilities further fuels this adoption rate. The government focuses on investing and supporting the development of infrastructure, boosting the market expansion. Asia's increased investments in state-of-the-art SMT equipment and solutions are contributing to improving the production capabilities of thermal jumpers and meeting global quality standards. The emerging adoption of automation in industries is expected to demonstrate the growth of thermal jumper adoption in the Asia Pacific.

China is leading the regional market with the presence of strong semiconductor manufacturing capabilities and key market vendors. China has a strong base for electronic manufacturing and automotive industries. The high demand for advanced electronics such as smartphones, laptops, and servers contributes to the market expansion.

The Chinese government's support boosts the semiconductor industry and investments and the research and development sector, playing a favorable role in market expansion. A high consumer base for electronics, government and regulatory initiatives, high adoption of electric vehicles, and rapidly expanding IT infrastructure are projected to dominate the market continuously.

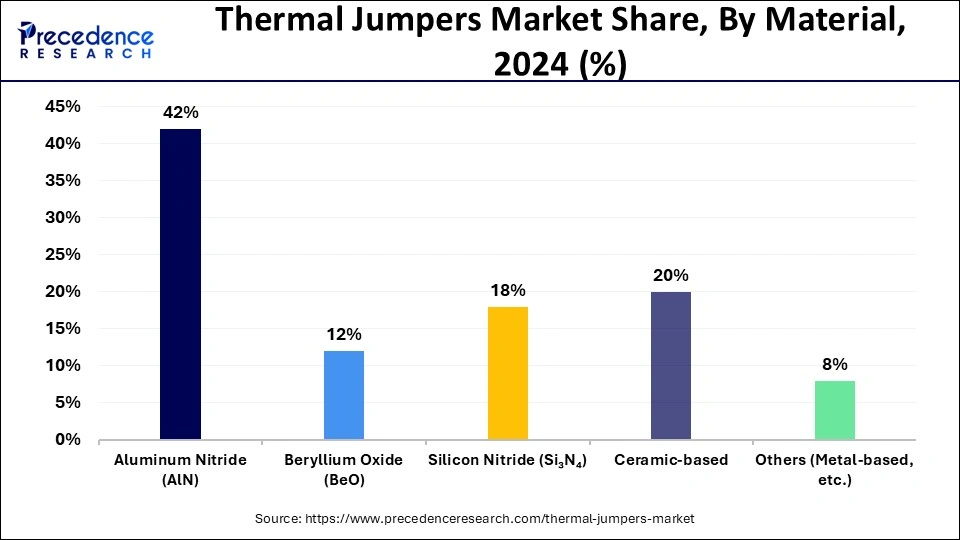

The thermal jumpers market refers to the industry that deals with the electronic components used to connect two or more thermal pads to reduce and manage heat generation. Thermal jumpers use aluminum nitride (AlN), beryllium oxide (BeO), silicon nitride (Si₃N₄), ceramic, and other metals with high thermal conductivity to provide a low (not zero) path for thermal energy (heat) to get away from its source to a nearby heat sink of some type. This component allows the connectivity of high-power devices to heat sinks without grounding or otherwise electrically connecting the devices. Thermal jumpers are the major application for power electronics.

Factors like increased use of 5G infrastructure, high-performance computing, and adaptation of internet of things devices drive demand for electronic cooling solutions, contributing to the adoption of thermal jumpers. Furthermore, the healthcare and automotive industries play a crucial role in the increased need for thermal jumpers. The rise in the importance of thermal management in electronics, automotive, and aerospace & defense industries plays a vital role in the adoption of thermal jumpers. The thermal jumpers market is further anticipated to witness spectacular growth with advancements in material science.

| Report Coverage | Details |

| Market Size by 2034 | USD 20,12,537.70 Thousand |

| Market Size in 2025 | USD 10,29,176.20 Thousand |

| Market Size in 2024 | USD 9,65,735.00 Thousand |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.74% |

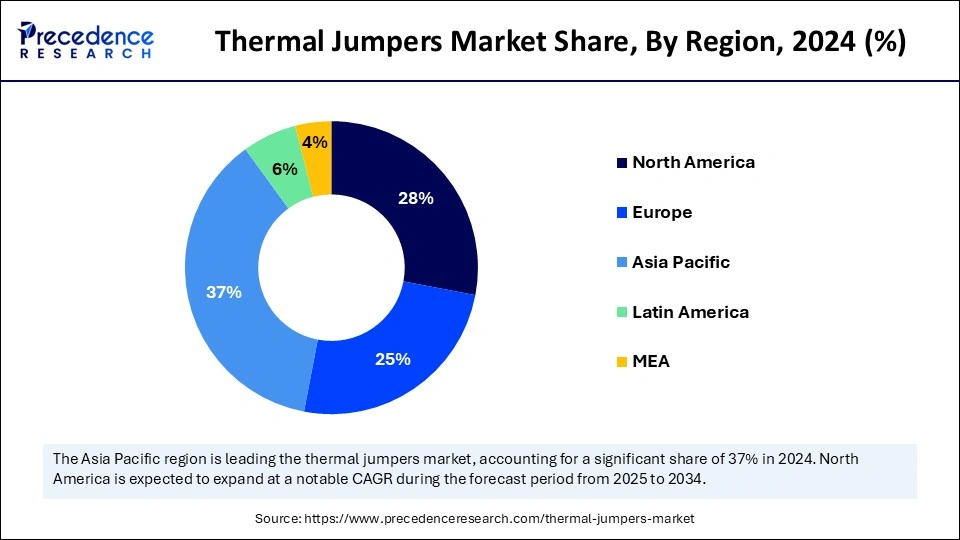

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Mounting Style, Thermal Conductivity, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for miniaturized electronics

The adoption rate of miniaturized electronics such as smartwatches, fitness trackers, smartphones, mobile devices, variable devices, autonomous vehicles, IoT devices, and sensors has increased, driving the need for thermal jumpers to manage heat generation. Furthermore, emerging technologies like quantum computing, AI, extended reality, and smart grids are expected to drive extensive demand in the thermal jumpers market.

Technologies like 3D packaging, wireless communications, system-on-chip, and nanotechnologies are the major trends in miniaturized electronics. Miniaturized electronics generate high heat density. These electronics often need high-performance thermal management solutions, which drives the adoption of thermal jumpers. The healthcare and automotive sectors are the major adopters of miniaturized electronics.

Lack of materials

Material limitations are the major restraints influencing the growth of the thermal jumpers market. Thermal jumpers require materials such as copper, silicon, aluminum, and graphite. The mechanical strength of the material utilized in thermal jumpers can limit their ability to handle the mechanical traits and vibration. Additionally, materials can explore a limited ability to be exposed to the harsh environment. The need for advanced materials to enhance thermal conductivity, increase thermal resistance, and reduce mechanical strength causes a significant challenge for the manufacturers.

Demand for 5G infrastructure

The demand for 5G technologies, such as beamforming technology, edge computing, and massive MIMO, has increased. The technologies are contributing to the increased adoption of thermal jumpers in 5G infrastructure. 5G infrastructure, such as radio frequency (RF) amplifiers, baseband units, remote frequency (RF) amplifiers, and antenna systems, drive the need for thermal jumpers to manage heat generated by these components.

A thermal jumper helps to maintain stable operating temperatures among several components. Fighting infrastructure often needs more powerful and dense electronics, which generate high heat. The higher data rates of small sales and base stations of 5G infrastructure drive the need for the thermal jumpers. Additionally, the increasing adoption of edge computing contributes to the further need for thermal jumpers to manage heat generation.

The aluminum nitride (AlN) segment dominated the thermal jumpers market in 2024, with a share of 42%. Thermal jumpers are often developed with aluminum nitride materials, as these materials are highly durable, provide electrical insulation, and are exceptional for thermal conductivity. The increase in the need for high-performance electronics contributes to the demand for thermal jumpers with aluminum nitride. The demand for aluminum nitride-based thermal jumpers has taken a significant place in electric vehicles for high-performance thermal management solutions. This segment is anticipated to witness further expansion with ongoing advancement in material science to improve properties and suitability for the thermal jumpers.

The silicon nitride (Si₃N₄) segment is poised for significant growth over the forecast period. The high thermal conductivity, electrical insulation, high corrosion resistance, and mechanical strength of silicon nitride make them ideal for thermal jumpers. Silicon nitride provides excellent electrical and thermal properties, high plasma resistance and chemical stability, and high thermal conductivity, which are required in electronic devices. Increased adoption of high-performance electronics and electric vehicles is driving the growth of thermal jumpers, with silicon nitride being a key material. The next-generation power devices are considering silicon nitride with high thermal conductivity, a most promising substrate material.

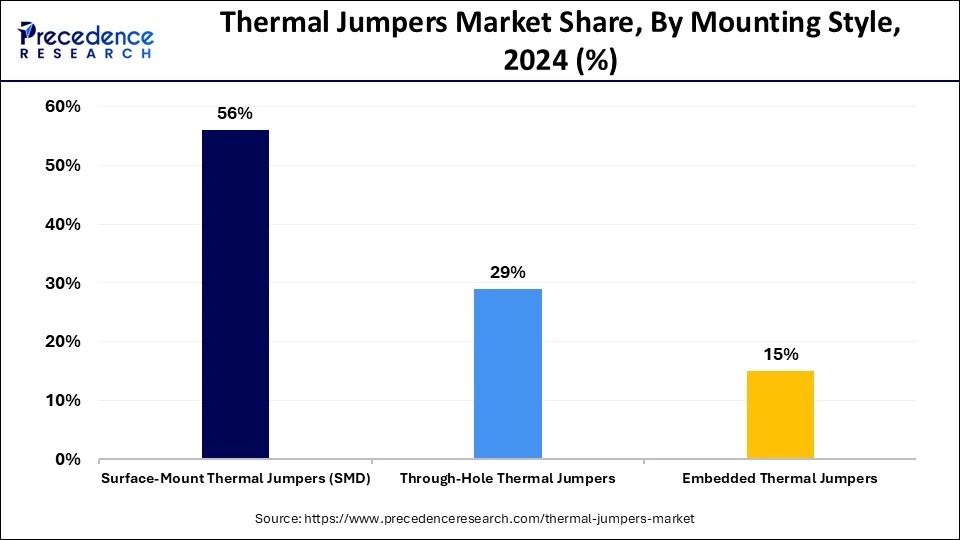

The surface-mount thermal jumpers (SMD) segment generated the biggest thermal jumpers market share in 2024. The segment is driven due to factors like ease of use, high thermal conductivity, and compatibility. Surface mount thermal jumpers are easy to install and offer high thermal conductivity, enabling efficient heat transfer. The surface-mount thermal jumpers are compatible with surface-mount technology, making them ideal for high-density interconnections. Their high-performance thermal management capability makes them popular for power components that require electrical isolation. Aerospace & defense and automotive are the major adapter industries of surface mount thermal jumpers.

On the other hand, the embedded thermal jumpers segment is expected to witness notable growth during the forecast period. Embedded thermal jumpers provide efficient thermal management solutions in compact electronics. These jumpers offer improved thermal performance by reducing resistance and increasing heat transfer. Demand for compact electronics and the growing adoption of electric vehicles drive the growth of the thermal jumper segment. The compact and lightweight design of embedded thermal jumpers makes them ideal for various applications.

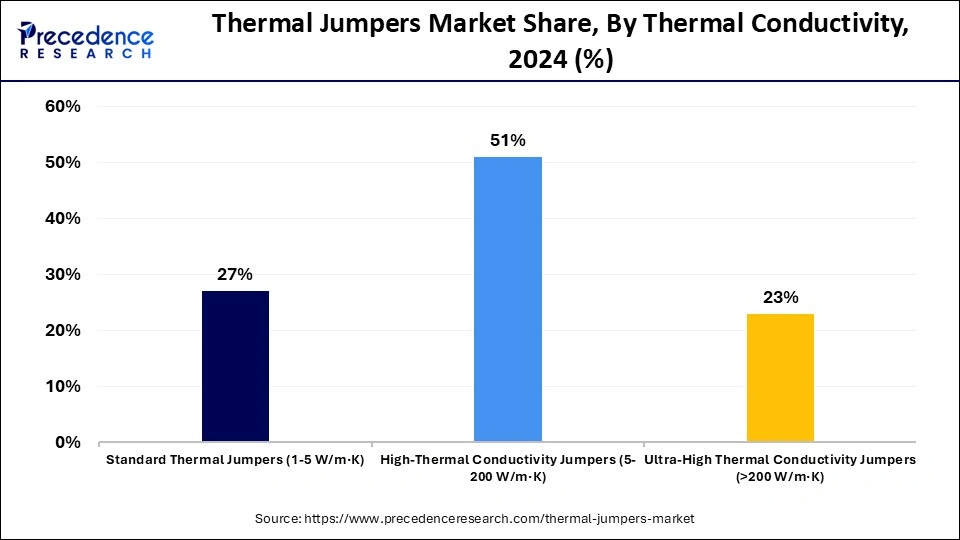

The high-thermal conductivity jumpers (5-200 W/m·K) segment led the market with the largest share in 2024. These jumpers provide high thermal conductivity, enable efficient heat transfer, and reduce thermal resistance. High thermal conductivity jumpers enable high processing speed and improve reliability by reducing thermal resistance and improving overall system performance.

High thermal conductivity jumpers are ideal for applications where effective heat dissipation is essential. These jumpers are often developed by using materials like aluminum nitride (AlN), beryllium oxide (BeO), silicon carbide (SiC), and copper aluminum oxide (CuAlOâ‚‚), which makes them popular for applications like consumer electronics, LED lighting, high-power density electronics, aerospace, and thermal management.

On the other hand, the ultra-high thermal conductivity jumpers (>200 W/m·K) segment is seen to grow at the fastest rate in the thermal jumpers market during the forecast period. Companies that integrate ultra-high thermal conductivity jumpers into their products can offer superior performance and reliability, which can provide them with a competitive edge in the market.

As industries such as electronics, automotive, and renewable energy continue to evolve, manufacturers will increasingly adopt ultra-high thermal conductivity solutions to meet performance demands and differentiate their products. Ultra-high thermal conductivity jumpers are increasingly used in these systems to manage heat dissipation effectively, particularly in power electronics that operate at high temperatures. As renewable energy systems expand, the need for thermal management solutions like ultra-high thermal conductivity jumpers is expected to grow rapidly.

The power electronics segment dominated the thermal jumpers market with the highest share in 2024 due to the need for active thermal management in power electronics. The segment is witnessing increased demand for thermal management solutions. The increased adoption of electric vehicles and renewable energies has driven demand for high-performance power electronics, driving the need for thermal jumpers to manage heat generated by power electronic devices. Thermal jumper plays a crucial role in more reliable and cost-effective energy conversion. Thermal jumpers increase efficiency and reliability. Advancements in power electronics, such as wide bandgap and semiconductors, are further fueling demand for thermal jumpers.

On the other hand, the automotive electronics segment is poised to expand at a CAGR of 9.11% in the forecast period. This growth is driven by increased demand for advanced safety features and autonomous driving technologies in vehicles. The rising adoption of electric vehicles is driving the need for standard thermal jumpers. Additionally, the growing demand for smart thermal management in automobiles is contributing to the segment expansion. The utilization of thermal interface materials has increased between electronic devices and heat sinks, driving the automotive electronics segment. Government initiatives in automotive industries and strict emission regulations are expected to poison market growth in upcoming years.

By Material Type

By Mounting Style

By Thermal Conductivity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

April 2023